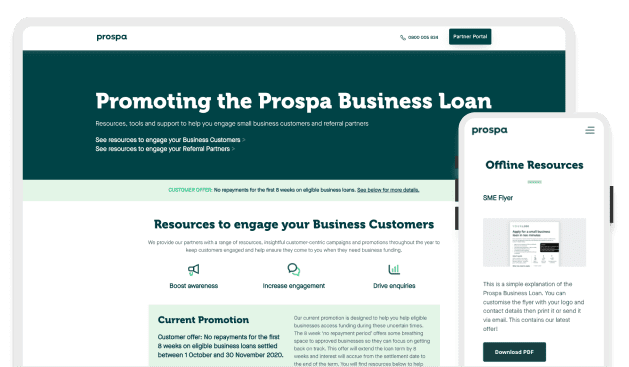

Flexible business funding

New Zealand’s small business lending specialist

THINGS YOU SHOULD KNOW

No repayment period available to approved customers who settle a new or refinanced Prospa Small Business Loan or Prospa Plus Business Loan. Approved customers can elect to take an optional initial no repayment period of between 1 to 4 weeks from the loan settlement date, during which interest will accrue but no repayments will be required. Total loan repayment term will be extended by the time equal to the selected no repayment period (1 to 4 weeks) and interest will accrue from the loan settlement date until the end of the term. Interest that accrues on the loan during the no repayment period is capitalised and included in the total interest expense and forms part of the regular fixed daily or weekly repayments due on each payment date following the end of the no repayment period. Not available to refinance an existing Prospa loan if the existing loan is currently within a no repayment period at the time of application. Product settings may be amended or withdrawn without notice.