Small business loans to match your business needs

We’re big believers in small business!

That’s why we offer a no-nonsense approach to business lending.

It’s why we’re New Zealand’s small business lending specialist.

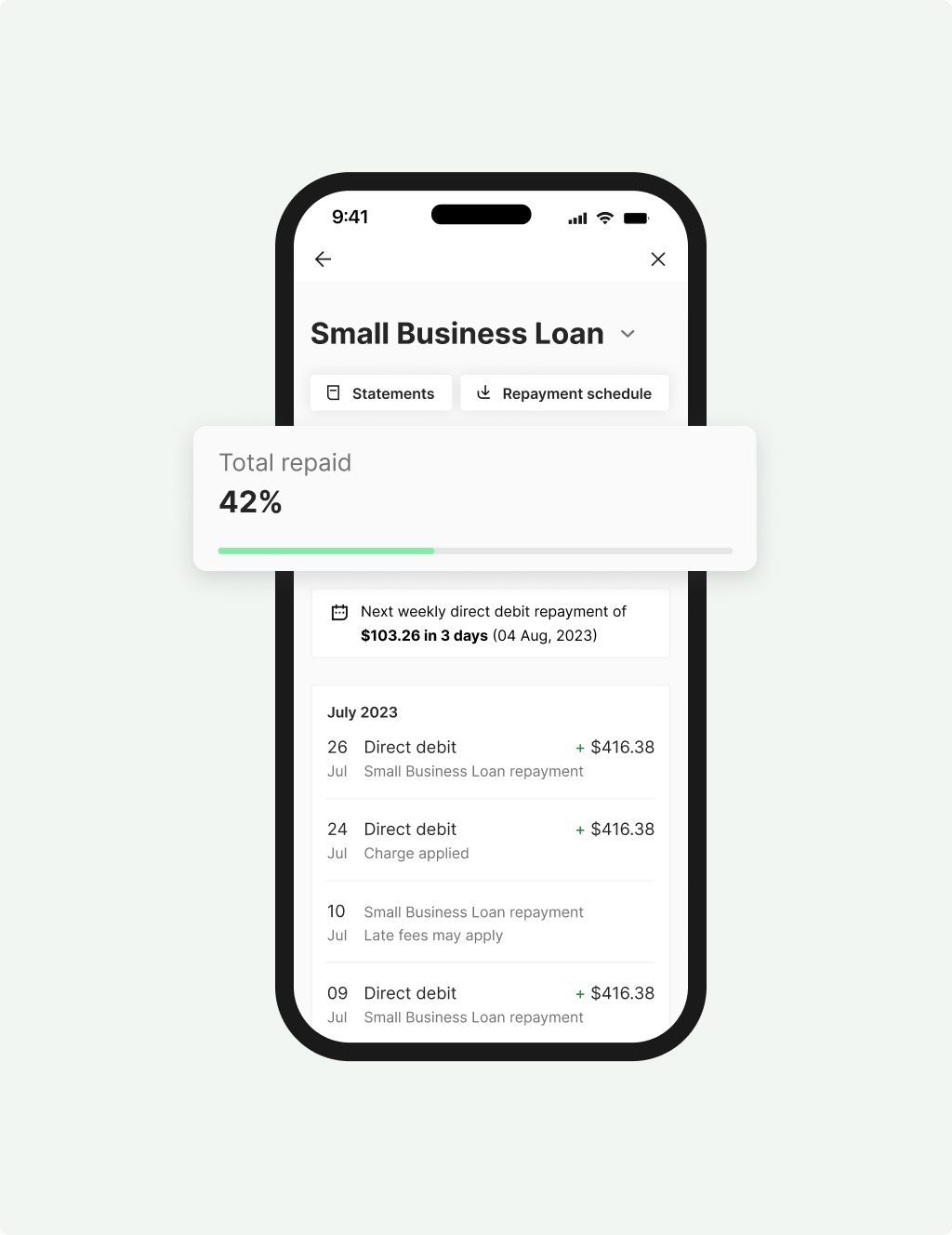

Prospa Small

Business Loan

- Borrow from $5K up to $100K as a lump sum over a fixed term of up to 36 months.

- Minimum $6K monthly turnover and minimum trading history to apply.

- Great for managing cash flow, buying stock and equipment, or covering unexpected expenses.

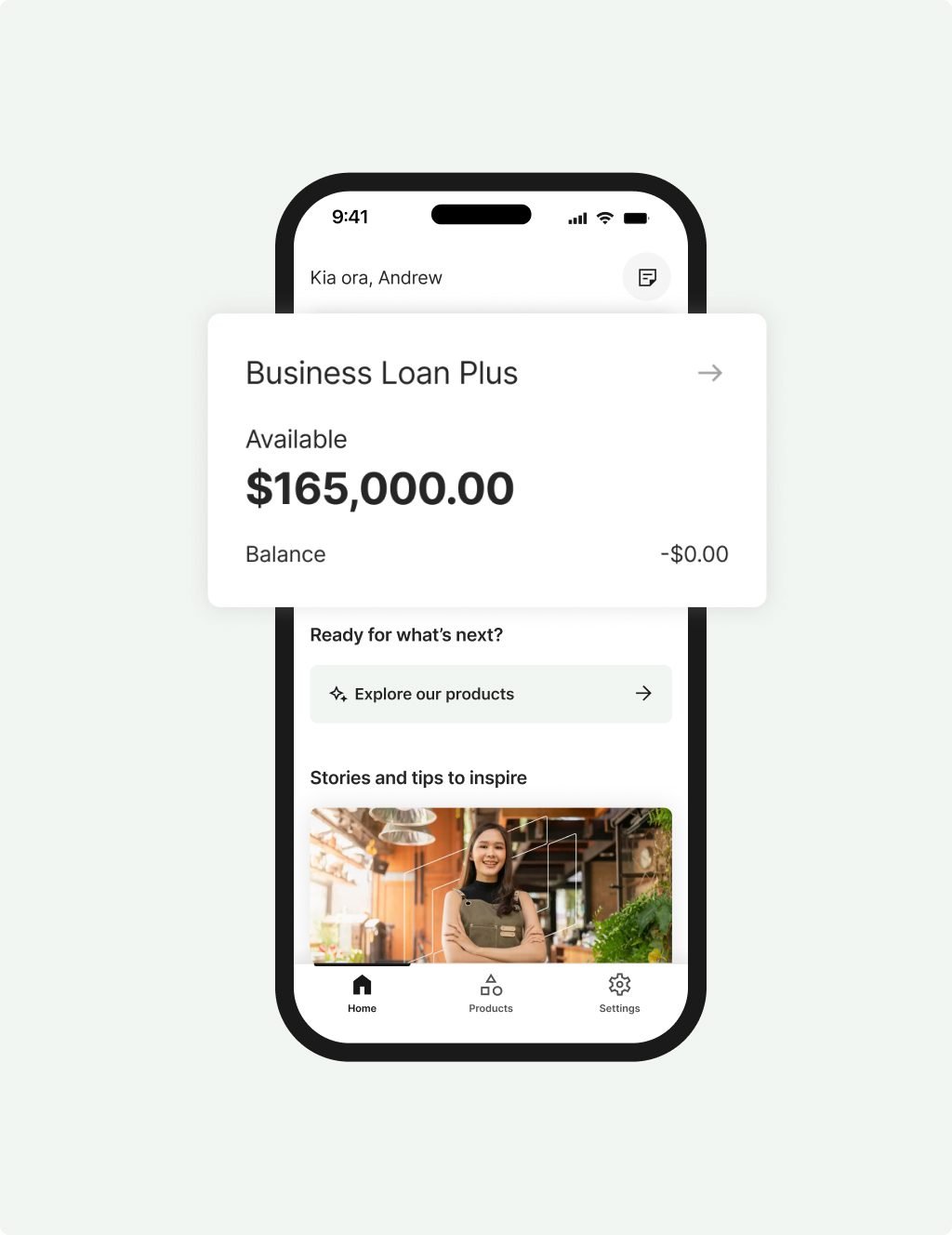

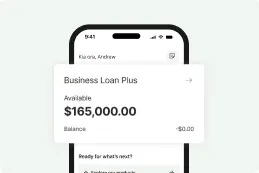

Prospa Business

Loan Plus

- Borrow from $100K up to $500K as a lump sum over a fixed term of up to 36 months.

- Minimum $1 million annual turnover and 3 years trading to apply.

- Often used for funding growth, renovations and refits, or equipment purchases.

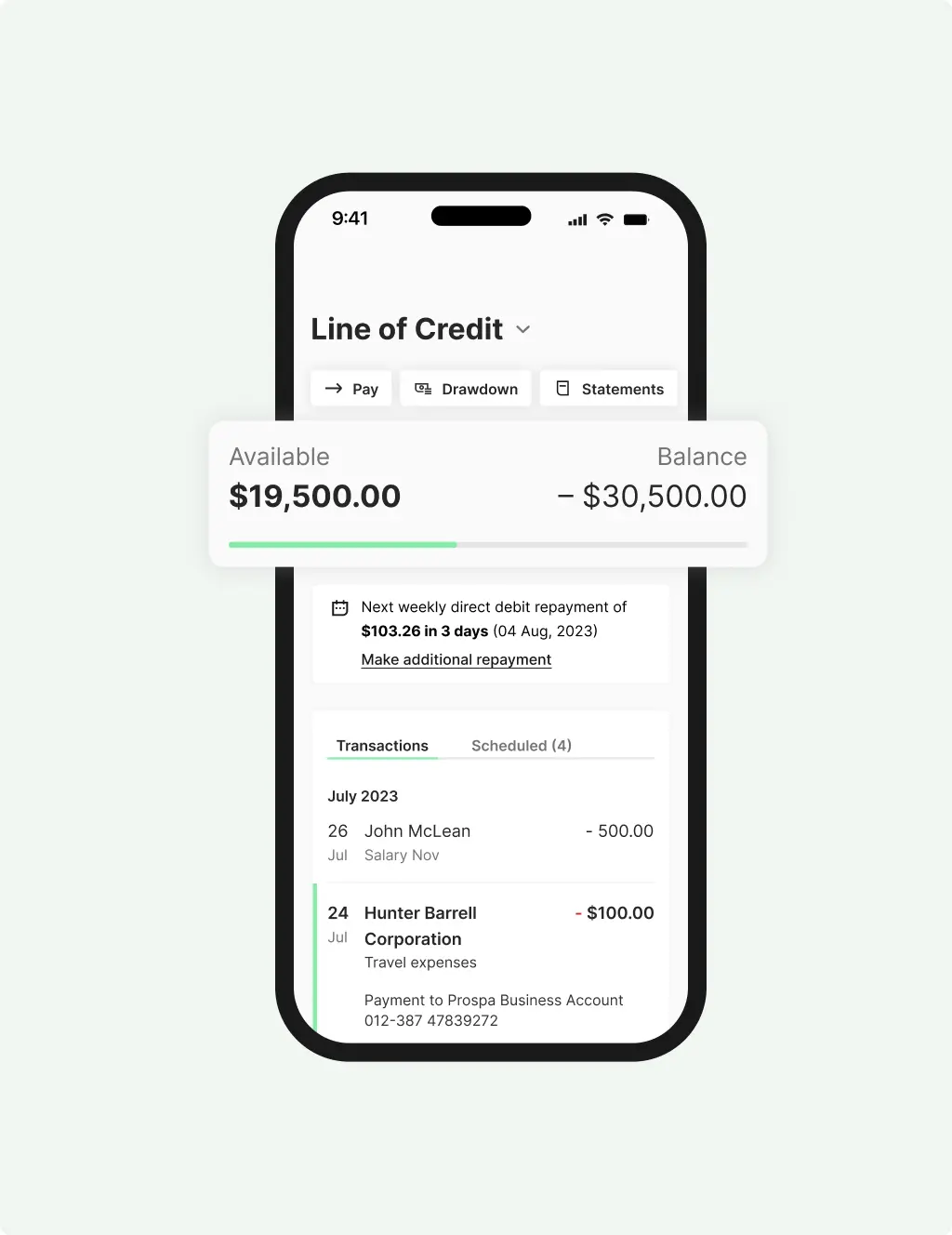

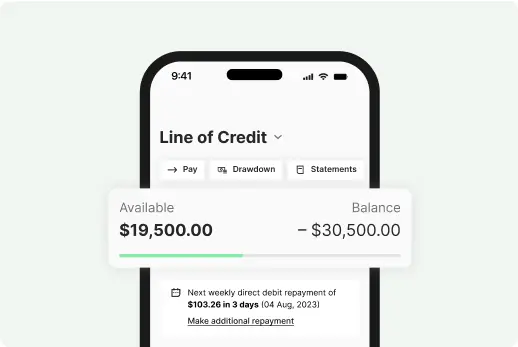

Prospa Business

Line of Credit

- Get ongoing access to funds up to $150K and only pay interest on the funds you use.

- Minimum $6K monthly turnover and minimum trading history to apply.

- Ideal for managing cashflow and unexpected expenses.

Why Prospa? Because we believe in you.

We’re New Zealand’s small business lending specialist.

Get extra support when it counts

- Simple, hassle-free application process

- Friendly team of business lending specialists

- Flexible repayment options to suit your cash flow

Never miss an opportunity

- Apply in 10 mins, funding is possible in 24 hours

- Business loans between $5,000 and $500,000

- Early payout discount available

Focus on growing your business

No asset security required upfront to access up to $150,000

01

Check if you qualify

Check if you qualify

02

Apply in 10 minutes

Apply in 10 minutes

03

Get on with business

Get on with business

FAQs

Frequently asked questions

Prospa offers business loans of $5,000 to $500,000 with terms between 3 and 36 months and cash flow friendly repayments that are either daily or weekly.

A Prospa business loan can be used for almost any business purpose including cash flow management, business renovations, marketing, to purchase inventory or new equipment, as general working capital and much more. The loan cannot be used for personal purposes.

The application process is easy and fast. Simply complete the online form in 10 minutes.

For loans of $150,000 or less, all you need to have ready is:

- Identification details (valid Driver’s Licence)

- Details about your business (including trading time, ownership details & an active Business Number)

For loans over $150,000 you will also need some basic financial statements like a P&L and cashflow, so we can evaluate the health of your business and see what kind of repayments your business can manage without stress.

Business loan interest rates vary due to factors including the amount borrowed, what business assets the funds will be used for, the industry the business operates in, how long the business has been running, whether the business has sufficient cash flow to support the loan, and the overall ‘health’ or creditworthiness of the business.

There are no hidden fees for our business loans, and you’ll know exactly how much you need to pay, and when, from day one. There’s no compounding interest, no penalties for early repayment and no additional fees (as long as you make your payments on time).

Prospa doesn’t charge an Application Fee. You can apply for a loan with Prospa with no upfront cost or obligation to proceed.

The Origination Fee covers the costs associated with setting up and managing the loan. You are only charged this fee if you proceed with the loan. Our Origination Fee is 3.5% of the loan amount.

For loans up to $150,000 no asset security is required upfront to access the money, however we do require a personal guarantee. As long as you follow your loan obligations (as detailed in your loan contract document), asset security will never be required. For loans of over $150,000 Prospa generally takes a personal guarantee and security in the form of a charge over assets.

Other questions?