Your business, funded faster

Already know what

you’re after? .

Need help?

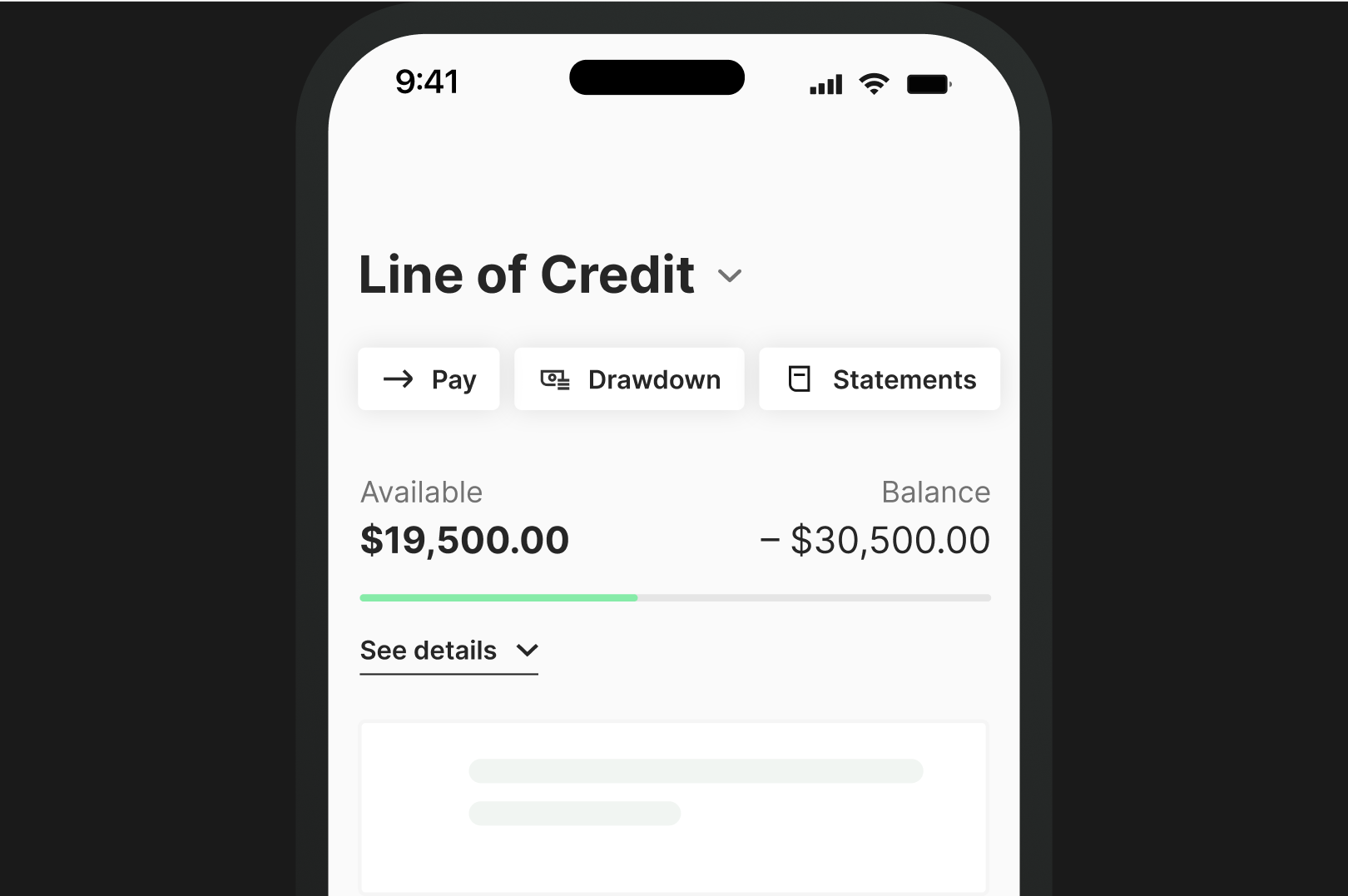

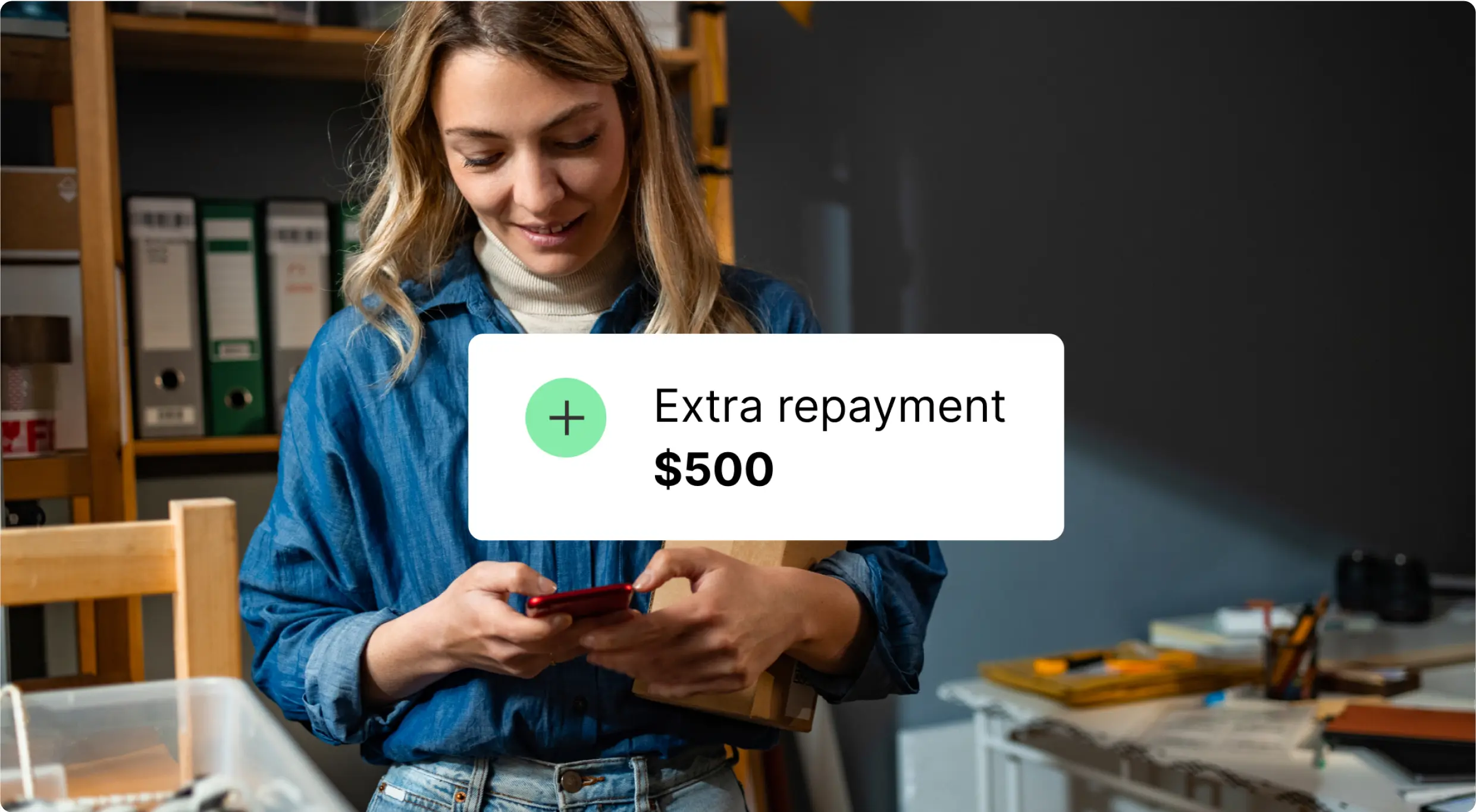

Greater flexibility and control

To keep business moving

Interest savings

Why Prospa

About us#1

online lender in New Zealand

12+

over 12 years of experience

$4B

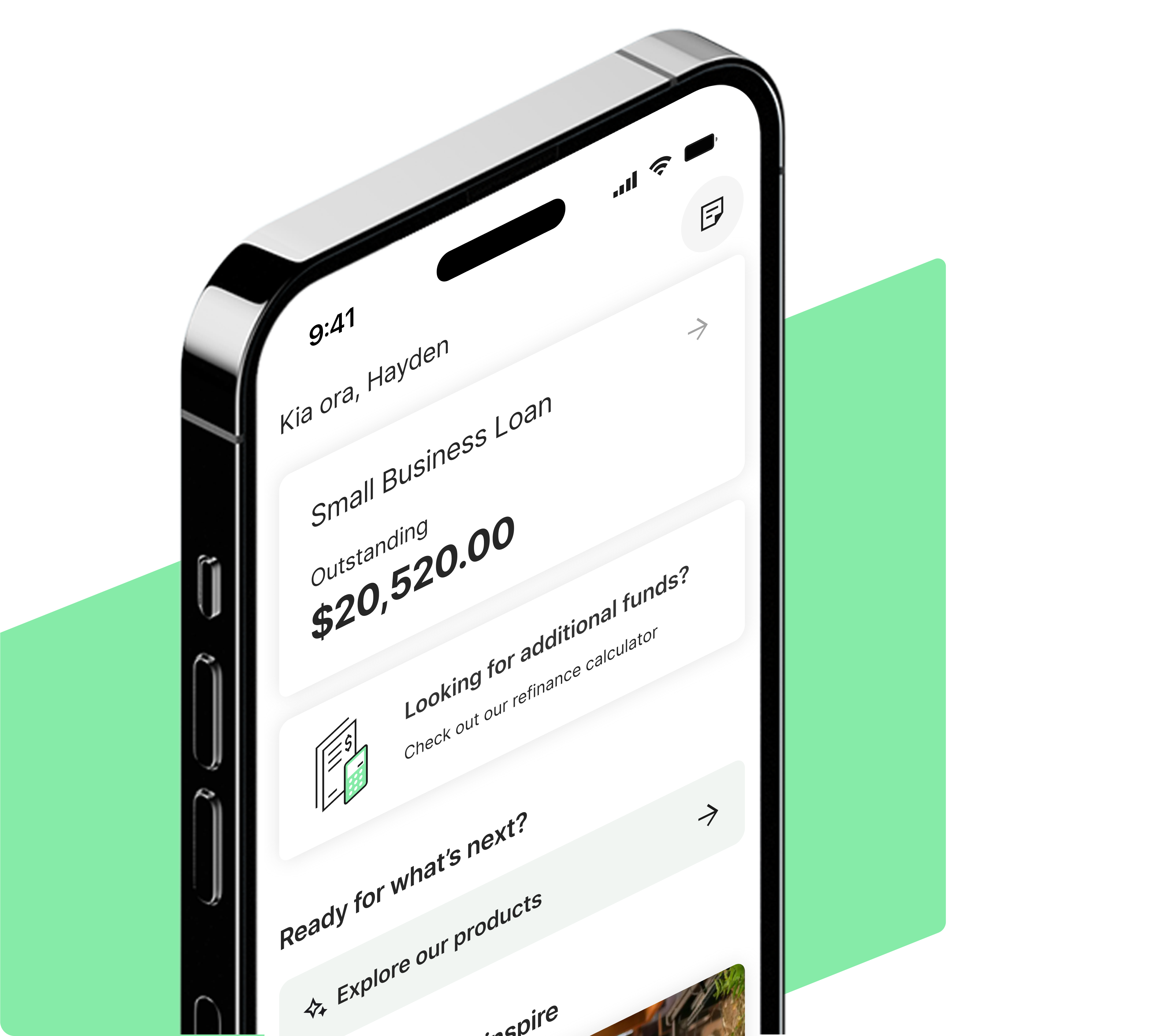

Small business loans

50K

over 50K businesses funded

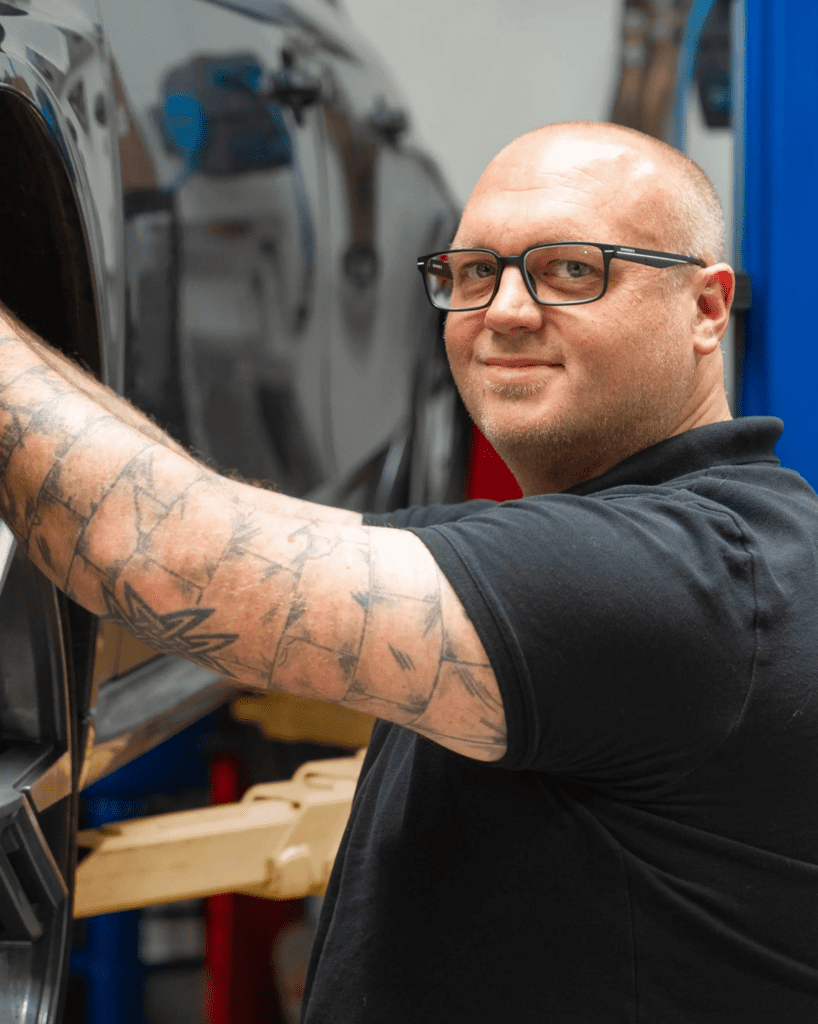

Customers making it happen with a Prospa loan

Read customer storiesRecent articles

Stories to inspire you,

tips to save you time

FAQs

Common questions answered

To qualify for Prospa funding, you must be:

- A New Zealand Citizen (or Permanent Resident)

- Over 18 years old and own a New Zealand business (with a valid NZBN/IRD)

- Meet the minimum trading history requirement

The application process is quick and easy. Simply complete the online form in minutes and a dedicated business lending specialist will be in touch to guide you.

- For funding between $5K to $150K we can often provide a response in one hour – as long as you apply during standard business hours and allow us to use the advanced bank verification system link to instantly verify your bank information online. If you choose to upload copies of your bank statements we can provide a decision in as little as one business day.

- For funding between $150K to $500K we may take a little longer. Turnaround times are around 2–3 days for final approval, however this may be quicker depending on the circumstances of each application.

Often, you can have the funds in your account in as little as 1 hour after settlement.

We offer Business Loans or Line of Credit up to $500K, however the total amount of your loan will depend on the specific circumstances of your business.

We consider a variety of factors to determine the health of your business and based on this information we will make an assessment on how much you can borrow.

Use our loan calculator to discover much you could afford to borrow.

We understand that circumstances can change. That’s why we offer a 14-day Change of Mind Policy. If you decide you no longer want the funds, you can cancel your loan agreement and return the funds free of charge, as long as it’s within 14 days of your loan agreement date.

To take advantage of this policy, simply contact one of our lending specialists at 0800 005 797, and we’ll assist you with the process.

If it’s been more than 14 days since your loan agreement date, you still have the option to pay off your loan in full to minimise interest costs. However, please note that fees and charges will still apply. For assistance with a full payout, reach out to our lending specialists at 0800 005 797.

Protecting your information, and being clear about how we collect, use, exchange and protect your information, is of huge importance and a vital part of our relationship with you. View our Privacy Policy.

Yes. We use industry recognised encryption standards to protect your personal, sensitive and financial data and are aligned to ISO27001 and NIST CSF for our commitment to customer security and privacy. We use an advanced bank verification system link to instantly verify your bank account information online so we can provide a fast response.

When you apply, we will assess the risk profile of your business and provide you with a customised offer including loan amount, term and interest rate.

Eligibility and approval is subject to standard credit assessment and not all amounts, term lengths or rates will be available to all applicants. Fees, terms and conditions apply.