As many small businesses across New Zealand face economic uncertainty as the global coronavirus pandemic bites, the New Zealand Government has promised wage subsidies and tax relief.

Here’s what you need to know about the economic stimulus package.

Updated: 27 March 2020

As governments across the world move to support their countries’ economies by pumping funds into them, New Zealand’s response has emerged among the most generous.

More than $12 billion has been pledged, or around 4% of annual GPD. Almost three-quarters of the funds are earmarked to support business and jobs, in two key ways: wage subsidies and tax relief.

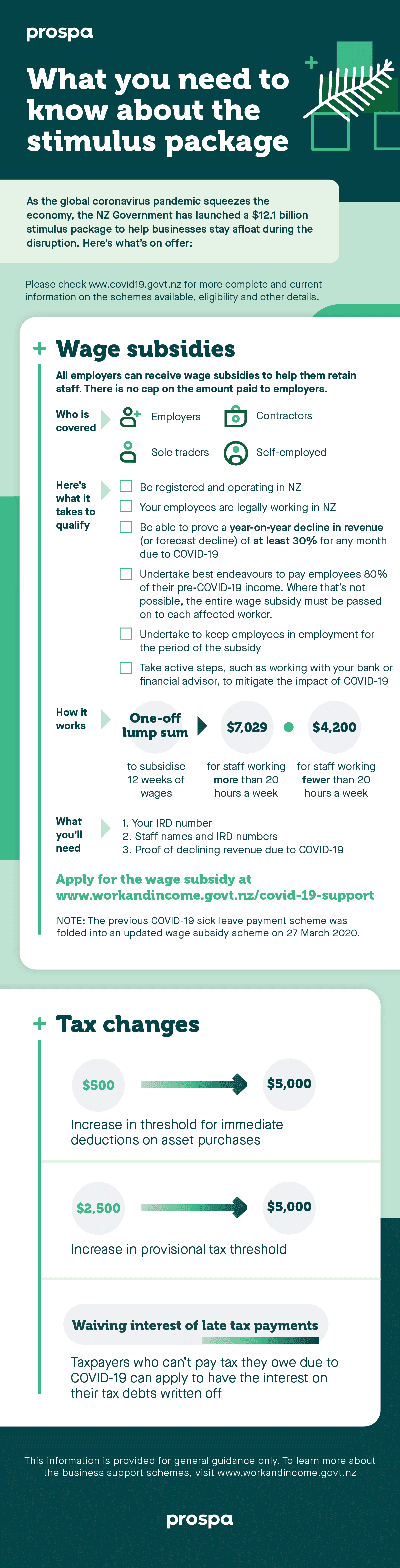

Wage subsidies

The wage subsidies are aimed at any employers significantly impacted by COVID-19 and struggling to keep staff on as a result, as well as self-employed and sole traders.

The subsidy is worth $585.80 a week for a full-time employee or $350 for a part-time employee, paid as a lump sum covering 12 weeks. There is no cap on the amount paid to employers.

For example, if a Queenstown tourism operator with 20 permanent part-time employees saw a significant drop in forward bookings because of the travel ban, they could apply for the subsidy and receive up to $84,000 (20 part-time employees at $350 a week multiplied by 12 weeks).

Those funds would then be used to pay those employees for the next three months.

Tax relief

The has also been an increase in the threshold for an immediate deduction on asset purchases, an increase in the provisional tax threshold and a waiver on late tax payments.

Sign up to the Prospa Blog newsletter for more small business news and tips.