At a glance

- A new 20% upfront deduction aims to help NZ businesses reinvest in productive assets during a period of economic uncertainty.

- To qualify, the asset must be new or new to New Zealand, used primarily for business, and depreciable under IRD rules.

- The Investment Boost applies to any qualifying asset, regardless of value, which means it can support both small upgrades and major capital investments.

There’s a new way for NZ businesses to deduct asset costs, and it’s more flexible than what came before. Thanks to a tax incentive introduced in the 2025 Budget, eligible businesses can now deduct 20% of the cost of new assets upfront. Known as the Investment Boost, it applies to a wide range of purchases made from 22 May 2025 onwards.

This incentive was introduced to encourage reinvestment and support economic growth during a period of uncertainty. Treasury modelling estimates the policy could lift GDP by 1% and increase wages by 1.5% over the next two decades, with around half of that impact expected within five years.

In this article, we’ll explain how the Investment Boost works, which assets qualify, and how to claim it in your next tax return.

What the Investment Boost is

The scheme offers businesses a one-off 20% deduction on eligible new assets in the year they’re acquired or first available for use. The remaining 80% is depreciated normally across the asset’s useful life.

While the instant asset write-off scheme allowed businesses to deduct the full cost of qualifying assets, but only up to a set threshold, the Investment Boost removes that cap and offers broader access, especially for businesses planning larger purchases. It applies to any qualifying asset, regardless of value. Whether you’re spending $5,000 or $500,000, you can deduct 20% immediately and depreciate the rest over time.

Which businesses and assets qualify

The Investment Boost is available to all businesses operating in New Zealand, regardless of size or industry. There’s no application process. If you meet the criteria, you can claim the deduction in your income tax return.

To qualify, the asset must:

- Be new, or new to New Zealand

- Be available for use on or after 22 May 2025

- Be depreciable for tax purposes under IRD rules

This includes a wide range of tangible assets, from laptops and tools to commercial vehicles and manufacturing equipment. It also applies to:

- New commercial and industrial buildings

- Improvements to depreciable property (excluding residential buildings)

- Primary sector land improvements

- Assets related to petroleum or mineral development expenditure, provided the expenditure is incurred on or after 22 May 2025

If you’re still weighing up your options, our Lease vs buy business equipment in NZ guide can help you assess what’s right for your business and cash flow.

What assets are excluded from the Investment Boost?

Some assets aren’t eligible for the 20% deduction. These include:

- Assets that have previously been used in New Zealand

- Land (though land improvements like fencing may qualify)

- Residential buildings (dwellings)

- Trading stock held for resale

- Fixed-life intangible assets, such as patents and trademarks

- Assets already fully expensed under other rules (e.g. items under $1,000)

The asset must also be used primarily for business. If it’s a shared or mixed-use item, like a vehicle used for both personal and work purposes, only the business-use portion qualifies.

How the 20% deduction works

Once an eligible asset is purchased and available for use, you can deduct 20% of its cost in that year’s income tax return. The remaining 80% is depreciated as usual, using IRD’s standard rates for that asset type.

This structure gives your business an upfront tax benefit while preserving the long-term value of depreciation. It’s designed to help owners reinvest earlier, without losing out on ongoing deductions.

How the Investment Boost works in practice

A growing restaurant refurbishes its kitchen to improve service speed and capacity. The full fit-out, including new ovens, benching, refrigeration units and ventilation, costs $80,000.

Under standard rules, these assets are depreciated at an average rate of 13%, meaning the business would normally claim $10,400 in deductions in the first year.

With the Investment Boost, the restaurant can immediately deduct 20% of the full amount ($16,000) in the year of purchase. It then depreciates the remaining $64,000, resulting in an additional $8,320 deduction that year.

Altogether, the business claims $24,320 in its first year. That’s an extra $13,920 in deductions, more than double the amount it would have received through depreciation alone.

To see how the Investment Boost fits into your overall tax position, check out our guide to small business tax deductions in New Zealand for 2025.

How mixed-use assets are treated

To qualify for the full 20% deduction under the Investment Boost, the asset must be used primarily for business purposes. If it’s used partly for personal or private reasons, only the business-use portion is eligible.

Take, for example, a vehicle purchased for $45,000 and used 60% of the time for business and 40% for personal errands. Only 60% of the asset’s value, that is, $27,000, can be used to calculate the deduction and depreciation.

In this case:

- The 20% deduction applies to the $27,000 business-use portion, allowing the business to claim $5,400 upfront.

- The remaining $21,600 (80% of $27,000) is depreciated as normal.

If your asset use changes over time — for instance, if personal use increases — you’ll need to adjust future depreciation claims accordingly. Keeping accurate usage records is essential, especially for high-value or dual-purpose assets like vehicles and technology.

If you’re unsure how to work out the deductible portion, an accountant or tax adviser can help you apply the correct apportionment.

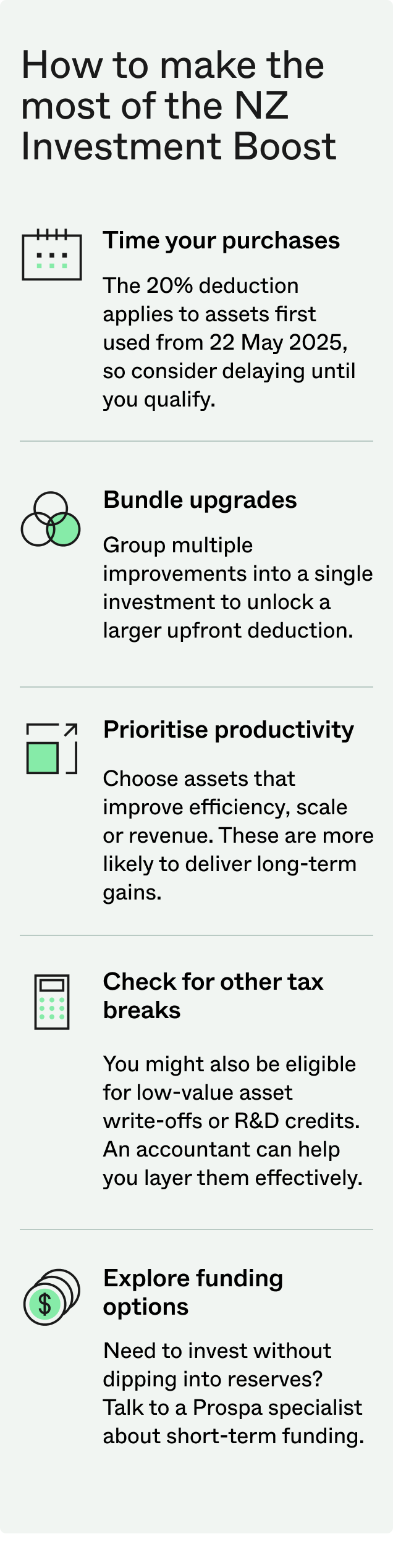

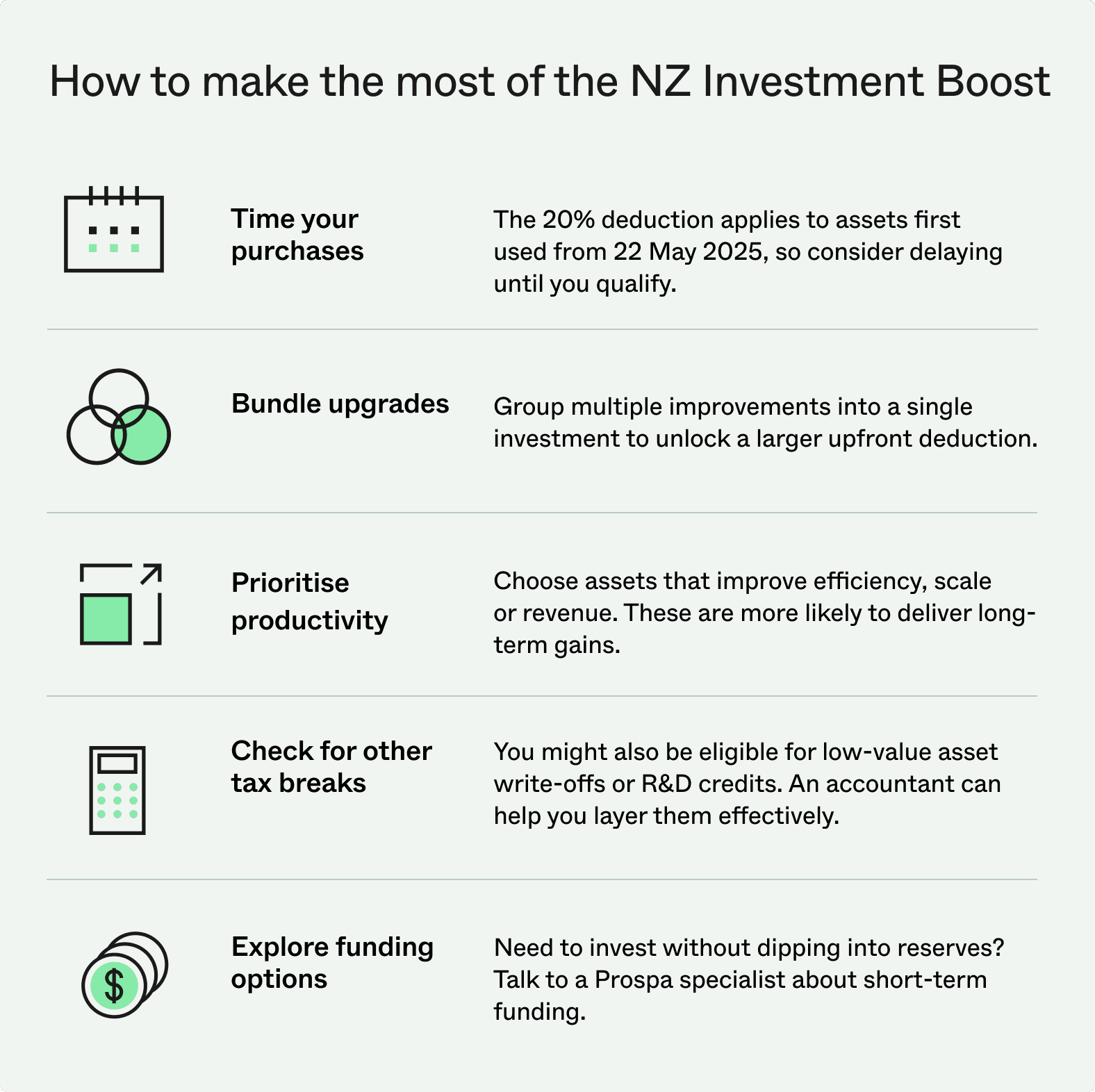

What to do next

If you’ve purchased a new asset and it’s available for use, you can claim the Investment Boost in your income tax return for that year. The 20% deduction is treated as a business expense, and standard depreciation applies to the remaining 80%. Make sure your records clearly show the asset’s purchase date, cost, and how it’s used in the business.

For full guidance on how to include the deduction in your return, check the IRD’s official Investment Boost page, or speak to your accountant or bookkeeper.

If you’re planning to take advantage of the deduction but need help funding the purchase, talk to a Prospa specialist.