Business funding solutions for SME clients

Make business happen with

A range of funding solutions

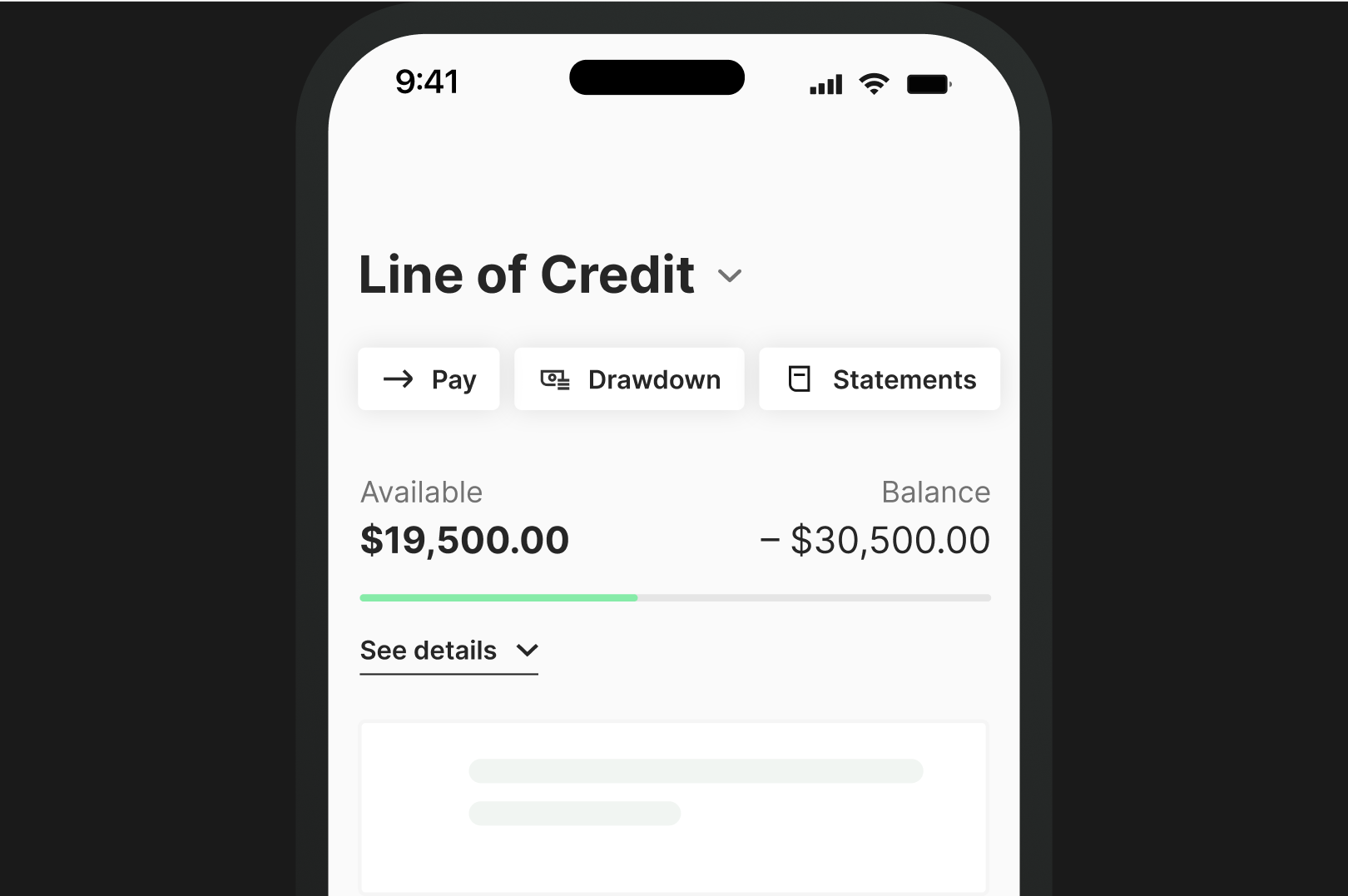

Prospa Business Line of Credit

Ongoing access to up to $500K to simplify cash flow.

| Facility amount | $2K – $500K |

| Upfront security | No asset security required upfront to access up to $150K in Prospa funding.

Security may be required when accessing over $150K in Prospa funding. |

| Decision time | Within 24 hours |

| Term | Renewable 24-month term |

| Repayment options | Weekly |

| Application requirements

|

Completed application (incl. credit consent)

Minimum trading history applies

|

| Minimum eligibility criteria | Minimum trading history applies

Business must not operate in excl. industries A New Zealand Citizen (or permanent resident) Over 18 years of age, own a New Zealand Business (with a valid NZBN/IRD)* *NZBN not required for sole trader applications |

| Preliminary assessment/ Pre-approval available without credit check |

Not applicable |

| Fees | Origination Fee: $0

Weekly Service Fee: 0.046% of facility limit per week |

| Partner Commissions | New customer: 2% of facility size on 1st draw

Repeat referral: 1% p.a. of facility size on 1st draw Term extension: 1% p.a. of the average drawn balance over the first term of the facility |

| Standard features | Only pay interest on the funds being used

Make additional principal repayments at any time Access funds wherever and whenever with Prospa Online |

Prospa Small Business Loan

Same day access to funds from $5K to $150K to keep business moving.

| Facility amount | $5K – $150K |

| Upfront security | No asset security required upfront to access up to $150K in Prospa funding |

| Decision time | Possible within 24 hours |

| Term | 3 – 36 month term |

| Repayment options | Weekly |

| Application requirements | Completed application (incl. credit consent)

Minimum trading history applies |

| Minimum eligibility criteria | Minimum trading history applies

Business must not operate in excl. industries Averaging at least $6K turnover per month |

| Preliminary assessment Pre-approval available without credit check |

Not applicable |

| Fees | Origination fee: 3% or 4% |

| Partner Commissions | New customer: 3%

Repeat referral: 1.5% (fresh capital only) |

| Standard features | Early payout option available

Unlimited extra repayment to save on interest |

Prospa Business Loan Plus

A larger lump sum to invest in longer term plans.

| Facility amount | $150K – $500K |

| Upfront security | Security may be required when accessing over $150K in Prospa funding. |

| Decision time | Within 24 hours for up to $250K

Within 3 days for above $250K |

| Term | 12 – 60 month term |

| Repayment options | Weekly |

| Application requirements | Completed application (incl. credit consent) plus

12 months bank statements Last 2 years finalised financial statements, plus interim current FY financials Aged Payables and Aged Receivables summaries Copy of IRD Tax Portal |

| Minimum eligibility criteria | Minimum 3 years trading

At least $700K turnover annually Business must not operate in excluded industries |

| Preliminary assessment/ Pre-approval available without credit check |

For applications above $250K |

| Fees | Origination fee: 3% or 4% |

| Partner Commissions | New customer: 2%

Repeat referral: 1% (fresh capital only) |

| Standard features | Early payout option available

Unlimited extra repayments to save on interest |

Customers making it happen with a Prospa loan

Read Customer StoriesHave a scenario?

Find out if Prospa could be the right solution for your client’s need.

Fill in the details below and we’ll get straight back to you.

Thank you

We've received your details. A member of the Prospa team will contact you shortly.

While you wait, register as a Prospa Partner here to speed up the process

Already a Prospa Partner? Log in to the Partner Portal here

Need more info?

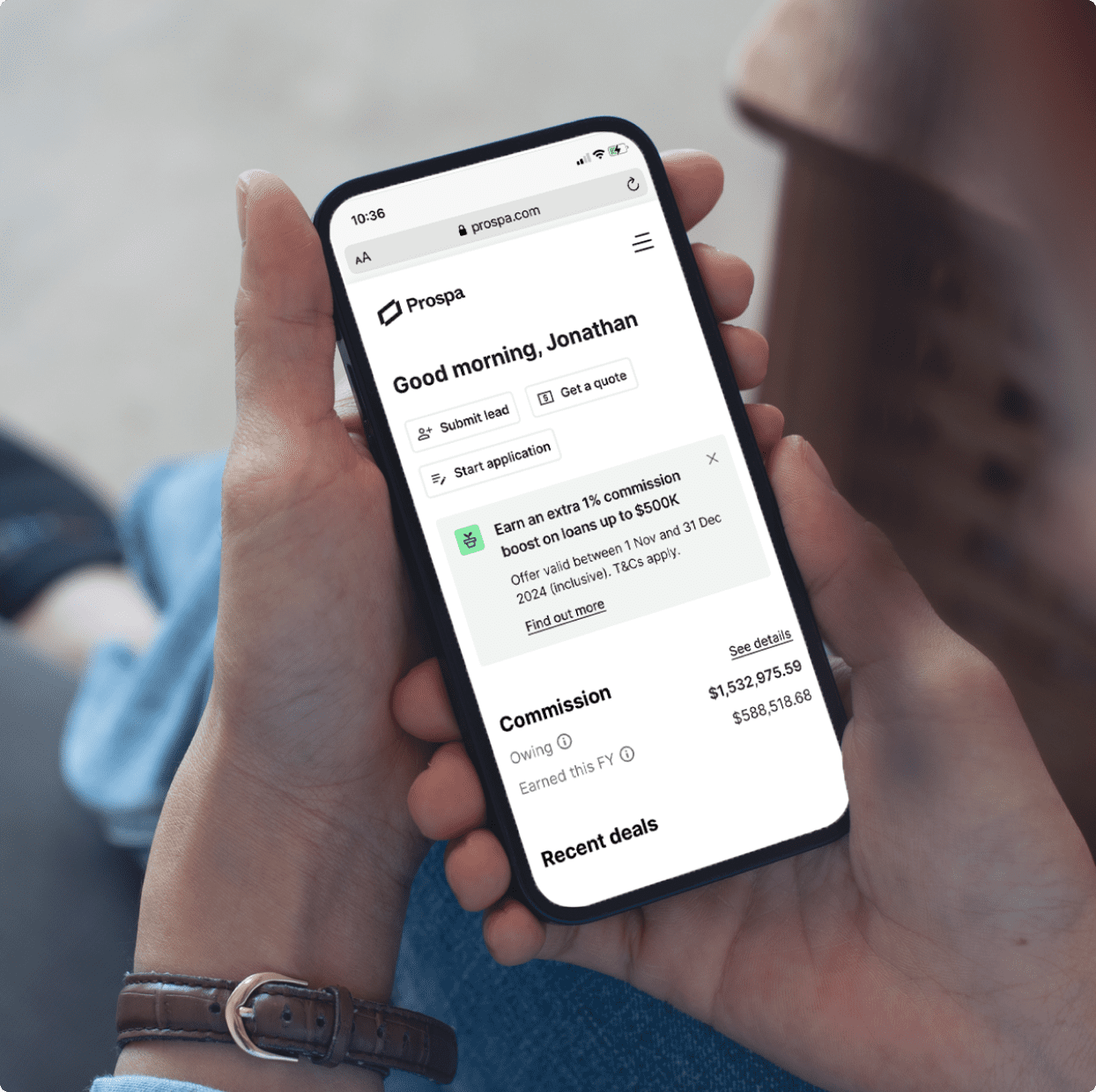

Let’s get this partnership started

Choose your involvement

Choice for SME clients

Attractive commissions

Support

Education & tools

Partner Portal

1. Prospa uses a risk-based pricing model to determine applicable rates using factors such as industry, time in trade, cash flow and creditworthiness. The lowest rate is only available to applicants with the strongest cash flows, business experience and credit ratings.

2. Lead Management Policy and Commission Matrix applies, see Partner Portal.

Disclaimer: This is a general guide only and does not constitute an offer or credit approval. Gradings may differ after customer information is provided and credit assessment. Prospa may seek additional information from customer at its discretion. Information is accurate as at 25 October 2021 and subject to change without notice (including pricing). Eligibility and approval is subject to standard credit assessment and not all amounts, term lengths or rates will be available to all applicants. Fees, terms and conditions apply.