At a glance

- Many small business owners still operate without a budget, which puts them at greater risk of cash flow issues

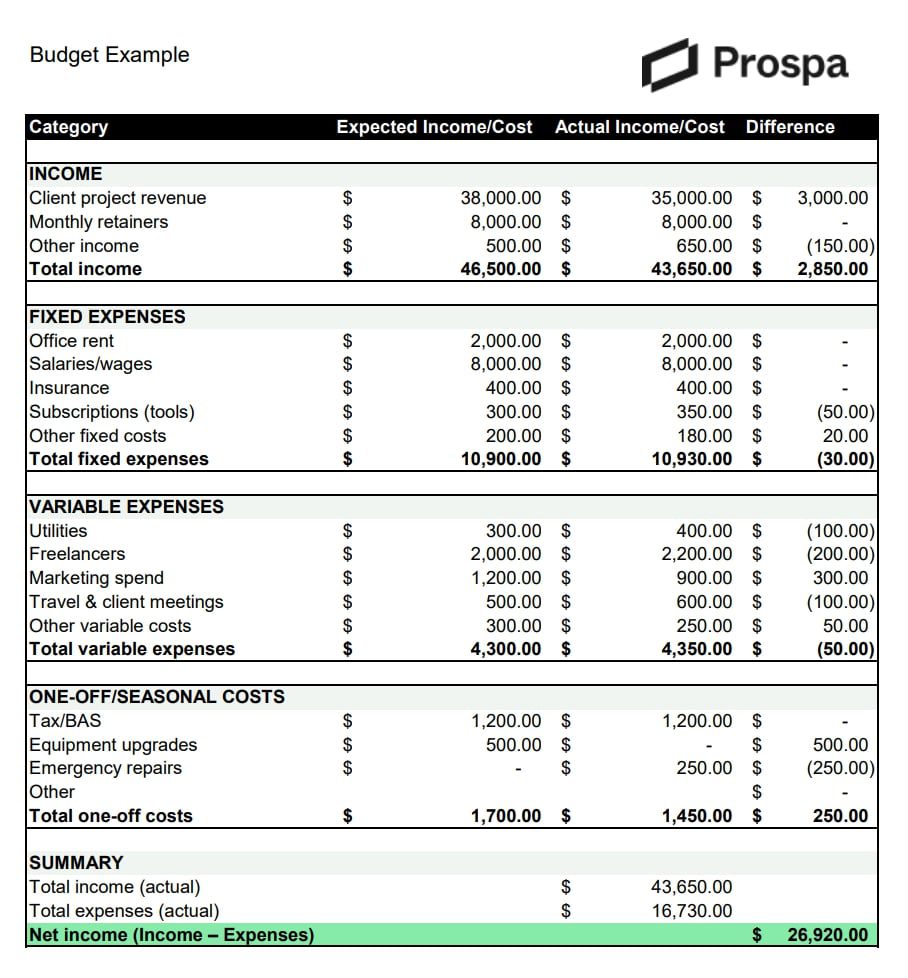

- Tracking fixed, variable, and one-off expenses helps you spot patterns and plan for quieter months

- This guide walks you through simple budgeting steps and includes a free template with a pre-filled example to help you avoid blank page syndrome

Creating a business budget isn’t always at the top of a small business owner’s to-do list. But when things get busy or unpredictable, having a clear plan can make all the difference.

A good budget helps you stay focused on the numbers that matter. It shows you what’s coming in, where the money’s going, and how much room you have to move. Whether you’re preparing for growth, covering seasonal slowdowns, or just aiming for less stress at tax time, budgeting gives you more control and peace of mind.

This guide takes you through each step, with practical tips and a free downloadable template to help you put it all into action.

The risks of running your business without a budget

Without a budget, it’s easy to assume things are going well just because sales are steady. But the numbers don’t always tell the full story.

Picture a café owner with strong weekend trade and regular customers. On paper, things may look good. But quarterly GST returns, rising supplier costs, and a few quiet weeks in winter can quickly put pressure on cash flow. When the coffee machine breaks or rent increases, there’s no buffer.

Many small businesses run into similar challenges. Without a clear picture of what’s coming in and going out, it’s harder to make confident decisions, prepare for slower periods, or invest in growth. A budget won’t prevent every issue, but it can give you the breathing room to handle them.

What a business budget is — and isn’t

It’s easy to confuse a budget with a business plan, or to assume it’s only useful once your business reaches a certain size. In reality, a good budget is simple, flexible, and helps you make decisions without second-guessing. It doesn’t have to track every dollar, but it should reflect how your business runs and where it’s heading.

Here’s what a business budget really is:

| A business budget is… | A business budget isn’t… |

|---|---|

| A working plan to guide financial decisions | A business plan or investor pitch |

| A tool to monitor income and expenses in real time | A one-off document that stays in a drawer |

| Useful for any size business | Something only large or complex businesses need |

| Flexible and responsive to change | A rigid set of rules you’re locked into |

| A way to catch problems early and reduce financial stress | Just another layer of admin |

The best budgets grow with your business. They are simple, practical, and help you to adjust when things change.

6 simple steps to create a budget for small businesses

The goal of any business budget is simple: make sure your income consistently covers your expenses and leaves room to grow. By identifying your biggest costs and revenue sources, you can plan ahead instead of reacting. It’s a good idea to build in a safety margin of 10% to 20% around projected income, giving you flexibility when costs rise or sales dip.

These business budgeting tips for small business owners will help you get started.

1. Review your income

Start by listing all income sources from the past 6 to 12 months. This includes product sales, service fees, recurring contracts, or project-based work. If your revenue changes throughout the year, map it month by month to spot trends. Relying on averages alone can hide slower periods.

Need help forecasting those patterns? Take a look at our cash flow forecasting for small businesses guide. It includes a free template to help you get started.

2. List your fixed and variable expenses

Fixed costs stay consistent each month. Think rent, insurance, salaries, and software subscriptions. Variable expenses change depending on activity and might include inventory, utilities, marketing, or freelance support. Understanding which expenses move and when helps you manage cash flow more effectively.

3. Plan for one-off and occasional expenses

Include irregular costs like tax payments, equipment upgrades, emergency repairs, or annual fees. These might not appear every month, but when they do, they can affect your budget if you haven’t accounted for them.

4. Set financial goals

Use your budget to support the goals that matter most, whether that’s building a cash buffer, paying off debt, or investing in staff or systems. Having clear goals makes it easier to track progress and make better decisions.

5. Use tools to stay on track

Spreadsheets are a good place to start, but tools like Xero Expenses or MYOB Capture & Expenses can make budgeting more accurate and less time-consuming. They act as business expense trackers, helping you monitor income and spending in real time and flag any issues early. For more options, explore the top financial tools for NZ small business owners in 2025.

6. Review and adjust regularly

Check in on your budget monthly or quarterly. Are you tracking as expected? Have costs crept up? Is revenue consistent with your forecast? A regular review helps keep your budget relevant and useful.

Not sure where to start? We’ve included a free small business budget template you can download and adapt. It also includes an example tab pre-filled with realistic figures to give you a head start.

Is your budget working hard enough?

When you review your budget, keep these small business budgeting tips in mind.

- All your expenses are covered

You’ve accounted for fixed, variable, and one-off costs like tax, subscriptions, and emergency repairs. - You’ve planned for seasonal changes

Your forecast adjusts for slower months, not just yearly averages. - Your goals are grounded in real numbers

You’re working toward targets based on past performance, with enough stretch to stay ambitious. - You’ve included a buffer

You’ve included a 10% to 20% margin around projected income to help absorb fluctuations. - You’re reviewing it regularly

You review your budget monthly or quarterly to keep it aligned with how the business is performing.

If a few of these didn’t get a tick, now’s a good time to make some updates. They’ll pay off when your business needs to move fast.

Final thought

Budgets work best when they reflect how your business actually runs. Keep it simple, check in regularly, and adjust when needed. The more you use it, the more confident your decisions will become.

Looking to smooth out cash flow or invest in growth? A Prospa Line of Credit could give you the breathing room your budget can’t always guarantee.