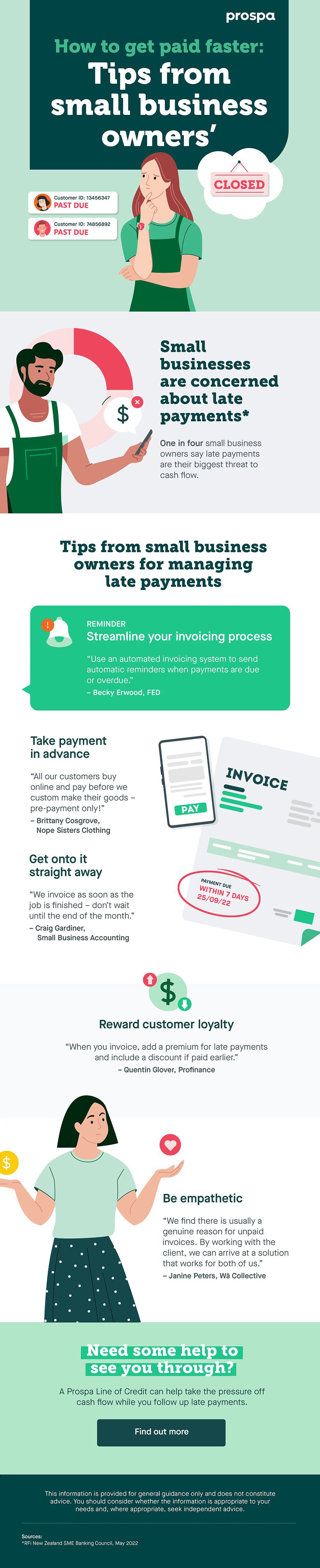

A quarter of small business owners say late payments are the biggest threat to cash flow – here are tips from five small business owners on how to get paid sooner.

At a glance

Here’s a snapshot of the advice from our interviewees:

- Prompt and automated invoicing can lead to faster remittance.

- Consider taking payment for services or goods beforehand, rather than afterwards.

- Encourage a prompt response with a premium for late payments – or a discount for early payments.

- The personal touch goes a long way, as can empathy for your clients – it’s not only business owners who are doing it tough.

Late payments on invoices can often be the bane of a small business owner’s existence.

In fact, according to recent research one in four small businesses say late payments from customers is the biggest challenge facing their business when it comes to managing cash flow.*

On top of this, the number of small businesses saying that late payments was one of their top concerns increased by four percentage points in the six months to May 2022 – to almost half of all small businesses surveyed.

Late payments could have a severe impact on cash flow, and in the current challenging economic climate, that isn’t ideal.

Here are five small business owners on how they manage late payments from customers, and how you can spend less time chasing up invoices and more time getting back to business.

*RFi New Zealand SME Banking Council, May 2022

Need flexible access to funds to cover unpaid invoices? We might be able to help. See how a Prospa Line of Credit could ease the pressure.