Considering invoice financing to solve late payments? We break down the true costs and risks, and explore simpler, more flexible funding alternatives for your NZ business.

At a glance

- Invoice finance allows you to access cash from unpaid customer invoices immediately, with a provider advancing up to 85% of the invoice's value.

- The main benefit is improved cash flow, but this commonly comes at a high cost with an equivalent APR greater than traditional business loans, and it can also put your client relationships at risk.

- It is a specialised financial tool, best suited for a niche of businesses like fast-scaling B2B firms or those in sectors where 60-90 day payment terms are standard.

It’s a common challenge for many Kiwi business owners: your sales ledger shows a healthy stream of revenue, but your bank account tells a different story. This delay between invoicing and getting paid can create a stressful cash flow crunch, making it difficult to pay suppliers, cover wages, or invest in the next opportunity.

Invoice finance is often presented as the go-to answer for this problem, offering a way to turn unpaid invoices into immediate cash. But to determine if it’s the right choice, you must look beyond this promise to fully understand the costs, complexities, and commitments involved.

A guide to invoice finance for NZ businesses

Invoice finance is a financial tool that allows your business to access cash by using your unpaid customer invoices as security. Rather than waiting weeks or months for clients to pay, this solution provides an upfront cash advance, effectively bridging the gap between completing a job and receiving the funds.

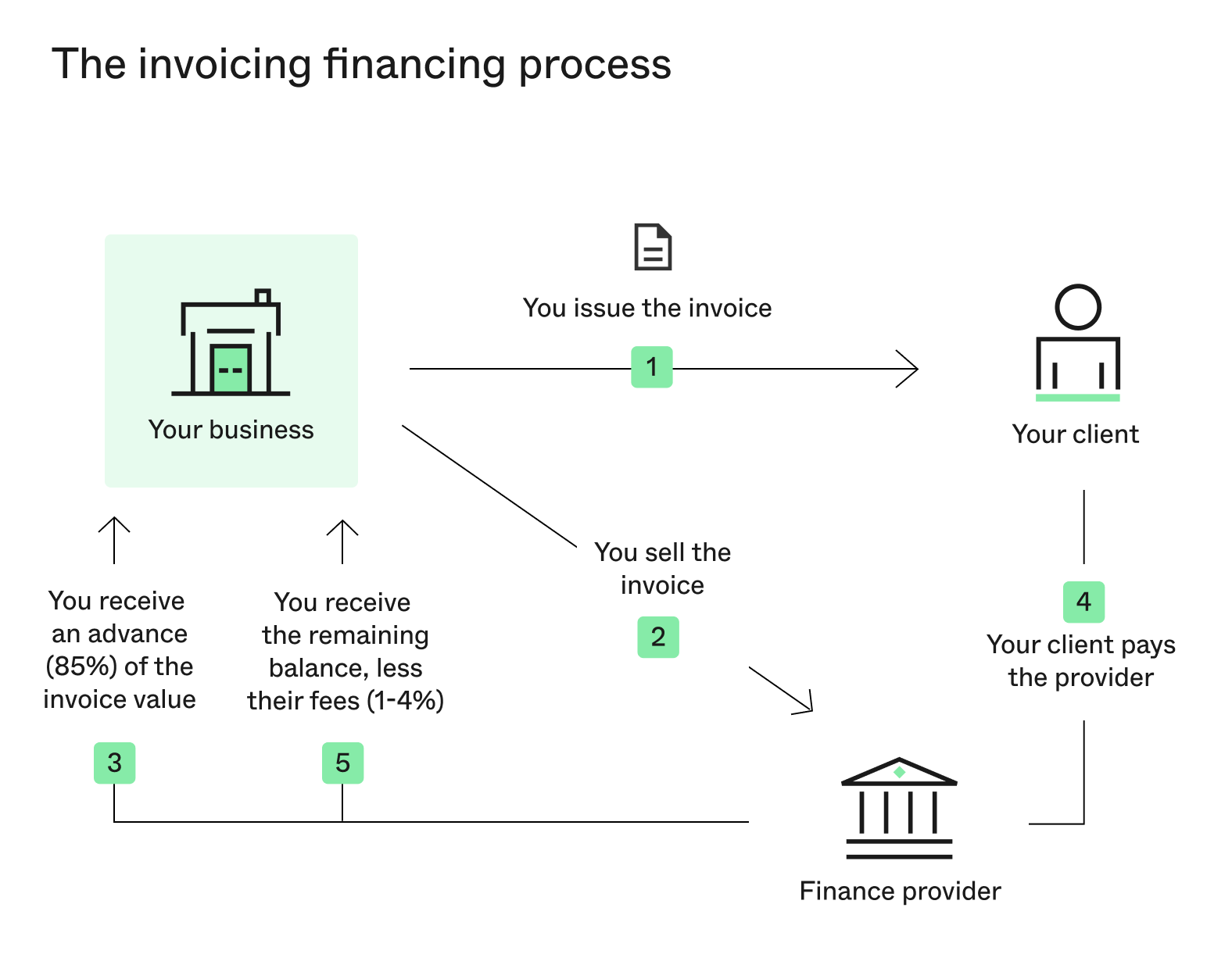

The process usually involves five key steps:

- Issue your invoice to the client. Once you’ve delivered the goods or services, send an invoice to your customer based on your regular payment terms.

- Sell the invoice to a provider. You then provide a copy of this outstanding invoice to a third-party finance company.

- Receive your cash advance. After verifying the invoice, the provider will deposit a large portion of the invoice’s value (up to 85%) into your account, usually within a day.

- The client pays the full amount. At the end of the payment term, your client pays the full invoice amount as instructed, directly to the finance provider.

- The remaining balance is paid to you. Once the full payment is received, the provider transfers the remaining funds to you, after subtracting their fees.

Example: Let’s say you’re an electrician who has just finished a commercial job and issued a $10,000 invoice. The client’s payment terms are 30 days, but you need the cash sooner to cover upfront costs for your next major contract. Following the steps above, you could get an $8,500 advance this week.

When your client pays the $10,000 a month later, the provider would send you the final $1,500, less their service fee (typically between $100 and $400 for an invoice of this size).

What is the difference between invoice financing, factoring and discounting?

When researching ways to solve cash flow gaps, you’ll likely encounter three key terms: invoice financing, factoring, and discounting. Though they sound alike and share a similar goal, the choice between them has significant implications for your business, especially regarding how you interact with your clients. The core difference lies in who manages your customer payments and whether your use of funding is kept private.

Invoice Financing

As a confidential funding method, invoice financing allows you to get an advance on your invoices without your clients being aware. In this model, you maintain complete control over your own sales ledger and are responsible for collecting payment from your customers as usual.

Invoice Factoring

Invoice factoring is a different model where you sell your accounts receivable to a third-party company, known as a factor. The factor then takes over the collections process, meaning the arrangement is disclosed to your customers, who will pay the factor directly.

Invoice Discounting

In New Zealand, the term ‘invoice discounting’ is widely used as a synonym for invoice financing. It refers to the same confidential process where your business maintains control over customer collections, using its invoices as collateral for funding.

This table breaks down the main points of difference.

Financing / Discounting vs. Factoring

| Feature | Invoice Financing / Discounting | Invoice Factoring |

|---|---|---|

| Confidentiality | Confidential. Your client is not aware. | Disclosed. Your client pays the factor directly. |

| Collections | You manage your sales ledger and collect payment. | The factor manages collections on your behalf. |

| Best For | Businesses that want to maintain full control of their customer relationships. | Businesses that want a full-service option and are prepared for the higher cost. |

Weighing the advantages and disadvantages of invoice finance

To decide if invoice finance is the right move for your business, you must compare the obvious benefits against potential drawbacks.

The advantages of invoice finance

- Quick access to working capital. The most significant advantage is the ability to unlock cash tied up in your sales ledger almost overnight. This helps you cover expenses and seize new opportunities without waiting on client payments.

- Scalable funding. Unlike a conventional loan with a fixed limit, an invoice finance facility can grow as your business grows. As you generate more sales and issue larger invoices, the amount of capital you can access increases with you.

- No real estate security needed. The finance is secured by the quality of your invoices and the creditworthiness of your clients. This means you generally don’t have to use your family home or other personal property as collateral.

The disadvantages of invoice finance

- The true cost can be high. As a specialised service, invoice finance often has a higher equivalent APR than traditional business loans. These fees directly reduce the profit margin on every job you finance.

- Risk to your client relationships. With factoring, a third-party company takes over your collections, which can alter the important relationship you have with your customers. Even with confidential financing, the lender’s requirements can add pressure to your collection process.

- Requires ongoing administration. You’ll need to dedicate time to submitting the right paperwork for each invoice and reconciling the payments, which can be a burden for lean businesses.

- Limited flexibility. The funds are directly tied to the value of your invoices and are designed for one purpose: bridging a payment gap. This differs from a business loan, where the capital can be used for any purpose, such as buying an asset or investing in growth.

Advantages vs. Disadvantages at a glance

| Advantages | Disadvantages |

|---|---|

| Unlocks cash from unpaid invoices quickly | Can be expensive with a high equivalent APR |

| Funding limit grows alongside your sales | May negatively impact customer relationships |

| Your home isn’t required as security | Creates an ongoing administrative workload |

| Lacks the flexibility for general business investment |

What are the true costs of invoice financing?

To determine the true cost of invoice financing, you need to look beyond the headline rate and understand the complete fee structure. The total price you pay is a blend of different charges that can vary between providers.

In most cases, the cost is a combination of two main elements:

- A discount rate: This is the primary fee, calculated as a percentage of the invoice’s total value. It normally falls within a 1% to 4% range for every 30 days an invoice is outstanding.

- Administration or service fees: Many providers include ongoing fees for managing the account, which can be a fixed monthly charge or a percentage of your facility limit.

It’s also a good idea to ask about any other potential charges, like one-off setup fees or transaction costs.

Example: Let’s go back to our electrician with a $10,000 invoice and a 30-day payment term, who needs to cover an $8,500 cash shortfall for one month. With an invoice financing arrangement, the cost for the 30-day period could be a 2.5% discount rate ($250) plus a $100 monthly admin fee, making the total cost $350.

Now, let’s compare this to using a Prospa Business Line of Credit for the same purpose. You would draw down the exact $8,500 needed. Based on the figures from Prospa’s NZ Loan Calculator, the total cost for using those funds for the first month, excluding the principal, would be around $215*, made up of the interest paid and the weekly service fees.

The difference in the total cost (excluding the principal repayments) to solve the same 30-day problem is clear:

- Invoice Financing: $350

- Prospa Business Line of Credit: ~$215

In our electrician’s case, paying $350 to use $8,500 for a month results in an equivalent Annual Percentage Rate (APR) of over 40%. That’s why, to understand the true long-term cost, you need to ask for the APR of all options you’re comparing.

*Calculations are for illustrative purposes only and do not constitute an offer of credit or financial advice. To calculate repayments, this calculator uses a fixed annual percentage rate (APR) of 31% as the interest rate and a weekly service fee of 0.046% of the facility limit. Calculated repayments include principal, interest, and fees. Repayments are calculated based on the first drawdown amount and do not consider the facility limit. The calculated repayments may not be sufficient to repay the total loan amount. At the end of the term, any outstanding balance must be repaid in full or over an additional two-year payment plan. Terms and conditions, standard credit criteria, and applicable fees apply to Prospa products.

Does your small business qualify for invoice financing?

When you apply for a standard business loan, the lender focuses primarily on your business’s financial history and assets. With invoice finance, the main asset being considered is your unpaid invoice, which means the financial standing of your customer is just as important as your own.

While specific criteria can vary between providers in New Zealand, you will generally need to have the following in place:

- A business-to-business (B2B) model. This type of funding is for companies that sell to and invoice other businesses. It is usually not available for businesses that sell directly to the public (B2C).

- Creditworthy customers. The strength of your application rests on the credit history of your clients. A sales ledger of invoices to reputable, well-established companies with a history of on-time payments is a major advantage.

- Clear and verifiable invoices. You’ll need to demonstrate a professional invoicing process, with clear payment terms for work that has been fully completed and signed off on.

You may see providers advertising “no credit check” invoice finance. This is different from how ‘no credit check’ works for unsecured funding, and it’s important to understand the distinction.

For invoice financing, the unpaid invoice itself is the asset. Therefore, a “no credit check” offer usually means the lender’s due diligence is focused more heavily on the credit risk of your customers rather than your own business’s credit file.

For an unsecured business loan or line of credit, a lender like Prospa can offer a ‘no credit check to apply’ because they use a different model. Instead of looking at historical credit scores, the emphasis is on your business’s real-time performance and health. By assessing data like your sales and cash flow, a lender can get a clear picture of your ability to repay without impacting your credit file during the application process.

What kind of businesses should use invoice finance?

Invoice finance is designed for a niche audience. It delivers the most value to businesses with a particular set of circumstances and operational needs, such as:

- High-growth B2B firms. A key benefit of this form of financing is its scalability. For a business experiencing rapid growth in sales, the available funding can increase in direct proportion to its accounts receivables.

- Companies with dedicated admin resources. Managing an invoice finance facility requires a consistent administrative effort. Businesses with an in-house bookkeeper or accounts department are better equipped to handle the reporting and reconciliation required.

- Businesses in sectors with long payment cycles. In industries like manufacturing, wholesale, or import/export, waiting 60 to 90 days for payment is common. For these companies, invoice finance is a widely-used and necessary tool to maintain liquidity.

- Companies whose clients have a stronger credit profile. If your business is relatively new but you have contracts with large, creditworthy clients, invoice finance can be a viable path, as the lending decision is heavily weighted on your clients’ history of paying their bills.

If your business doesn’t fall into these specific categories, then a more straightforward funding solution could be a better match.

Are there simpler alternatives to invoice finance?

If the complexities and potential customer impact of invoice finance don’t feel right for your business, it’s worth exploring more straightforward alternatives. In general, these are known as direct funding solutions, where capital is provided directly to your business based on its overall health, not the value of a single invoice.

For most small businesses in New Zealand, this comes in two main forms:

- A business loan offers a lump sum of funds for a clear purpose, such as buying an asset or fitting out a new location. It’s repaid with predictable instalments over an agreed-upon term, making it easy to budget for.

- A business line of credit provides ongoing access to a pre-agreed amount of funds. You can draw from it whenever you need to manage cash flow fluctuations or take up an opportunity, paying interest only on the funds you’ve used.

Both of these solutions offer a more direct relationship between you and your lender, and for many businesses, they provide a more adaptable and streamlined route to access funding.

Why a business loan or line of credit is often a better fit

So why do many Kiwi businesses choose a direct loan over invoice finance? The decision comes down to four fundamental benefits:

- A simpler process. You apply once for an approved loan amount or credit facility. There’s no need to submit individual invoices on an ongoing basis, which frees up valuable administrative time that you can reinvest into your business.

- Protection of client relationships. Direct funding is a private matter between your business and the lender. Your customers are not involved in the process, ensuring the important relationships you’ve built remain secure and under your control.

- More flexibility. The funds aren’t restricted to the value of your sales ledger. This gives you the freedom to use the capital for any business need, from covering unforeseen costs to investing in new assets or marketing. Discover how Triple R Engineering in Palmerston North prepares for the unexpected with a Prospa Line of Credit.

- Complete control. You retain full ownership of your invoices and manage your customer collections on your own terms. This means you control the entire client experience without a third party’s involvement.

Ultimately, the decision rests on your business’s primary goal. Is it to get an advance on money already earned, or is it to secure flexible capital to drive future growth? For Kiwi business owners focused on moving forward with simplicity and control, a direct funding solution like a Prospa Business Loan or Business Line of Credit ends up revealing the most fit-for-purpose choice.