For something that happens every year, the end of financial year (EOFY) period has a rare power to catch small business owners by surprise.

But getting ahead of the key tax year dates that NZ small business owners need to know will do more than just reduce your stress – it can potentially save you money as well.

NZ’s financial year period

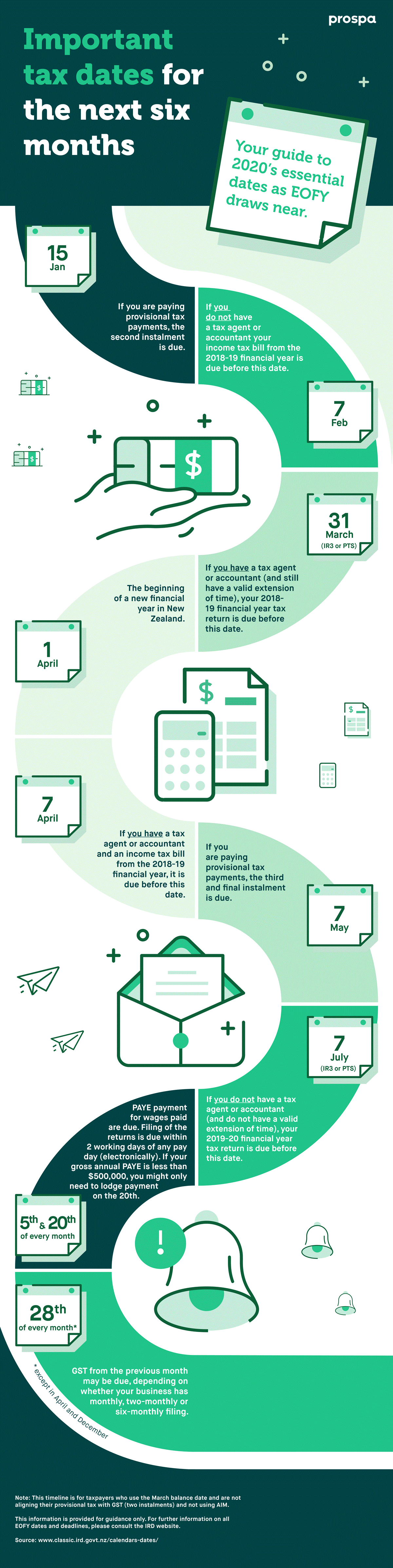

In New Zealand, the financial year, or tax year, is from 1 April to 31 March.

“The majority of businesses have this and it is known as the ‘standard’,” explains Geoffrey Hughes, Director at Hughes Judd Accounting.

“You can apply to change from the usual financial year to a ‘non-standard’, which will be considered on a merit basis. For example, many farming and agricultural businesses have different tax dates due to the seasonal nature of their business.”

Too many businesses leave it too late

Hughes says his business is often approached by new clients who are being followed up by Inland Revenue (IRD).

“The consequences, apart from IRD financial penalties, is possible loss of extended filing times going forward and an unexpected tax bill,” he says.

Stuart Ruddell, Director at JBM & Associates Limited, says the number one reason new clients approach his business is that they’ve left EOFY tax obligations too late.

The financial penalties of ignoring tax obligations

Inland Revenue currently charges $50 or $250 anytime you file a tax return late, depending on your circumstances, says Ruddell.

“On top of that, if you’re late filing the return you will be late for payment,” he explains.

“This then adds on Use of Money Interest of 8.35% (per annum), but you also get late payment penalties, which could be 5% (per annum) of the due amount during the first month and then 1% (per annum) of the tax due every month thereafter.”

Meanwhile, Hughes says, if you’re going to be late you should contact IRD prior to your tax deadline.

Of course, it’s better to be on time than it is to ask for forgiveness for being late, so make sure you mark the above key EOFY tax year dates in your calendar.

If you need some extra funds to grow your business in the new financial year or to get on top of your tax payments, talk to Prospa about how we could help meet your business finance needs.