Learn about personal guarantees for business loans. This guide weighs the pros and cons and explains how to protect yourself and your assets.

At a glance

- A personal guarantee provides lenders with the confidence to approve funding , but it also exposes your personal assets and credit score to risk if your business defaults on the loan.

- To manage this personal risk, borrow only what your business can realistically afford, test your repayment ability against leaner months, and maintain a cash reserve for unexpected costs.

- If a personal guarantee isn't the right fit, you might still secure funding based on your business's strong performance, or you could look into alternative options like a business line of credit.

For many Kiwi business owners, securing funding is a major milestone. But when a lender requires a personal guarantee, the decision becomes deeply personal, mixing the excitement of growth with the weight of putting your own finances on the line.

In New Zealand, these agreements are governed by specific laws, so understanding how they work is fundamental for protecting yourself and making a well-informed decision.

Understanding personal guarantees

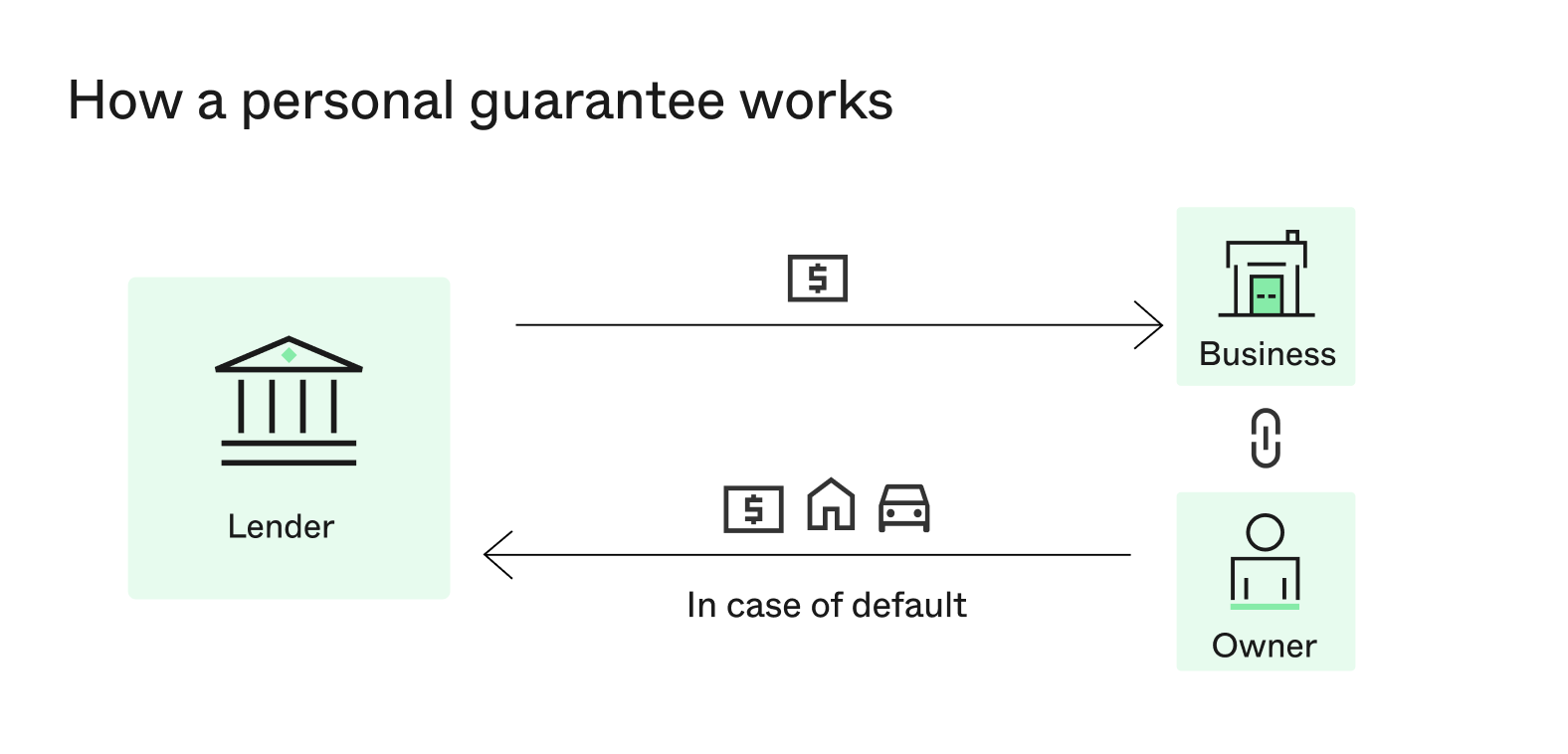

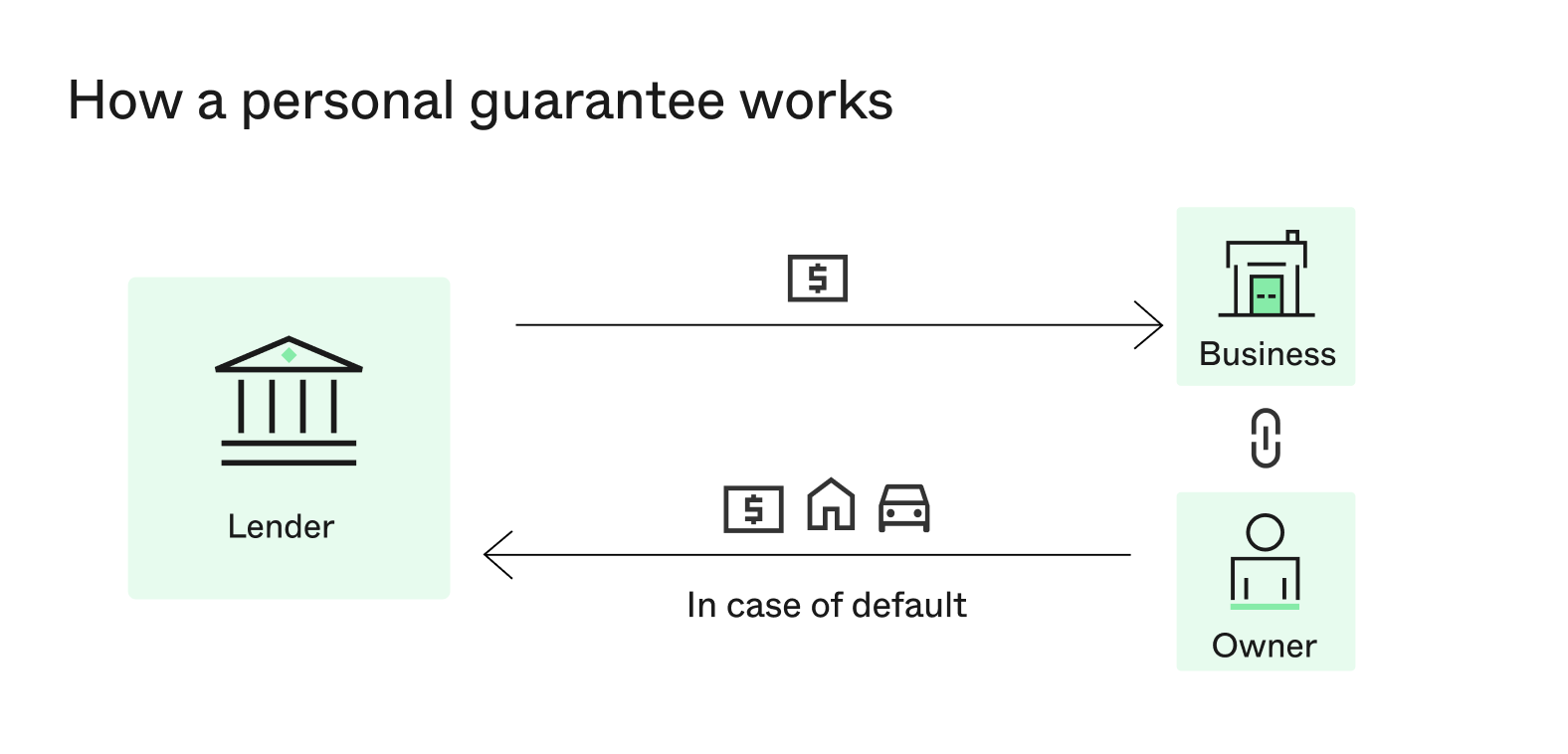

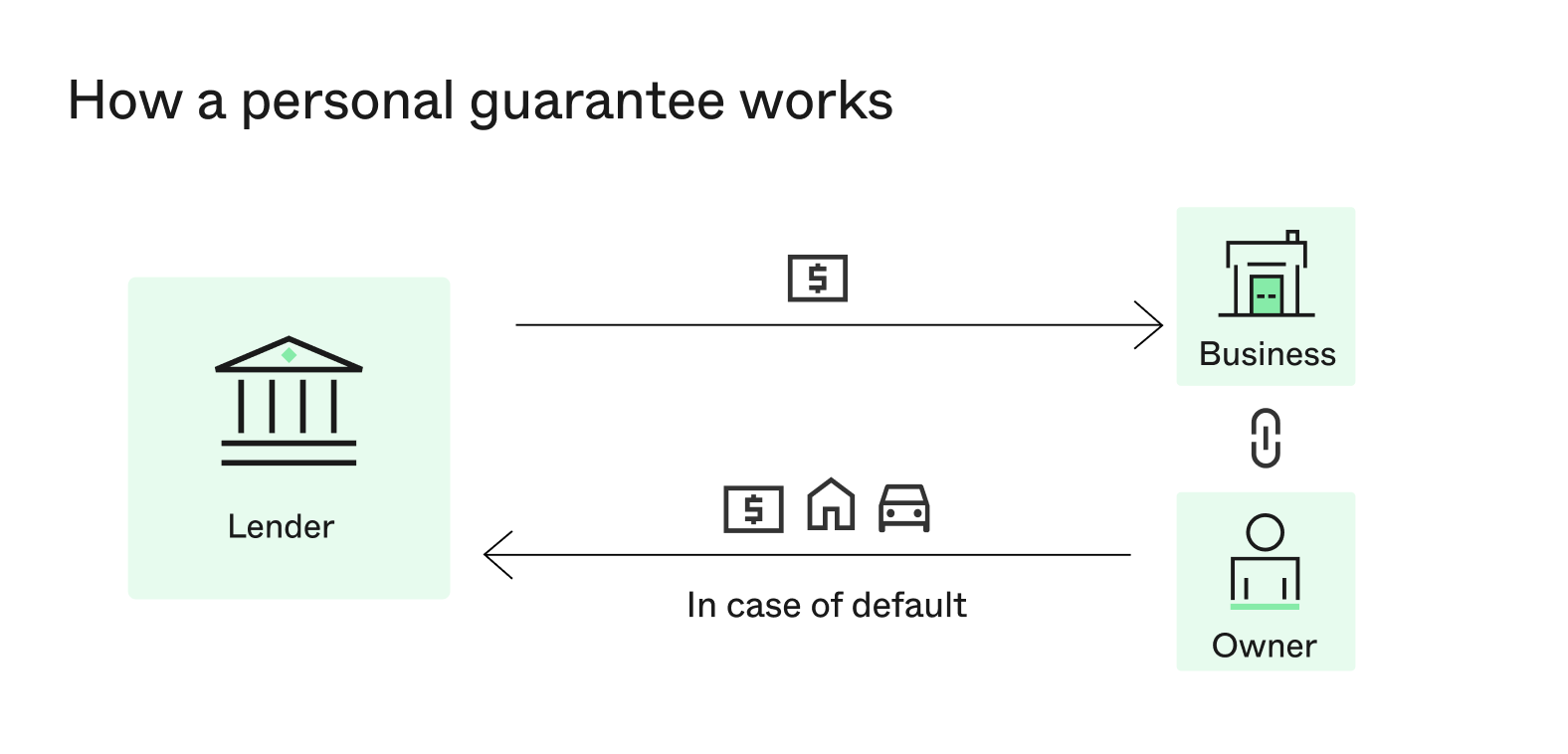

A personal guarantee makes an individual legally responsible for repaying a loan if the business cannot. In New Zealand, this usually takes the form of a director’s guarantee, rather than involving a family member or friend as a third-party guarantor. For the agreement to be legally binding, it must be in writing and signed by the guarantor, as required by the Property Law Act 2007.

In most cases, the guarantee itself is unsecured, meaning no specific personal asset is listed as collateral. However, the agreement is still enforceable, so your personal assets and credit record may be at risk if repayments are missed.

Lenders often require a guarantee to show that you’re committed to the business and confident in its ability to repay. It also helps them approve loans for businesses that may not have significant assets available to use as security.

For example, imagine you own a boutique fitness studio and apply for an NZ$40,000 loan to refurbish your space and add new equipment. The lender approves the loan without asking for asset security but requires you, as the director, to sign a personal guarantee.

If your business continues to meet repayments, nothing changes. However, if the studio falls behind and cannot repay, the lender can recover the outstanding funds from you personally.

The risks of providing a guarantee

The main risk of a personal guarantee is that it connects your personal wealth to your business’s debt. If the business fails to repay the loan, the lender can legally seek payment from you. This means your personal property, savings, and other assets can be used to recover the debt.

This can also put your household finances under a lot of stress. When business revenue drops, covering everything from your mortgage to supplier invoices becomes a difficult balancing act.

Your credit history is also on the line. A default on the business loan can be recorded against your personal credit file in New Zealand, which could make it more difficult to get personal finance, like a mortgage or car loan, in the future.

Continuing the fitness studio example, let’s say it falls behind on its NZ$40,000 loan. The lender would first try to recover the funds from the business. If that’s not possible, they are legally entitled to require you to pay from your personal income or savings. Should you be unable to cover the debt, the lender could take further legal action, potentially putting your family home, vehicle, and other assets at risk.

The benefits of a personal guarantee

While providing a personal guarantee involves risk, it’s often the key factor in getting your business loan approved. It gives lenders the confidence they need to provide funding, especially when you don’t want to secure the loan against a specific asset. This is standard practice in New Zealand, where unsecured business lending frequently relies on a director’s guarantee instead of property or equipment security.

By showing this commitment to your business, you can often speed up the approval process and may even be offered better interest rates or more flexible terms. For a full breakdown of how rates and fees work, see our guide to the cost of borrowing.

Deciding if a guarantee suits your business

Choosing to sign a personal guarantee is a matter of balancing the risk against the reward. While the funding could unlock significant growth for your business, it also directly links the outcome to your personal financial situation.

Before you sign anything, use this checklist to be sure:

Your personal guarantee checklist

- Does this loan support a long-term goal, or is it a short-term fix?

- Is there a clear purpose for the loan? Do I have a clear plan for how it will generate a return?

- Is now the right moment for this commitment, or would waiting put the business in a stronger position?

- Can the business comfortably handle the repayments, even through a few months of lower revenue?

- Do I have a cash buffer or a backup plan in place if something unexpected happens?

- Which of my personal assets could be exposed if the business defaults, and am I comfortable with that level of risk?

If you’re feeling confident after working through these questions, the next section on managing your exposure is for you. If you still have doubts, we’ll cover other funding options further on in the article.

Managing your exposure as a guarantor

If you decide to proceed with a personal guarantee, taking a few proactive steps can help you manage the risk and protect your personal finances:

- Stress-test your ability to make repayments before you commit, ensuring you only borrow what your business can realistically handle, even during a slow period.

- Keep a cash buffer or financial safety net to avoid needing multiple loans at once if your cash flow gets tight.

- Ask your lender if the guarantee can be capped at a specific amount or if it can be reviewed after a set period of consistent, on-time repayments.

- Stay up to date with your GST returns, tax obligations, and insurance, as falling behind on compliance can cause financial problems that quickly snowball.

- Seek advice from a New Zealand solicitor or accountant to get total clarity on the agreement and your obligations before you sign.

Funding your business without a guarantee

If a personal guarantee doesn’t feel right for your business, you still have several funding options to explore. Lenders may not require a guarantee if their risk can be managed through other means.

Your first option is to qualify on your business’s strength. Lenders in New Zealand may waive the need for a guarantee if your business is well-established with a proven track record of strong, consistent revenue. Having clear, up-to-date financial records is key to demonstrating this stability.

Another path is to use a secured loan. Instead of providing a personal promise, you provide a specific asset — like commercial property or valuable equipment — as security. Because this directly reduces the lender’s risk, a personal guarantee often isn’t required. Deciding between secured vs unsecured business loans is an important step in finding the right fit for your situation.

You can also look at a different funding structure. The issue might not be the security, but the product itself. For instance, a

Still worried about putting your own finances on the line? Use Prospa’s loan calculator to explore borrowing amounts and repayments for an unsecured loan or line of credit.