Don't let a slow loan approval delay your plans. Our 2025 NZ checklist shows you exactly what you need to prepare for a fast decision.

At a glance

- Business loan approvals in NZ range from weeks with traditional banks to just hours with online lenders.

- The key to a fast approval is preparation; having your ID, NZBN, and bank statements ready is essential.

- Your approval speed is also influenced by your business’s trading history and the type of loan you choose (unsecured loans are typically fastest)

You’ve found the perfect opportunity: your supplier is offering a bulk-stock discount, a piece of equipment you’ve considered for months is finally on sale, or a great new hire has just become available. In these time-sensitive moments, the only thing standing in your way is funding.

While traditional bank loans can take weeks, modern online lenders in New Zealand offer a much faster path, provided you’re prepared. This guide is your 2025 checklist for a fast business loan approval. We’ll show you exactly what you need to have ready, what factors influence the timeline, and how you can get a quick decision.

How long does a business loan take to get approved in NZ?

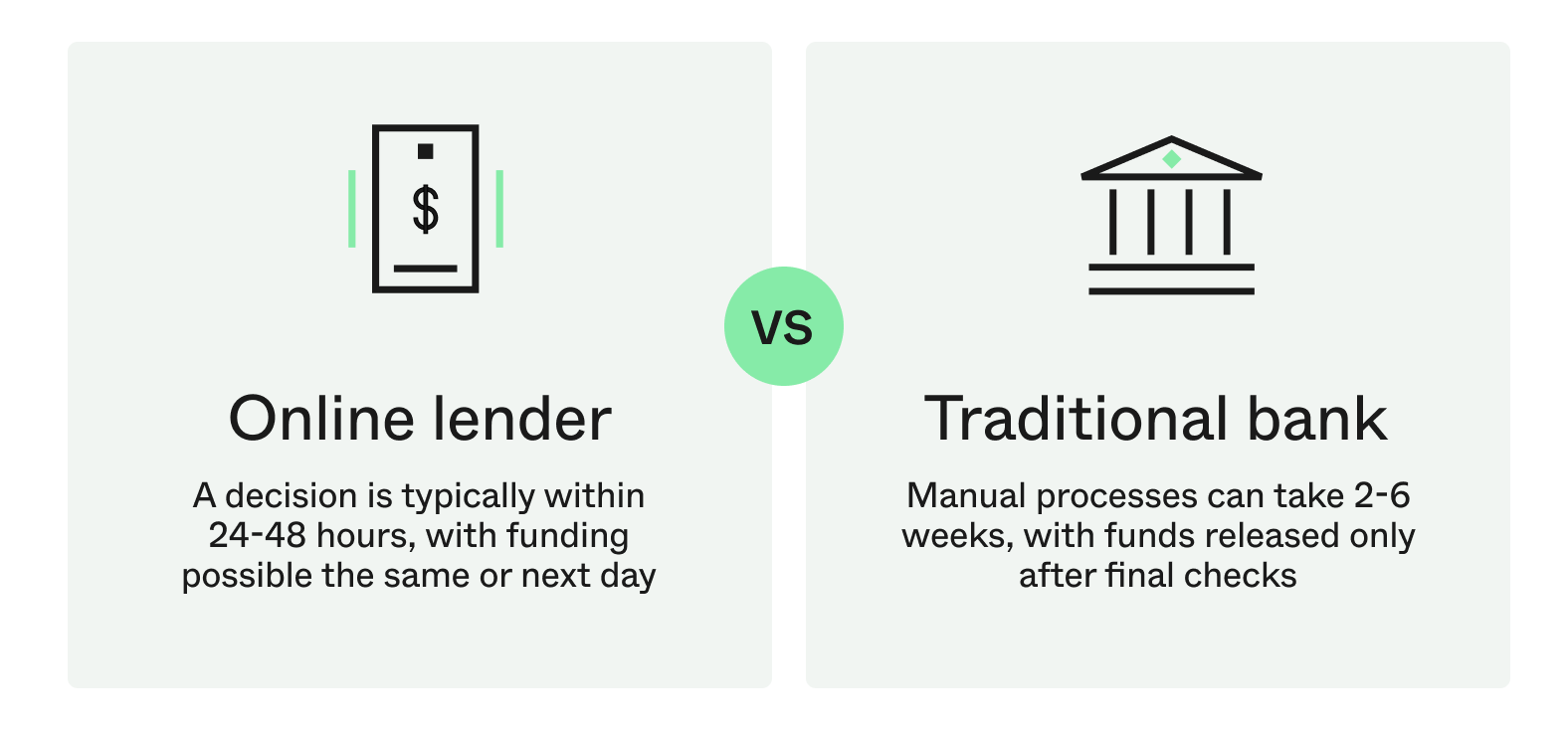

When you need to act fast on an opportunity, waiting weeks for a funding decision simply isn’t an option. That’s why it pays to understand what different lenders in New Zealand mean by “fast”.

With a traditional bank, you can expect multiple forms, credit checks, and sometimes property valuations. This process relies on manual assessments and paperwork, so timelines often stretch anywhere from two to six weeks before funds are released.

Online lenders use technology to fast-track the process. Thanks to automated data checks and digital applications, they can typically turn around a decision within 24 to 48 hours, with funds following shortly after. In some cases, approval and funding can happen in as little as one hour.

What do lenders mean by ‘fast’ funding?

When you’re looking for urgent funding, you’ll see terms like “instant approval” and “same-day loans” used frequently. While these sound straightforward, it’s important to understand what they mean in practice.

- Instant approval typically refers to the initial, automated decision from an online system. It’s a fast check to confirm you meet the basic eligibility criteria, but it’s not the final, unconditional approval. A final verification is still needed before funds are released.

- Same-day or 24-hour funding is often achievable with online lenders, but it usually depends on a few factors: your application must be complete, you need to meet all the requirements, and you must submit it before the lender’s daily cut-off time (usually early afternoon).

Let’s say a café owner in Auckland suddenly needs $20,000 to repair their main espresso machine. Every day the machine is down means a substantial drop in sales, so they get online and apply at 10 a.m. with all their information ready.

Because an online lender’s process is built for speed, the application can be approved in just a few hours, with the funds transferred that same day. Making that same request to a traditional bank could take weeks, a delay that could easily cripple the business’s cash flow.

Need funding to cover expenses or seize an opportunity? Check your eligibility today.

Your checklist for a fast loan approval

The fastest loan approvals happen when you make it easy for a lender to say yes. This means having the right information ready to go before you even start the application. A few minutes of preparation can save hours — or even days — of waiting.

1. Have your documents ready

Online lenders in New Zealand have moved beyond lengthy paper applications, but they do need to verify a few essentials. Having these on hand will make the process seamless:

- A valid ID: Such as a New Zealand Driver Licence or passport.

- Your NZBN: Your New Zealand Business Number to identify your business.

- Recent bank statements: You’ll typically need the last six months of transactions — securely connecting your bank account online is the fastest way to provide them.

2. Know your numbers and funding purpose

Lenders need to see that you have a clear understanding of your business’s financial health. Be prepared with a good handle on your approximate monthly turnover and expenses.

It also helps to be specific about why you need the funds. Are you buying a new vehicle to expand your delivery route, covering a temporary cash flow gap, or ordering extra stock for the Christmas rush? The clearer your plan, the faster a lender can approve the right funding solution for you.

Fast loan approval checklist

Want to improve your approval odds even further? See our 5 tips for getting your business loan approved.

Other factors that influence approval speed

Beyond having your documents ready, a few other elements play a role in how quickly a lender can assess your application and provide a decision.

The type of loan you choose

The loan product itself plays a big role. Simpler, unsecured options like a small business loan are usually the fastest to approve because they don’t require complex security checks like property valuations. In contrast, large-scale loans can require property security which can involve more paperwork, adding extra time to the process.

The completeness of your application

The fastest approvals happen when a lender has everything they need from the start. Missing or inaccurate information is the most common reason for delays, as the lender will need to pause the assessment to contact you for clarification. Using secure online options like instant bank verification can also save valuable time compared to uploading manual copies of statements.

Your business’s health and trading history

A business with a consistent cash flow and a clear trading record is simpler and faster for a lender to assess. For newer businesses or those with fluctuating income, a lender may simply need more time to understand the full financial picture. However, even with a less-than-perfect credit history, you can often still access fast business funding if you can demonstrate steady, reliable cash flow.

For co-founder Rachel Horan of RW Design, the next step in growing her architectural firm was upgrading their website. She needed a funding partner that could move as quickly as her business and found the straightforward process she was looking for with Prospa.

“Prospa just made it easy. As a business owner, you don’t have time for endless paperwork and back-and-forths. They understood what we needed and got us sorted quickly.”

What the Prospa NZ process looks like

The entire Prospa New Zealand process is digital and streamlined, which means no lengthy paperwork or long waits for an outcome. Here’s a simple walkthrough of how it works:

- Complete the online application. The secure online form takes less than 10 minutes. For funding up to $150,000 NZD, you’ll just need your NZBN, a valid NZ Driver Licence, and your business bank account details.

- Securely link your bank data. The fastest way to provide your business bank statements is by using our secure online banking connection. It gives us instant, read-only access to the last six months of your transaction history, which allows for a decision in as little as one hour. You can also choose to upload documents manually, but this may take a little longer to review.

- Get a fast decision. Once your application is submitted, our team will assess it quickly. Many applicants receive an answer on the same business day, with some applications receiving a decision within the hour.

- Access your funds. Once approved and your contract is signed online, settlement is fast. In many cases, funds are available in your account within hours, sometimes as soon as one hour after settlement.

With such a streamlined process, you can focus on running your business while the funding is processed in the background.

In summary

Fast business loan approvals come down to two things: being prepared and choosing a lender built for speed. With both in place, you can act quickly and keep your business moving forward.

Need funding fast? Start your 10-minute online application today and get a decision within hours.