Funding takes

your

business

further

A range of lending solutions to match your business needs

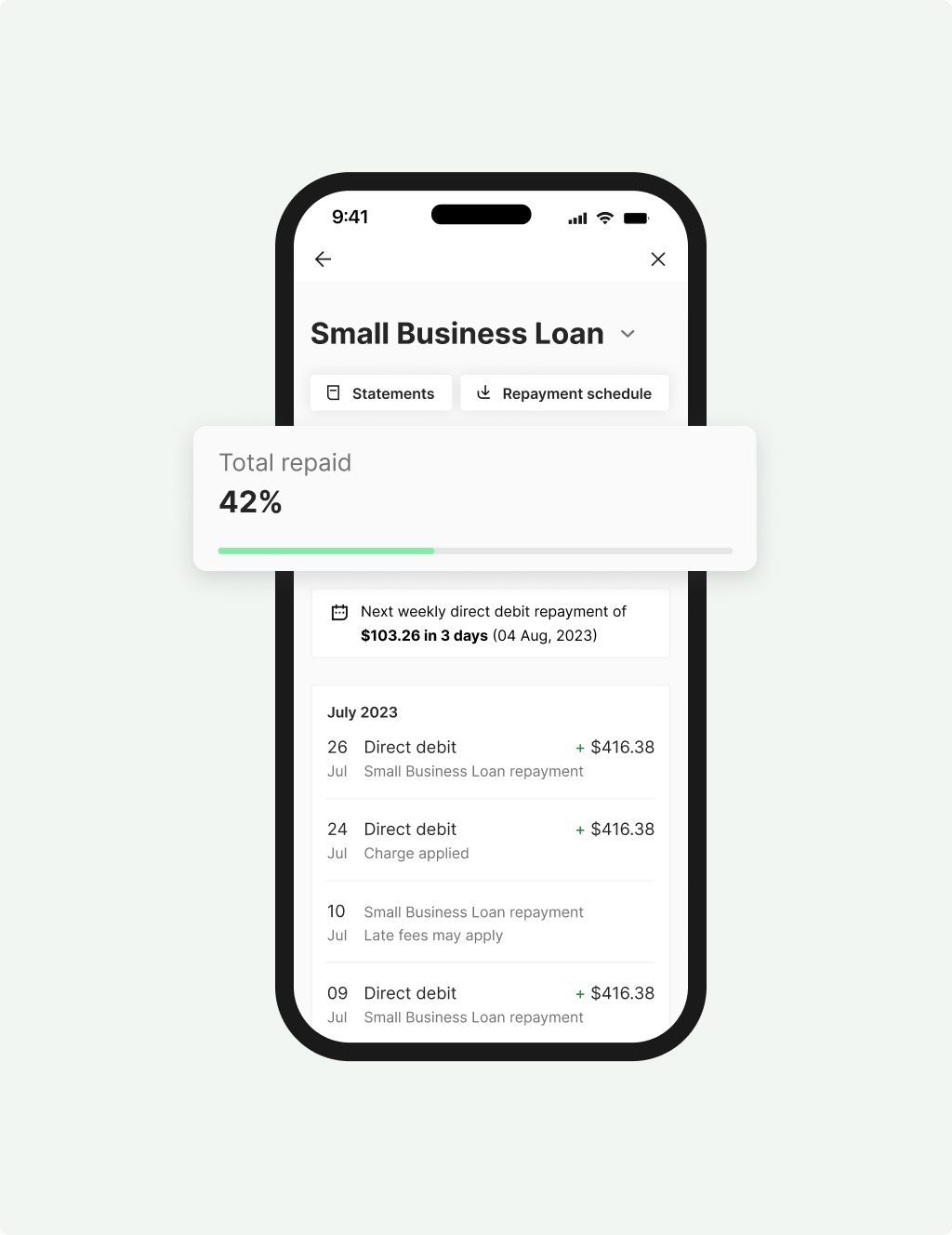

Prospa Small

Business Loan

Borrow from $5K to $100K as a lump sum over a fixed term up to 36 months. Great for managing cash flow, buying stock and equipment, or covering unexpected expenses.

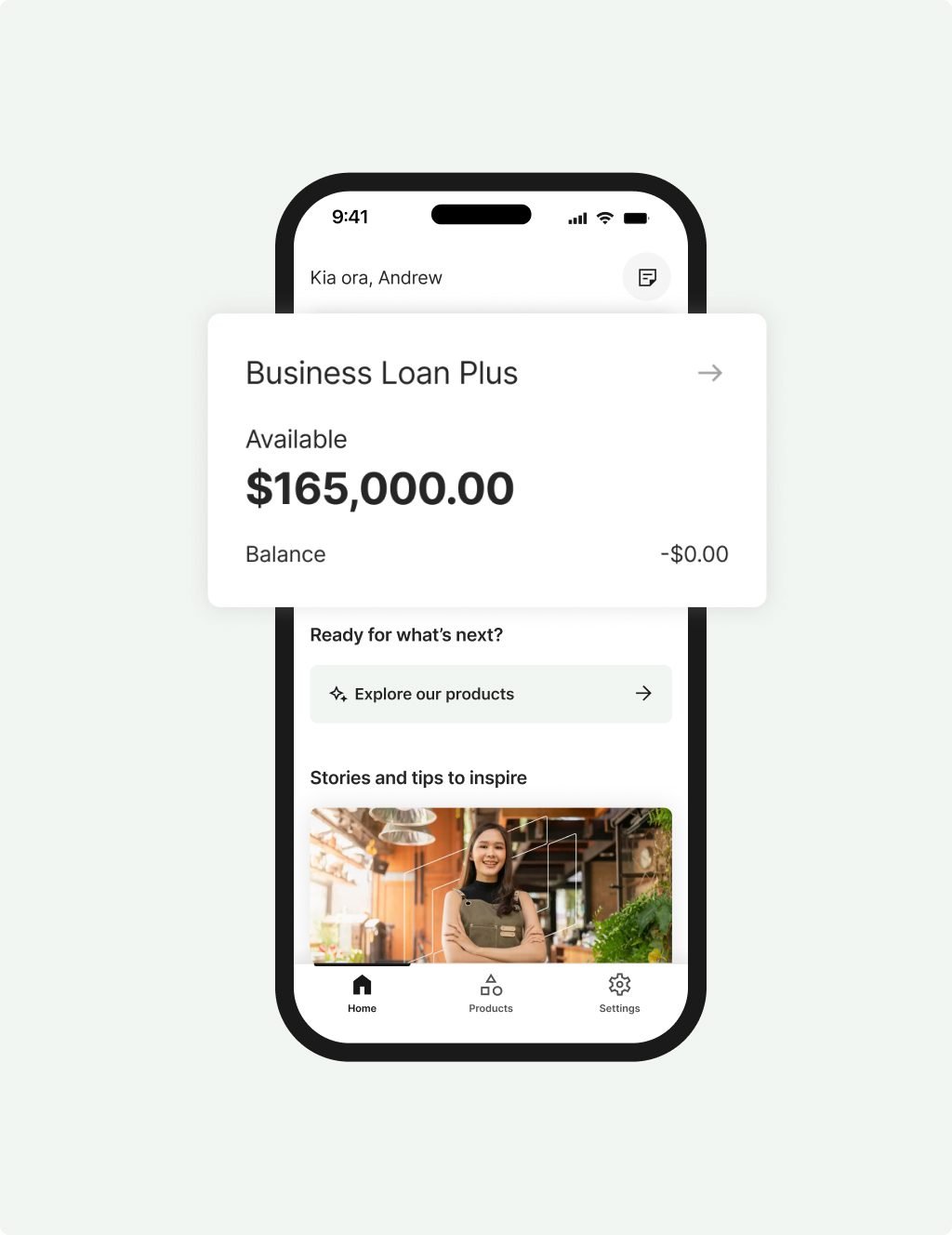

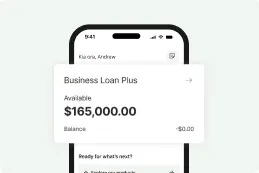

Prospa Business

Loan Plus

Borrow from $100K to $500K as a lump sum over a fixed term of up to 36 months. Often used for funding growth, renovations and refits, or equipment purchases.

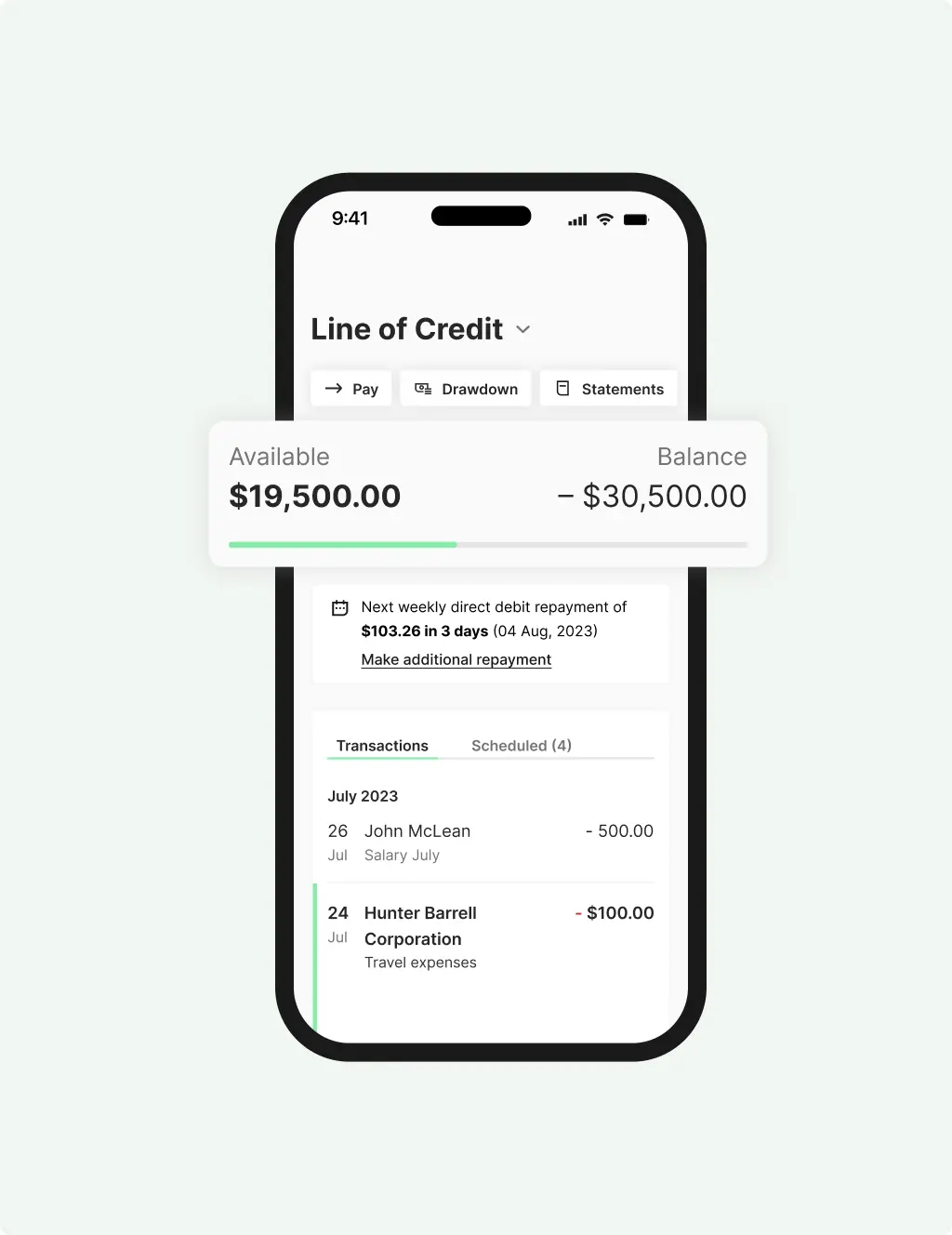

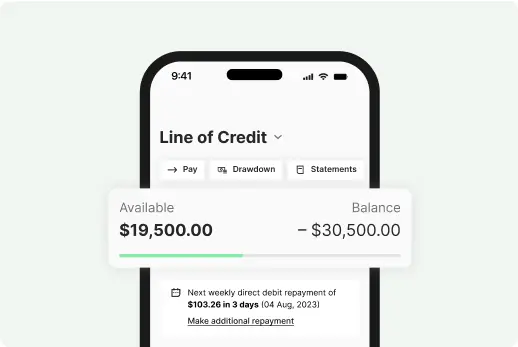

Prospa Business

Line of Credit

Get ongoing access to funds up to $150K and only pay interest on the funds you use. Ideal for managing cashflow and unexpected expenses.

Say hello to the

Prospa App

manage their cash flow on the go.

Download now on the App Store or Google Play.

01

Apply online in under 10 minutes

Apply online in under 10 minutes

02

Get a same-day decision

Get a same-day decision

03

Access your funds

Access your funds

Business lending specialists

Customers making it happen with a Prospa loan

Read customer storiesWe're number one, thanks to you

Learn more#1

online lender to small

business in New Zealand

10+

years in business

65+

awards and counting

4.7/5

average Trustpilot review score

Recent articles

Stories to inspire you,

tips to save you time

FAQs

Common questions answered

You can apply for a business loan with Prospa if you;

are a New Zealand Citizen (or Permanent Resident)

are over 18 years, own a New Zealand business (with a valid NZBN/IRD)

minimum trading history applies

The application process is quick and easy. Simply in 10 minutes and a dedicated business lending specialist will be in touch to guide you.

For the Prospa Small Business Loan ($5K to $100K) we can often provide a response in one hour – as long as you apply during standard business hours and allow us to use the advanced bank verification system link to instantly verify your bank information online. If you choose to upload copies of your bank statements we can provide a decision in as little as one business day.

For the Prospa Plus Business Loan ($100K to $500K) we may be able to provide you with conditional pre-approval in around 6 hours. Once you have signed the pre-approval, turnaround times are around 2-3 days for final approval, however this may be quicker depending on the circumstances of each application. Some deals have been approved in 24 hours.

The fastest way is to make sure you apply during standard business hours and allow us to use the advanced bank verification system link to instantly verify your bank information online. If you choose to upload copies of your bank statements it will take a little longer.

Once your application is approved and we release the funds, it is possible to have money in your account the next business day.

We provide loan amounts between $5K and $500K. When you make an application for a specific amount we consider a variety of factors to determine the health of your business and the level of repayments your business can support. The total amount of your loan will depend on the specific circumstances of your business.

When you make an application for a specific amount we consider a variety of factors to determine the health of your business and the level of repayments your business can support. The total amount of your loan will depend on the specific circumstances of your business.

Protecting your information, and being clear about how we collect, use, exchange and protect your information, is of huge importance and a vital part of our relationship with you. View our Privacy Policy.

Yes. We use industry recognised encryption standards to protect your personal, sensitive and financial data and we’re ISO 27001 certified for our commitment to customer security and privacy. We use an advanced bank verification system link to instantly verify your bank account information online so we can provide a fast response.

Eligibility and approval is subject to standard credit assessment and not all amounts, term lengths or rates will be available to all applicants. Fees, terms and conditions apply.