Learn how NZ commercial loans work, what affects rates, and how to choose the right option to manage cash flow, invest in growth, and stay in control.

At a glance

- Commercial loans give NZ businesses flexible funding to cover everyday costs or long-term growth.

- Rates and terms depend on factors like cash flow, credit strength, and the type of loan you choose.

- Quick online applications and repayment options from lenders like Prospa, tailored to your small business, make managing finance easier.

You’re ready to move forward. Maybe expanding your team, renovating your space, or getting ahead of next season’s demand. The next step? Finding funding that gives you flexibility and confidence to grow.

A commercial loan is built for business needs, helping you:

- Balance cash flow between peaks and slow periods

- Invest in upgrades or new equipment

- Cover costs or refinance for better terms

According to Centrix, business lending demand in New Zealand climbed 6% year-on-year as of March 2025, as more owners looked to finance growth and maintain stability through changing market conditions.

Knowing how different commercial loans work and how to compare rates across trusted lenders can help you make faster, better-informed funding decisions for your business.

What is a commercial loan?

A commercial loan gives your business access to funds for bigger moves, whether that’s giving your shop a fresh fit-out, covering supplier invoices, or investing in growth opportunities.

It’s finance designed for business use only, not personal spending, and it’s typically structured around your revenue and cash flow rather than just the assets you own.

For small Kiwi businesses, cafés, salons, or tradies, this kind of funding can make all the difference. The right loan can help you stay competitive, manage seasonal cash flow, and keep momentum when the market shifts.

What are the commercial loan options?

With several loan types available, it’s important to understand your options. Here’s a clear breakdown of the main options available to minimise risk and maximise opportunity.

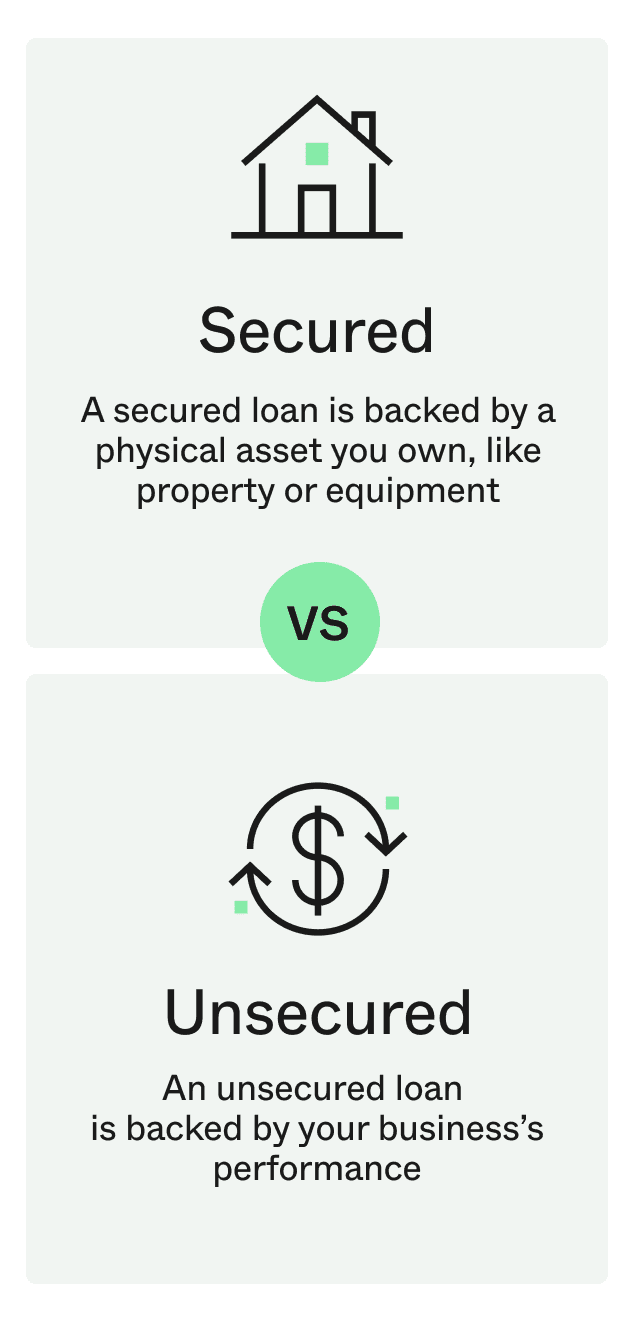

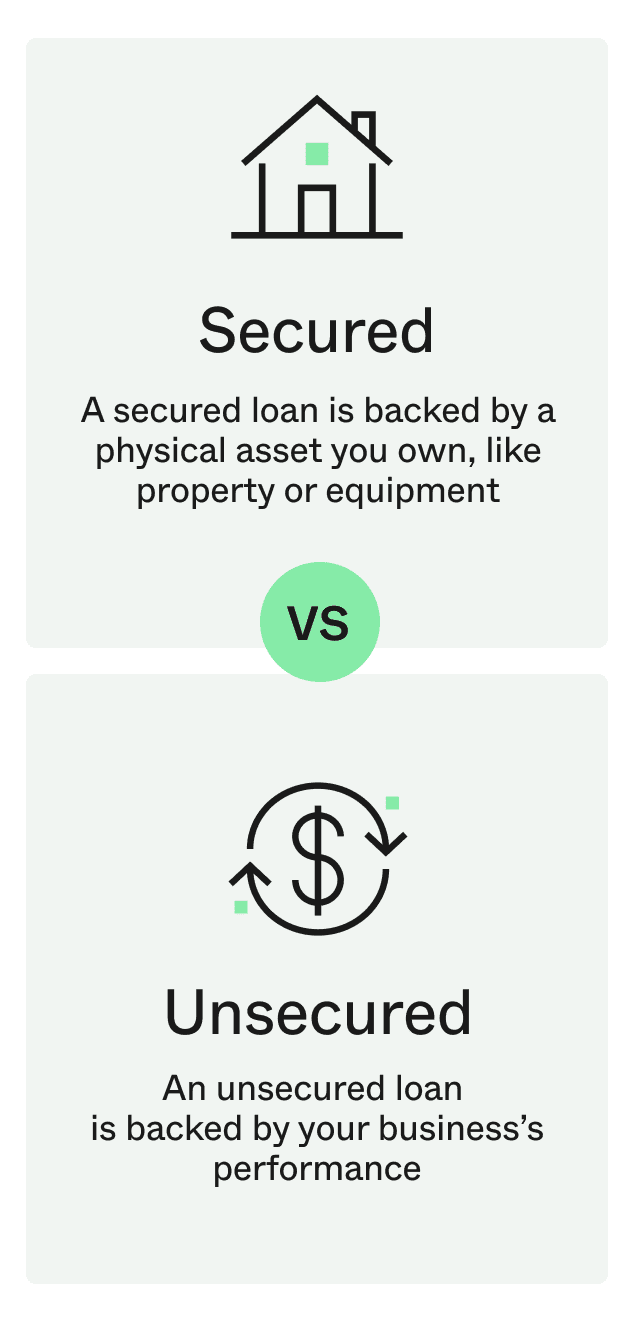

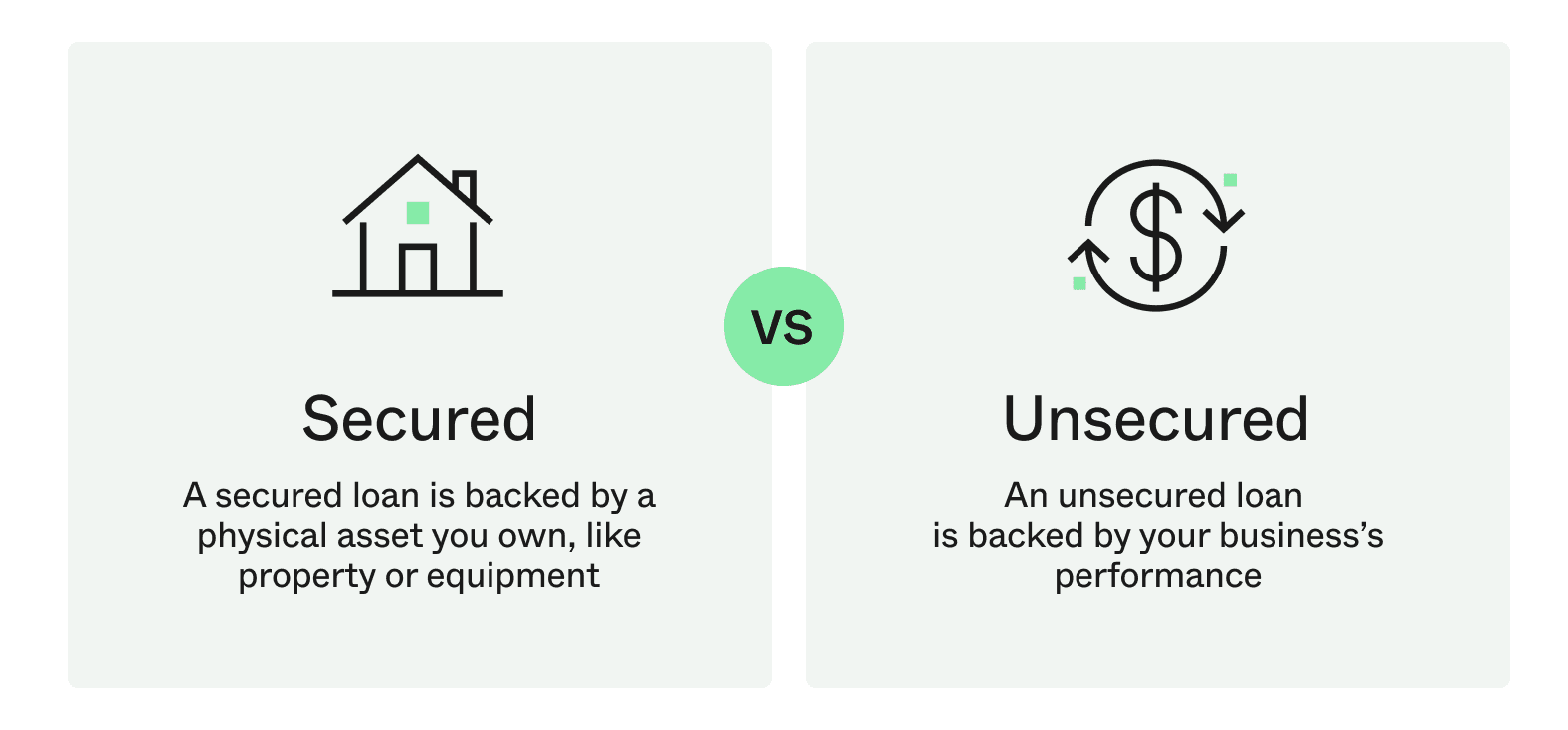

Secured loans: borrow more, pay less in interest

A secured loan uses your business assets, such as property, vehicles, or equipment, as collateral. Because this reduces the lender’s risk, you’ll generally benefit from:

- Lower interest rates

- Higher borrowing limits

- Longer repayment terms

They’re ideal for funding bigger projects like refitting your café, renovating a salon, or upgrading trade equipment. Just remember, if repayments can’t be met, the lender may claim the asset used as security.

Unsecured loans: quick access to working capital

An unsecured loan doesn’t require any collateral. Approval is based on your cash flow, trading history, and credit profile. This makes it a faster way to access funds for short-term needs such as ordering stock, paying staff or contractors, and running marketing campaigns.

Because there’s no asset attached, interest rates are usually higher and loan sizes smaller, but the speed and flexibility make them a popular choice for Kiwi businesses that value agility.

Comparing secured and unsecured business loans

| Feature | Secured loan | Unsecured loan |

|---|---|---|

| Collateral | Required (assets) | Not required |

| Typical interest | Lower | Higher |

| Loan amount | Usually higher | Usually lower |

| Lender risk | Lower (collateral can be seized) | Higher |

| Main approval focus | Focus on asset value | Focus on creditworthiness |

Equipment and asset finance

Equipment or asset finance is a form of secured lending used to purchase essential business tools, whether that’s a delivery van, salon chairs, kitchen gear, or IT hardware. Because the loan is secured by the asset itself, you can often access lower rates and longer terms, helping your business invest in the right equipment without draining cash reserves.

Business overdraft or line of credit

A business line of credit isn’t a one-off lump sum. Instead, it provides ongoing access to funds up to a set limit, and you’ll only pay interest on what you actually use. This makes it ideal for managing short-term cash flow gaps, handling seasonal slowdowns, or covering unexpected expenses without taking on a full loan.

Choosing what fits best for your business: For Kiwi small businesses, it’s all about matching the right loan to your goals. A secured loan can open the door to larger investments at a lower cost, while an unsecured loan provides quick access when timing is critical. Equipment finance works well for buying specific assets, and a line of credit gives you flexibility to manage day-to-day cash flow.

Commercial loan rates

Commercial loan rates in New Zealand are influenced by several key factors, including your loan term, business risk, and overall financial history. Shorter terms often mean less total interest paid but higher monthly repayments, while lenders may charge higher rates for businesses with irregular cash flow, limited trading history, or weaker credit.

Here are the most common loan types and how their rates typically compare in 2025:

- Secured loans (backed by assets): Usually range from 7%-15% p.a.

- Unsecured loans (no collateral): Commonly fall between 12%-28% p.a.

- Equipment or asset finance: Secured by the purchased item, often with lower rates.

- Overdrafts or lines of credit: Interest only on the amount used.

- Bad credit business loans: Higher due to increased risk.

Typical 2025 commercial loan rate ranges (New Zealand)

| Loan type | Starting range | Typical range (2025) |

|---|---|---|

| Secured business loan | 6.1%-8.5% | 7%-15% p.a. |

| Unsecured business loan | 10%-12% | 12%-28% p.a. |

Always check official RBNZ updates and compare current offers from major institutions like ANZ, BNZ, and Westpac, alongside alternative Kiwi lenders like Prospa for an accurate, up-to-date view of the market.

The headline rate is only part of the picture. To find the most cost-effective option, consider setup fees, origination costs, and the Annual Percentage Rate (APR). Even a small difference in APR can translate into thousands saved over a loan’s lifetime.

It’s also important to know how the interest is calculated. Most standard loans use a p.a. rate calculated on the reducing balance, while others, including Prospa, use simple interest calculated on the original loan amount.

| To keep his marine business afloat through changing tides, Paul Powney of Takacat used a Prospa Business Loan to purchase stock, smooth cash flow, and seize new opportunities.

“I was a bit dubious at first as it wasn’t a traditional bank, but the process was just so easy and fast. It kept the business moving forward.” – Paul Powney, Takacat |

|---|

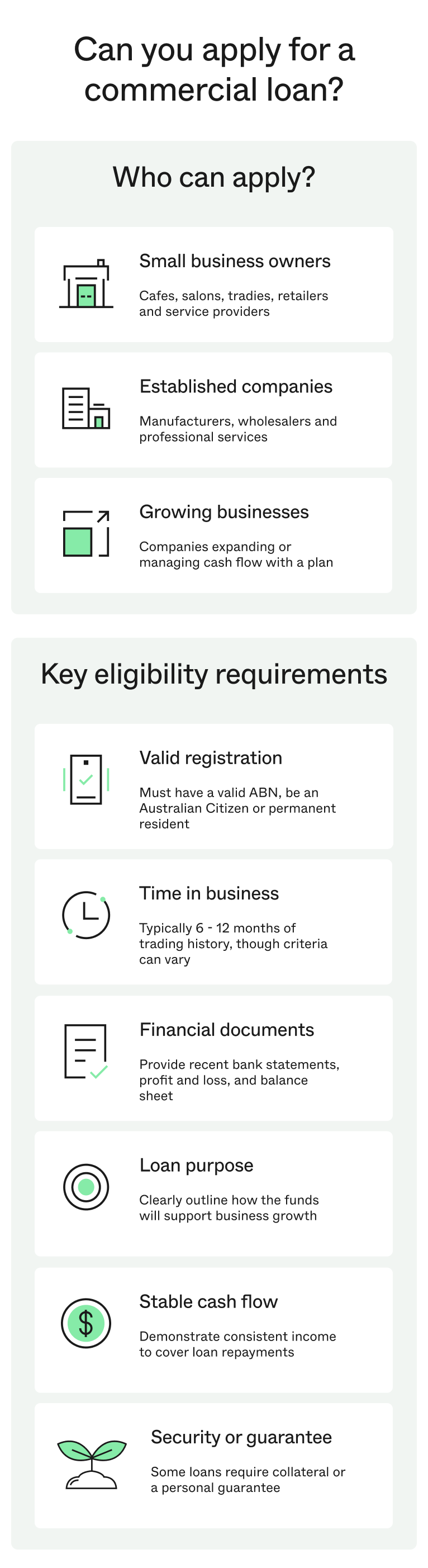

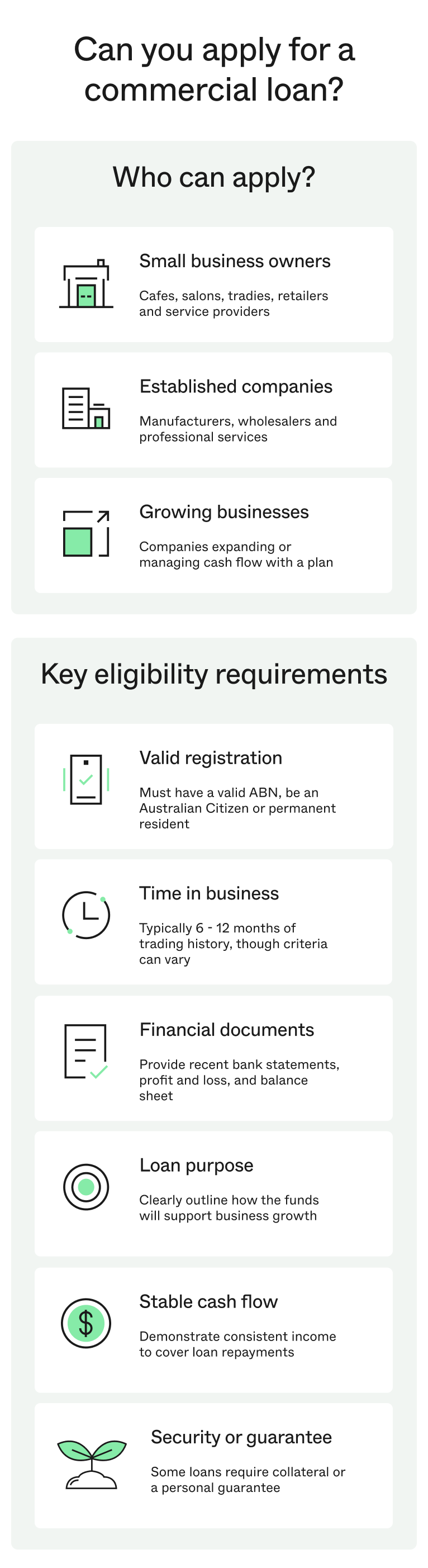

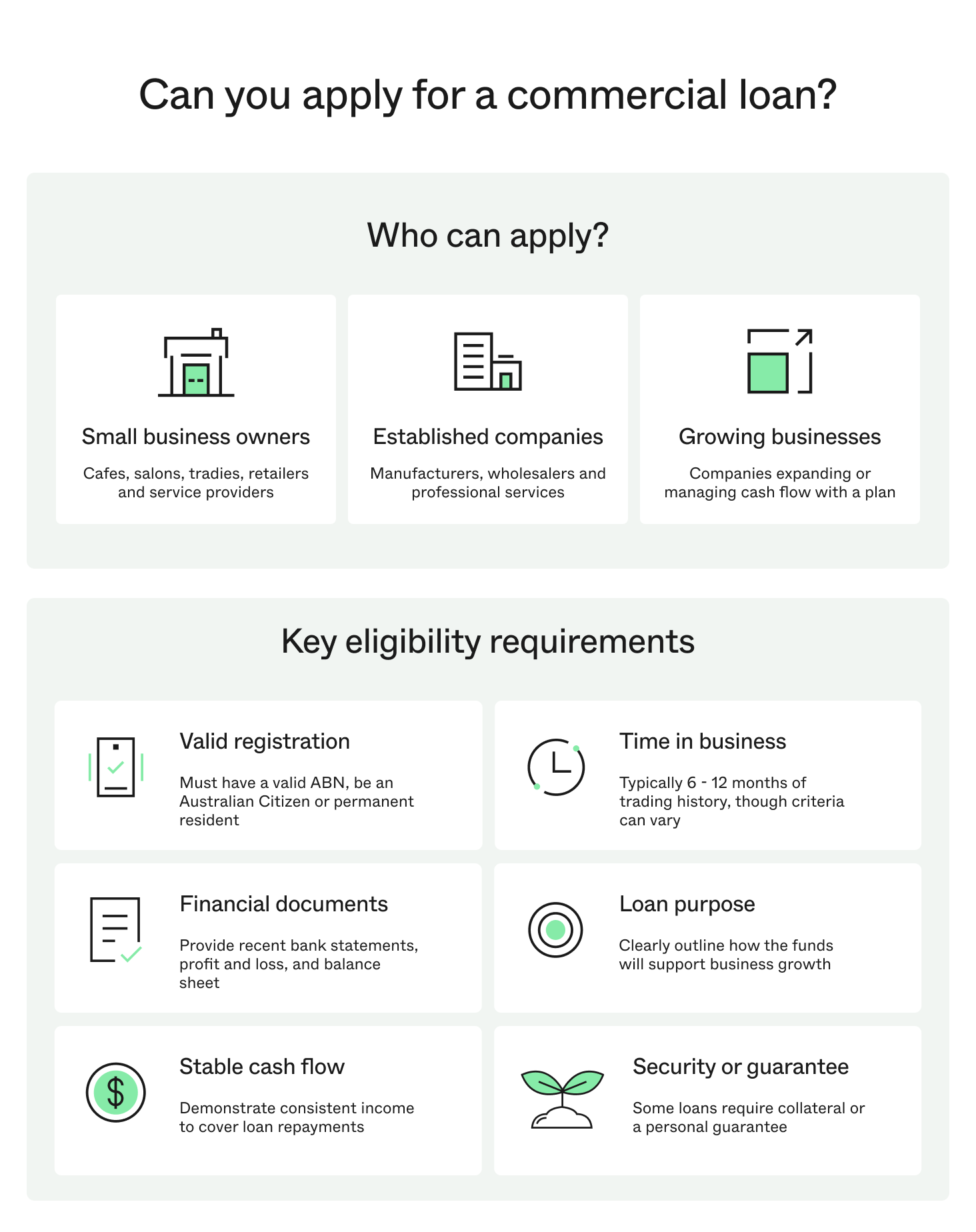

Commercial loans: Who can apply?

Almost any business in New Zealand can apply for a commercial loan, provided they meet basic criteria. Eligible groups include sole traders, partnerships, limited companies, and trusts with a valid NZBN and active trading.

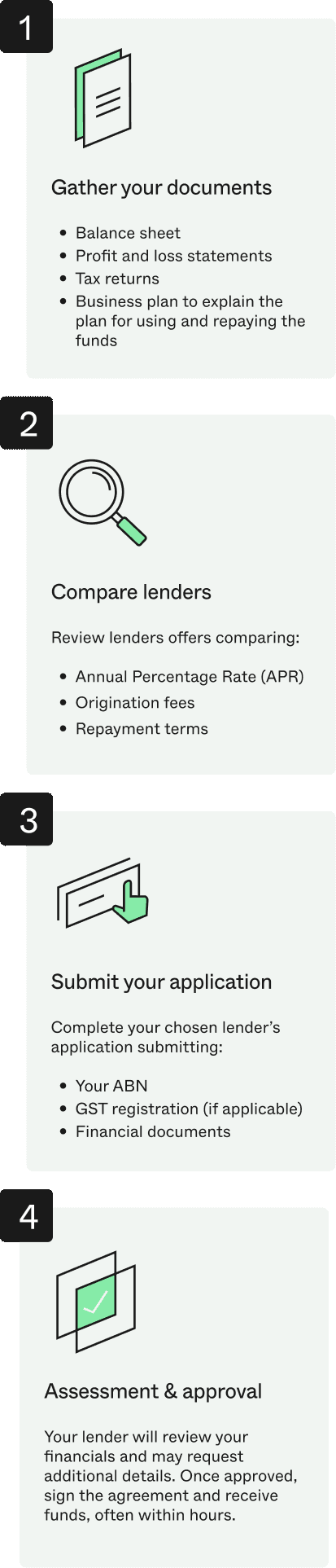

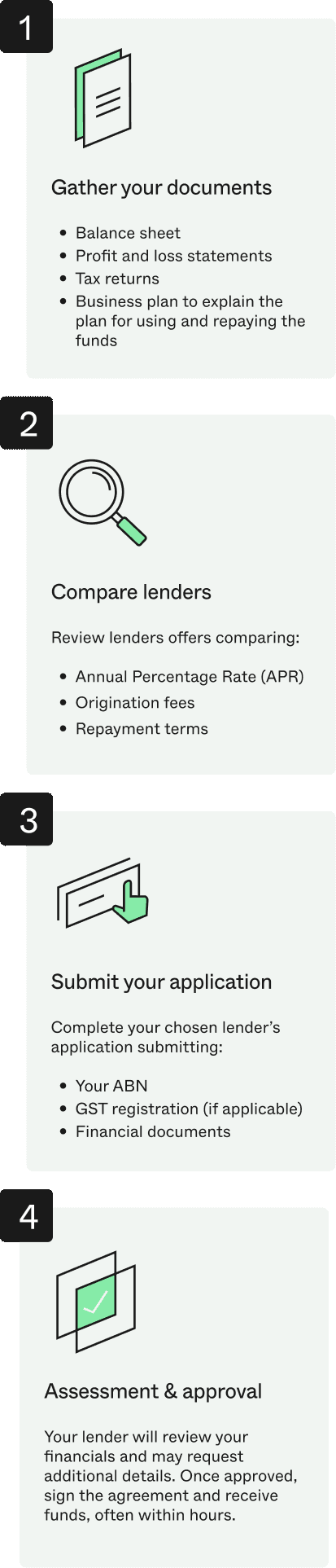

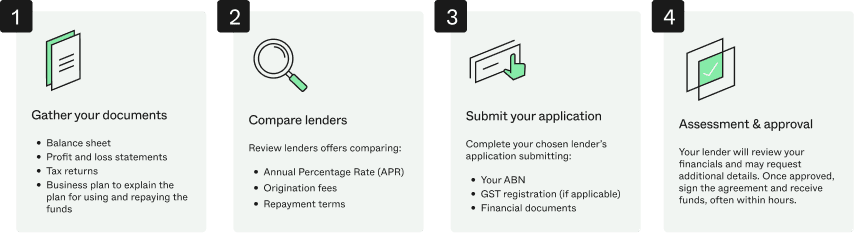

Commercial loans: how do you apply?

Applying for a commercial loan in New Zealand is simpler than many business owners think. Following a few clear steps can make the process faster and improve your chance of approval.

Step 1: Gather your financial documents

Prepare balance sheets, profit and loss statements, tax returns, and a business plan showing how the funds will be used.

Step 2: Compare lenders and total cost

Look at offers from trusted lenders. Compare APR, fees, and terms rather than just interest rate.

Step 3: Submit your application

Complete an online or in-person application with your NZBN, GST status, and financials.

Step 4: Assessment and approval

Lenders review your information and may seek more details. Online lenders like Prospa may approve and release funds within hours.

You can also use the Prospa Business Loan Calculator to estimate repayments.

How commercial loans help you grow without giving up ownership

For many NZ business owners, a commercial loan offers a way to grow without exchanging equity. You retain full ownership and future profits while accessing funds for upgrades, hiring, or expansion.

Why it matters: After the loan is repaid, all profits and control remain yours.

Repayment options designed around your business

A good commercial loan adapts to the way your business operates. NZ lenders now offer flexible features such as:

- Interest-only periods during slower seasons

- Variable or seasonal schedules aligned to revenue cycles

- Split-rate loans combining fixed and variable components

- Redraw or repayment pauses on select products

- Adjustable loan terms based on evolving plans

These features help Kiwi businesses stay agile and invest with confidence.

Final takeaway: Non-dilutive finance, matched with a flexible repayment plan, is the smartest way for a small business to grow in New Zealand without losing equity or control. Take the next step in your business journey today. Apply online in 10 minutes.