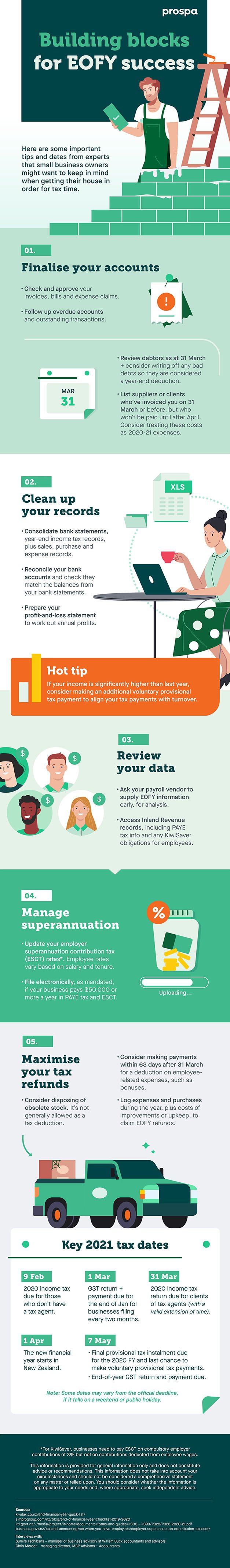

As EOFY approaches, we've rounded up some important changes, tips and dates New Zealand small business owners might want to consider.

Taking smart actions now can relieve annual EOFY tax-time headaches for small business owners. If you plan ahead, you could save considerable time, money and angst. Who doesn’t want that?

In New Zealand, the standard tax year ends on 31 March 2021. However, you should get into preparation mode sooner rather than later to avoid unexpected surprises with your annual financial reports and tax returns, says Sumire Tachibana, manager of business advisory at William Buck accountants and advisors.

“Record-keeping is something that all businesses should be getting right on a day-by-day basis,” Tachibana says. “Being organised from the get-go will ensure minimal preparation time is required when it’s time to put together your tax return.”

She adds that using intuitive accounting software such as Xero, cloud folders and storage such as Google Drive or Dropbox – as well as tenancy management software such as myRent.co.nz – will save businesses time.

3 important changes in 2021

It would be helpful for small business owners be aware of some important tax-related changes that have recently occurred or are on the agenda for 2021.

- Don’t forget that the minimum wage will rise by $1.10, taking it from $18.90 to $20 an hour as of 1 April 2021. This could potentially affect your financial records and superannuation payments.

- A new 39% personal tax rate will apply on income above $180,000. The new rate will apply from 1 April 2021. Tachibana says this is more likely to affect those who earn income from providing personal services, rather than those who hold investments and earn capital gains.“Remember, the Income Tax Act has a broad tax-avoidance provision. If you restructure your entities for the purpose of trying to save from paying tax at the highest rate of 39%, that is very likely to fall under the definition of ‘tax avoidance’,” she adds.

- Be aware that the ACC Earners’ levy, which funds the costs associated with employee injuries, will be kept at current levels until 2022 to help businesses deal with the financial pressures of COVID-19. As at January 2021, the levy sits at $1.39 per $100 (1.39%).

Getting your house in order for EOFY

Final advice for EOFY

Chris Mercer, managing director at MBP Advisors + Accountants, says the essence of good tax management is being proactive during the year.

“It’s not just a once-a-year thing where you sort out your taxes,” he says. “Proper preparation throughout the year will make your business better.”

For small businesses such as retailers or restaurants, it is especially important to track stock levels as the end of financial year looms, he adds.

“If you go to your accountant and can’t remember your stock levels from a couple of months ago, that creates difficulties.”

As a final piece of advice, Mercer reminds small business owners that a temporary increase during COVID-19 of the instant asset write-off from $500 to $5,000 is being scaled back to $1,000 from 17 March 2021.

“That’s a change that will have a big impact on small businesses.”

EOFY can be stressful enough without having to worry about cash flow issues. Find out how a Prospa Small Business Loan could help relieve some of the cash flow pressure for eligible applicants – talk to one of our small business lending specialists on 0800 005 797.