Does inventory management leave your head spinning? Don't stress. We've collected some helpful tips from experts to help you understand the basics – you've got this!

At a glance

Here’s a snapshot of the advice from our interviewees:

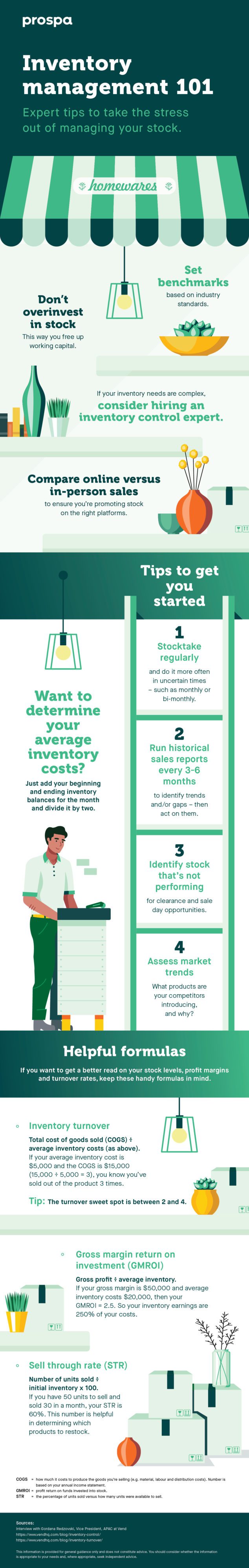

- Run historical sales reports every 3-6 months to identify trends and/or gaps – then act on them.

- Stocktake more often during uncertain times when consumer behaviours change quickly.

- Identify stock that's not performing for clearance and sale day opportunities.

- Invest in inventory management software that offers the right level of sophistication for your business.

How can you tell which products are your best-sellers or when your customers’ preferences change out of the blue? And what’s the best way to divvy up your marketing spend to advertise specific products? The answers may lie in good inventory management.

It’s not just a process that helps you to stay on top of day-to-day operations and keep a healthy stream of cash flowing through your business. If done properly, it can give you a clear-eyed, strategic view into your business’s future and present opportunities for growth.

But talk of things like EOQ formulas (🤷) can be a little bamboozling if you’re new to this kind of thing – so we’re putting it into plain English. We caught up with Gordana Redzovski, Vice President – APAC for retail management software company Vend, and two Kiwi small business owners to help you understand the basics of good inventory management.

Inventory management for the future

With many small business owners forced to run the show from home this year, Redzovski says being able to manage inventory from anywhere has become business critical.

“Business owners need to make important decisions around stock – such as which products need to be reviewed – quickly because throughout the pandemic, consumer behaviour changed so rapidly.”

Having an accurate read on your stock is also helpful when you’re deciding where to promote your products.

“Because I’m not having to run the inventory myself, it frees up my brain for the research and development side of my company.” – Andrea Blondel, founder of Nectar Body and Bath

Choose the right platform for your business

“Don’t put up with the pain of manual processes and time-consuming inefficiencies across your business,” says Redzovsk. “There are so many great tools out there to help you – it really makes all the difference.”

Make sure you choose software that offers varying sophistication levels, Redzovski adds. It should be able to service your business as it grows.

This is exactly what Prue Watson and her sister Kate have done. They started their French flax linen store Foxtrot Home three years ago. Back then all of their stock was kept inside their garage. But as the business grew, so too did their stock management approach.

Image: Foxtrot Home stock

“[After the garage] we moved to a group of storage units, but we quickly outgrew that. Now we’ve now got our own warehouse, so we’re looking at a new inventory management platform that offers more complexity and allows us to oversee inventory across multiple warehouses.”

Andrea Blondel, founder of Nectar Body and Bath, recently upgraded to a more sophisticated inventory management platform. As she got busier, it became clear she needed the support of a comprehensive platform.

“When we first started the business, we basically just had a piece of card on each product bin,” she laughs. “We’d strike it off the list as we took it out. But sometimes we’d be so busy that we’d forget to write on the card.

“Now I’ve learned the inventory control part of the website, it has made life so much easier.“

Blondel prides herself on being prompt with customers’ orders but says it wouldn’t be possible were it not for her inventory management set up. It also means she can focus on the part of the business she enjoys most.

Start 2021 with a clean slate and invest in software that will make your life easier. If you need funding to help make this happen, Prospa’s Small Business Loan could be an option.