Small business loans for growth and cash flow support

As small business finance specialists we help New Zealand business owners grow and develop their businesses with fast access to business loans. Our short-term loans are available over 3 to 36 month terms and range from $5K to $500K with no asset security required to access up to $150K. Our repayment schedules work in with your cash flow cycle.

We’ve made business finance simple. Applying for a small business loan is fast and easy with our online application process taking as little as 10 minutes – and there are no piles of unnecessary paperwork or annoying lengthy delays. Small business owners will get a fast decision on a business loan application and, if approved, funding is possible in 24 hours. Plus, there are no penalties if you want to pay out your business loan early. So, why not join hundreds of other NZ small businesses and put your business first with Prospa. Apply online today for business finance to help your business grow and succeed.

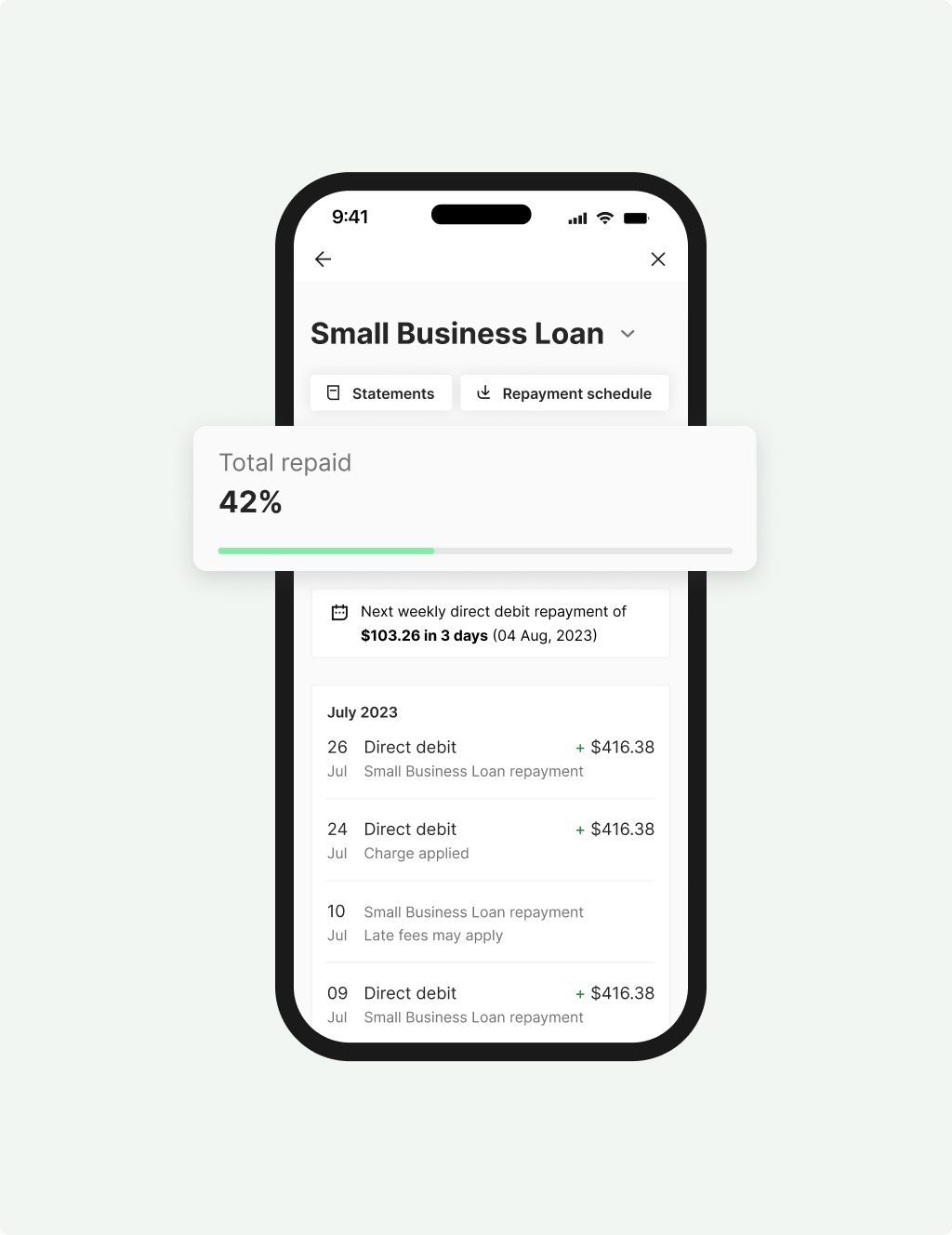

Small Business

Loan

Quick access to $5K – $150K to cover unexpected expenses or a one-off purchase.

- Fixed term up to 3 years with fixed rates

- Fast decision & funding possible in 24 hours

- No asset security required upfront to access Prospa funding up to $150K

- Minimum $6K monthly turnover and 6 months trading to apply

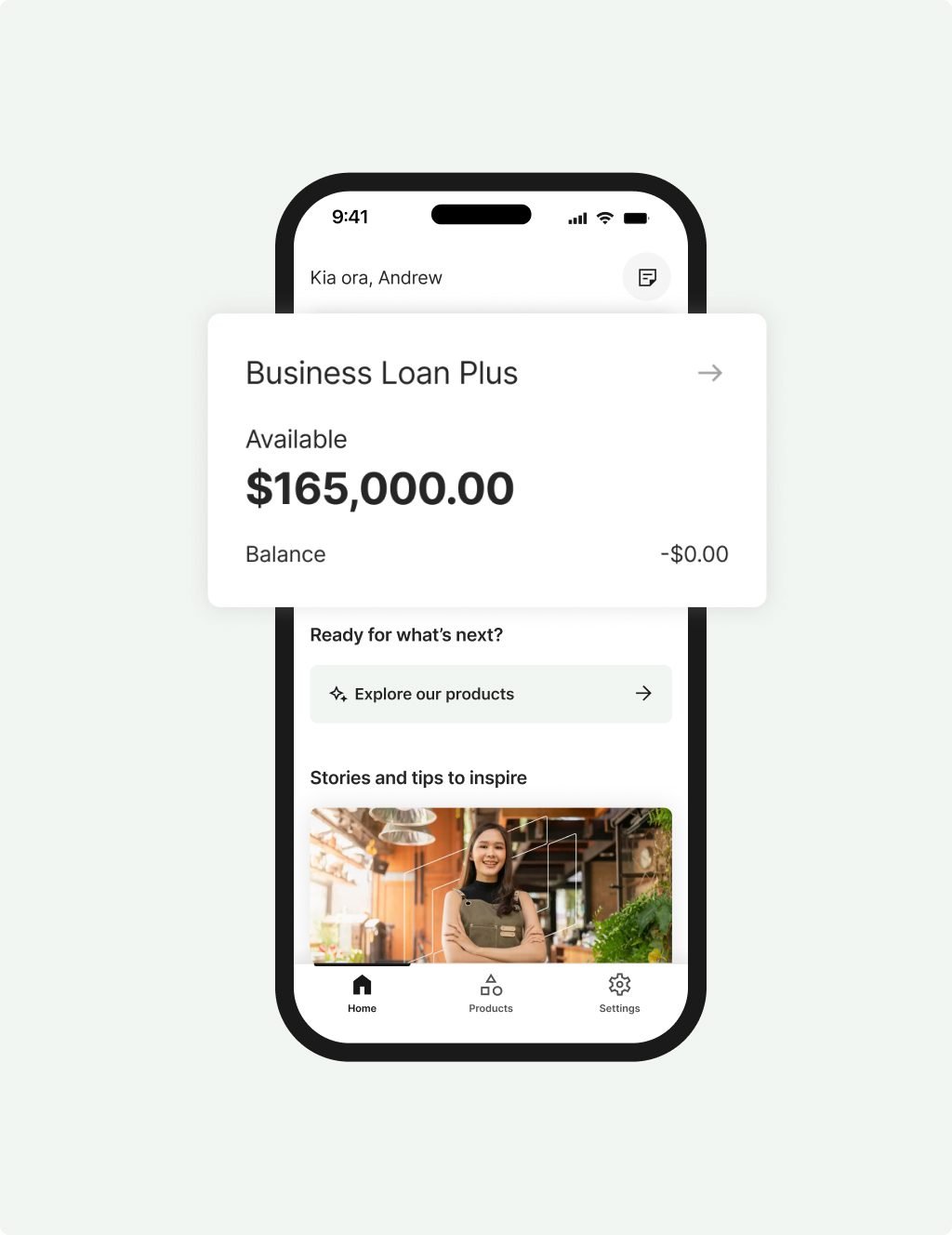

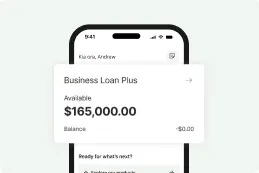

Business Loan

Plus

Larger loans above $150K and up to $500K to invest in your next business growth opportunity.

- Fixed term up to 5 years with fixed rates

- No credit checks to see if you are eligible

- Security may be required when accessing over $150K in Prospa funding

- Minimum $1M annual turnover and 3 years trading to apply

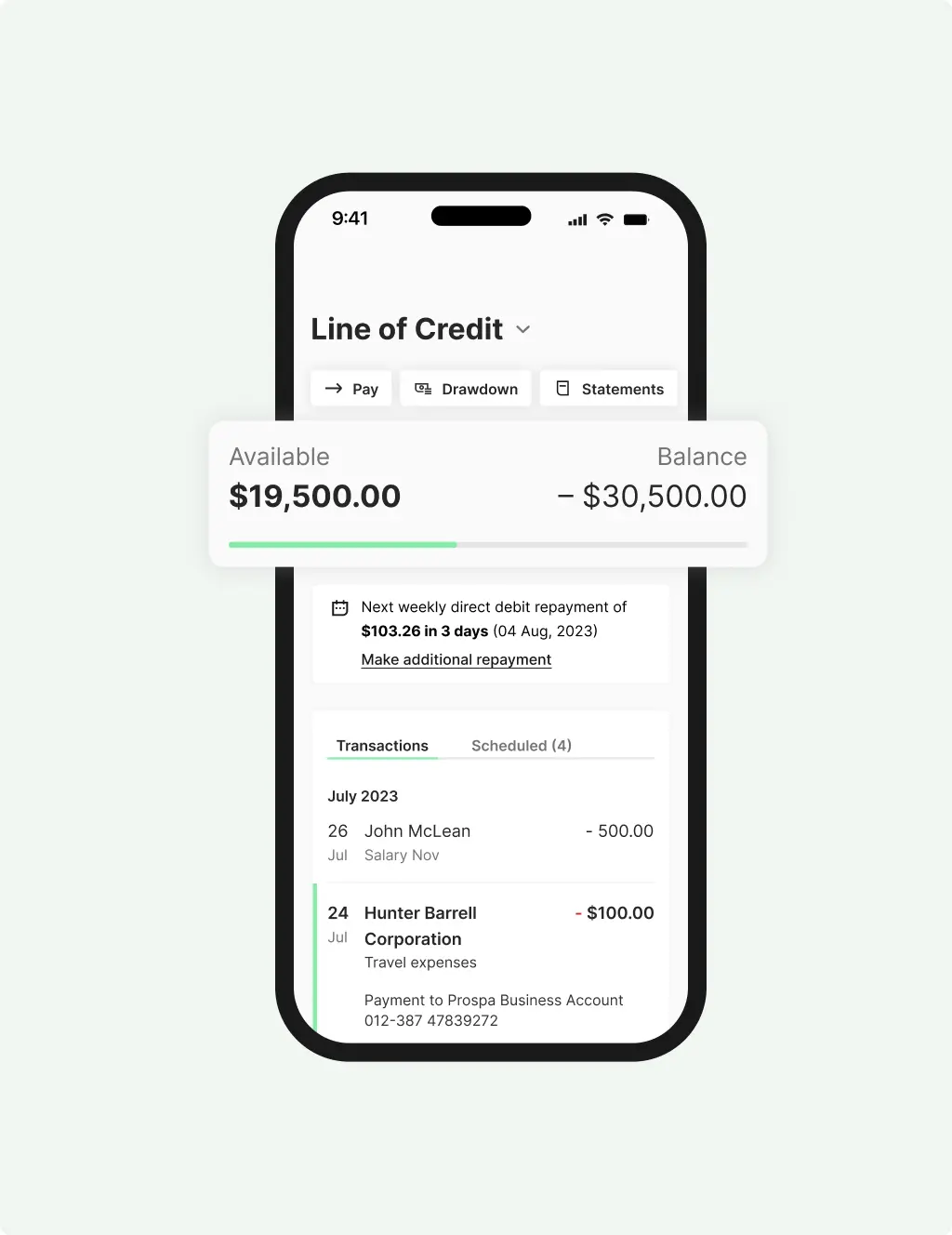

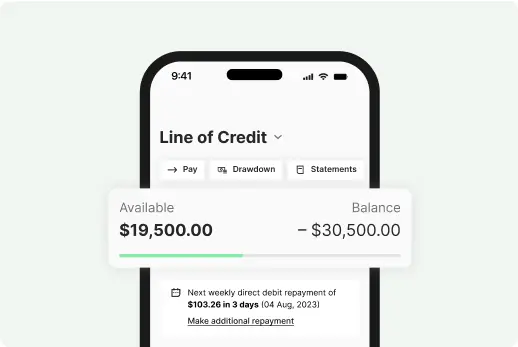

Line of Credit

Ongoing access to up to $500K to keep your business moving.

- Renewable 24 month term

- Fast decision and funding possible in 24 hours

- Only pay interest on what you use

- Access funds 24/7 with the Mobile App

- Minimum $6K monthly turnover and 6 months trading to apply

Why Prospa?

No more compromising or missed opportunities with Prospa by your side. Access funds for growth and cash flow support in a fraction of the time and without all the fuss. It’s just what we do.

We’re New Zealand’s small business lending specialist.

Choice

Borrow up to $500K with 10 minute application, fast decision and funding possible in 24 hours

Support

Confidence

have borrowed from Prospa.

You could benefit too.

How could Prospa business finance help your company?

Keep your business at its peak and one step ahead of the competition by ensuring you have the business finance available to maintain the best and most efficient technological solutions. Rebrand and relaunch with an intensive NZ-wide media campaign or give the shopfront, workshop or office a facelift with much-needed renovations. Speak to Prospa about a business loan solution that works for your business.

Business owners use Prospa business loans to:

- Upgrade equipment and assets

- Refurbish shopfronts and offices

- Launch media and advertising campaigns

- Boost stock levels leading up to peak sales periods

- Update software and infrastructure

- Much more

FAQs

Frequently asked questions

When your business needs funds for working capital or growth, there are a number of options for New Zealand small businesses to consider. The business finance option you choose depends on many factors including what you will use the funds for, the amount you need, the repayment term that best suits your cash flow and whether you want to use an asset as upfront security. Here are some business finance options to consider: business loans (either secured or unsecured), business overdrafts, a business line of credit, asset finance, equipment finance, business credit cards and invoice finance.

Due to the complexities or timeframes involved with many business finance options, some business owners decide to use personal loans or credit cards to support their business needs. However, while convenient, this can often be a last resort. Prospa offers fast business loans with funding possible in 24 hours and cash flow friendly repayment terms – designed specifically for the way small businesses operate.

If you are a NZ small business on the north island or south island, looking for business finance – your location is no barrier with Prospa. Whether you live in Auckland, Wellington, Christchurch, Dunedin or anywhere in between, you can easily apply direct for a Prospa business loan using our online form – and enjoy a fast, hassle-free online business finance application experience with funding possible in 24 hours to approved applicants.

Other questions?