Equipment Financing

A range of funding solutions

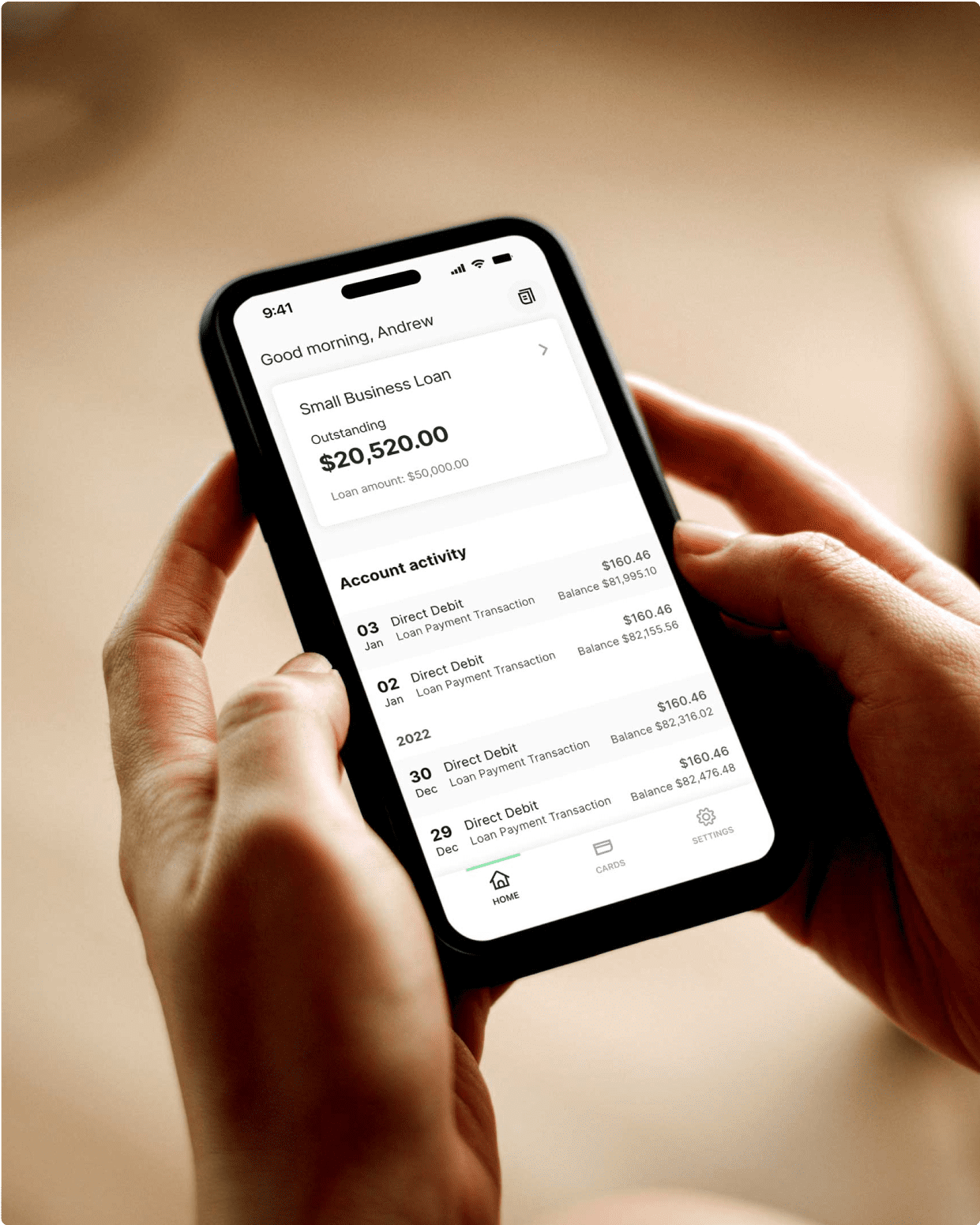

Small Business Loan

For fast funds

- From $5K up to $150K

- Easy application and funds available same-day

- Up to 3 year terms

- No upfront security required

Business Loan Plus

For big plans

- From $150K to $500K

- Same day approvals on funding up to $250K

- Up to 5 year terms for lower weekly repayments

- Security may be required for over $150K in Prospa funding

Business Line of Credit

Ongoing access to funds to simplify cash flow.

- From $2K up to $500K

- Access funds anytime via the Prospa App

- Only pay interest on what you use

- Security may be required for over $150K in Prospa funding

NZ businesses can get up to $500K for business equipment

Don’t let a lack of equipment hold your business back. With small business loan of up to $500,000, Prospa can help you access the tools, technology or machinery you need to grow and thrive. Our equipment loans are designed to support businesses looking to upgrade existing assets or invest in new ones. We also offer business equipment financing that can be used for more than just purchasing gear, including training and workspace upgrades. These loans for equipment can help you manage expenses while protecting your working capital.

How we do credit, differently

| Key Features | Prospa Equipment Loan | Traditional Bank Loan |

|---|---|---|

| Speed to Funding | Apply online in minutes with approval possible in 24 hours. | Applications often take days or weeks to process. |

| Equipment Ownership | You own the equipment from day one with no lease or residual structures. | Equipment may be owned by the bank during the loan term, depending on the structure. |

| No Asset Security Required | No security required on loans up to $150,000. | Usually requires security over the equipment or other business assets. |

| Minimal Paperwork | Simple application with just bank statements required. | Extensive documentation such as tax returns and financials often required. |

| Flexible Repayment Options | Weekly repayments tailored to your business cash flow. | Standard repayment terms with limited flexibility. |

Unlock Your Business Potential with Investment Boost

The government’s new Investment Boost lets you claim 20% of the cost of new assets as an immediate tax deduction. That means less tax to pay when you invest in equipment, tools or commercial property. There’s no cap and all businesses can benefit. It applies to new assets bought locally or imported, and it’s already live! Prospa can help you access fast funding to make the most of it. No red tape, just support when you need it.

Equipment financing can be easy with a Prospa Business Loan

No more compromising or missed opportunities with Prospa by your side. Access funds for growth and cash flow support in a fraction of the time and without all the fuss. It’s just what we do.

We’re New Zealand’s small business lending specialist.

Choice

Borrow up to $500K with 10 minute application, fast decision and funding possible in 24 hours

Support

Confidence

have borrowed from Prospa.

You could benefit too.

A great new option for NZ businesses

Purchasing assets and upgrading technology are essential parts of the growth plans for any small business. But sifting through the equipment financing options can be confusing. Your choice will depend on a range of factors unique to your business.

When you talk to your adviser, be sure to mention the Prospa Small Business Loan. We are small business lending specialists dedicated to helping NZ small businesses with flexible finance for business equipment and much more.

Common uses of equipment finance:

- Industrial machinery

- Commercial equipment

- Medical machines

- Trucks, Trailers, Forklifts

- Construction equipment

- Electronics, IT, Security

- Motor vehicles

- Heavy equipment

Why you should consider an alternative lender

If you think obtaining equipment finance for your business will be time consuming – think again. When you’re financing equipment and other business assets, alternative lenders like Prospa provide an intuitive online application process, with minimal paperwork and a fast application process. Prospa offers loans to NZ small businesses of up to $500K with funding possible in 24 hours.

This article talks about the benefits of alternative lenders.

FAQs

Frequently asked questions

Traditional equipment finance helps a business owner access important business equipment and technology without paying for it up front using working capital. The business gets the required funding from a bank or other lender and pays the amount off over a set repayment period. There are several ways of financing equipment including a Prospa Small Business Loan which is one way to get the benefits of the equipment without owning it outright.

There are various ways of equipment financing for business. These include the traditional equipment finance options such as hire purchase, an equipment finance lease or an equipment loan; or you could look at using a business loan. The choice you make depends on the needs and circumstances of your individual business – it’s a good idea to talk to your financial adviser or accountant before making a decision.

Hire purchase – The finance provider owns the equipment until the loan contract is paid out when ownership is transferred to the business.

Equipment finance lease – Similar to hire purchase but the business doesn’t own the equipment at the end of the contract, they negotiate a new leasing arrangement on the same equipment or upgrade to new equipment.

Equipment loan – A fixed interest loan secured by a mortgage over the asset. There may be some tax advantages with an equipment loan.

Business loan – This is also a fixed interest loan over a set term, but comes with more flexibility than traditional equipment finance. Because the loan is not necessarily secured against the asset, the funds can be used for a range of purposes including purchasing the asset. Apply now for a Prospa Small Business Loan of up to $500K – with funding possible in 24 hours.

Other questions?