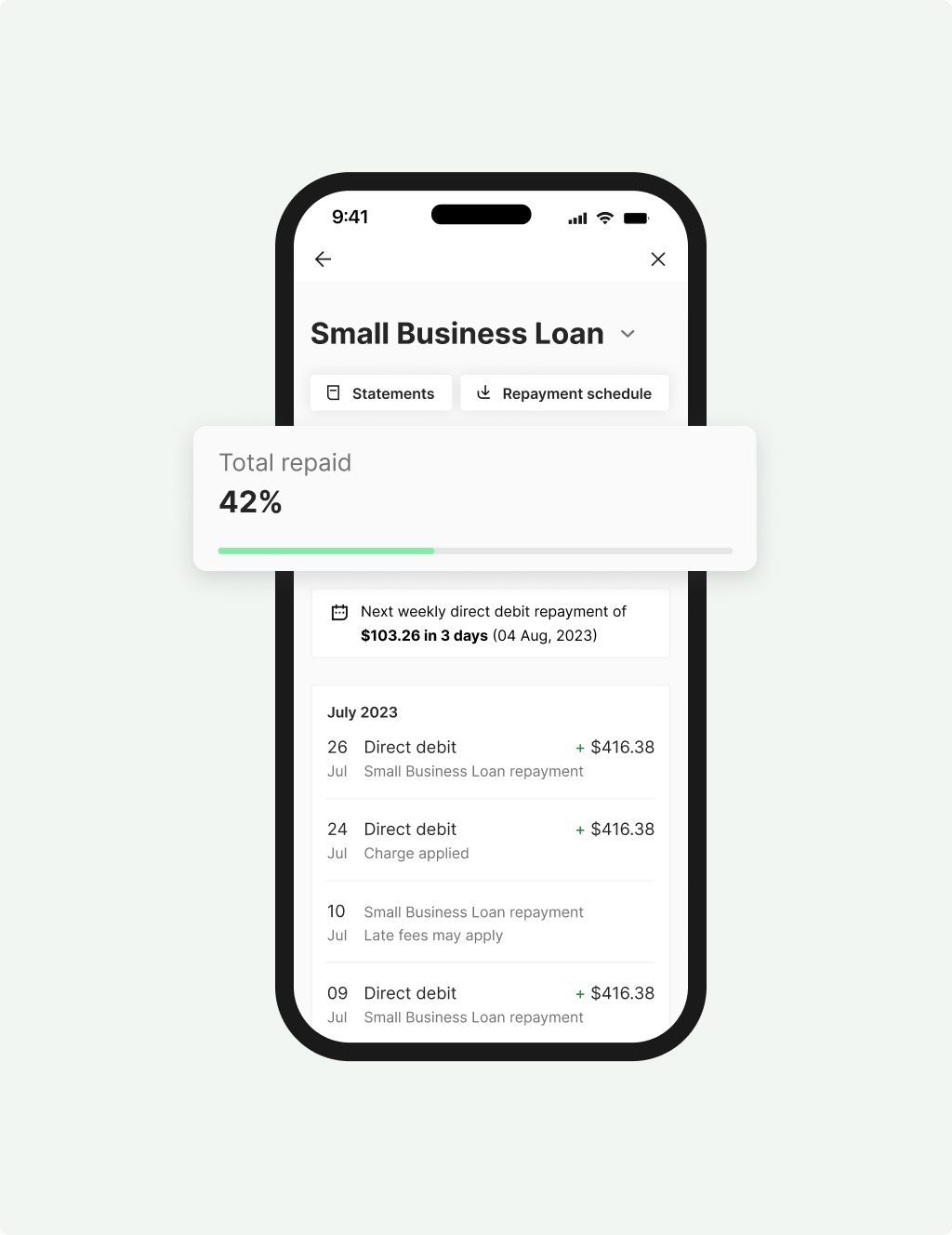

Small Business

Loan

Quick access to $5K – $150K to cover unexpected expenses or a one-off purchase.

- Fixed term up to 5 years with fixed rates

- Fast decision & funding possible in 24 hours

- No asset security required upfront to access Prospa funding up to $150K

- Minimum $6K monthly turnover and 6 months trading to apply

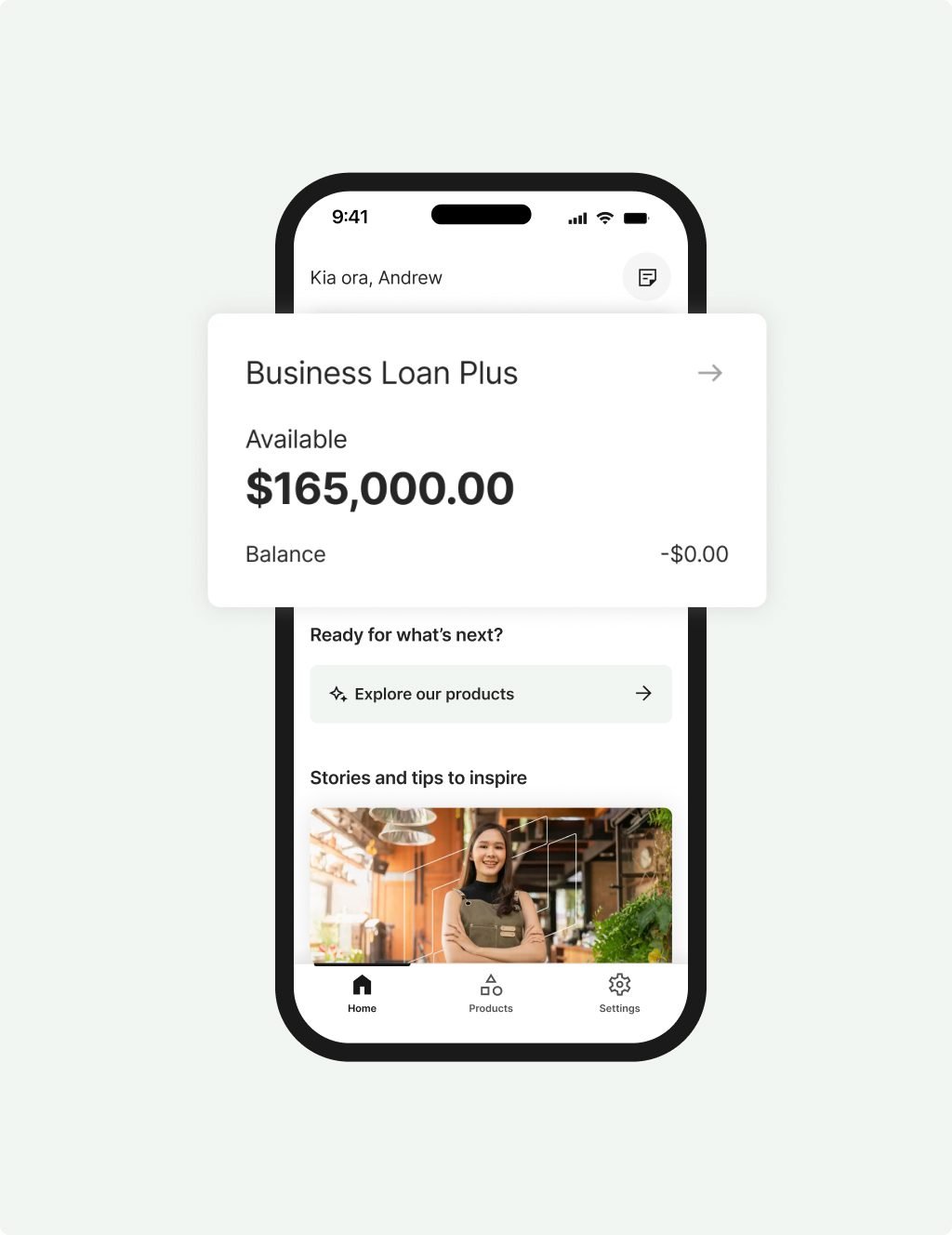

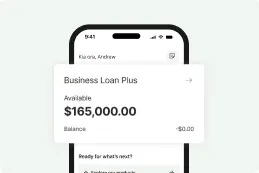

Business Loan

Plus

Larger loans above $150K and up to $500K to invest in your next business growth opportunity.

- Fixed term up to 5 years with fixed rates

- No credit checks to see if you are eligible

- Security may be required when accessing over $150K in Prospa funding

- Minimum $1M annual turnover and 3 years trading to apply

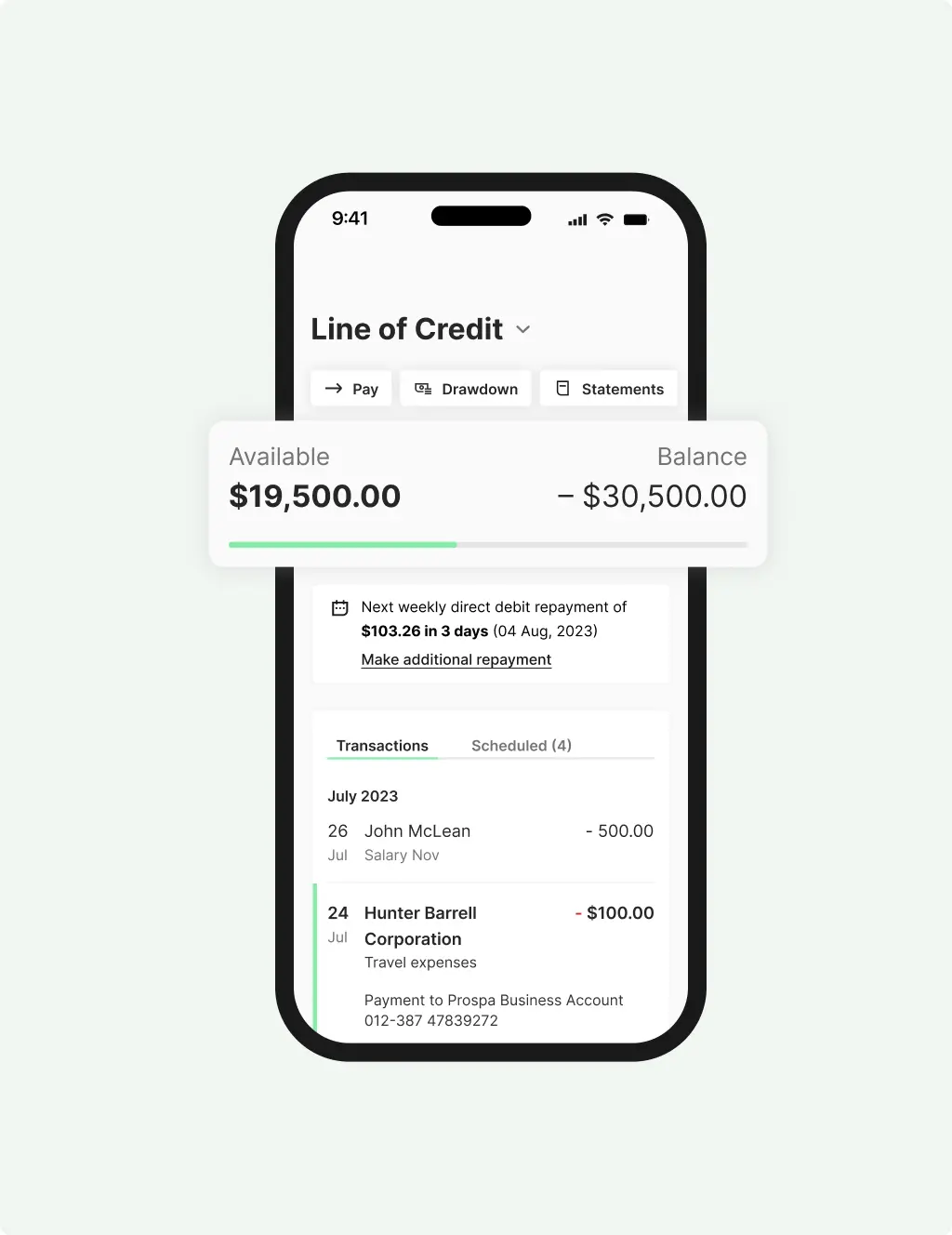

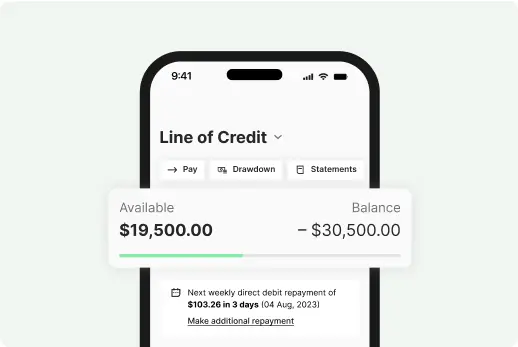

Line of Credit

Ongoing access to up to $500K to keep your business moving.

- Renewable 24 month term

- Fast decision and funding possible in 24 hours

- Only pay interest on what you use

- Access funds 24/7 with the Mobile App

- Minimum $6K monthly turnover and 6 months trading to apply

Small business loans for growth or cash flow support

Prospa provides NZ small business owners with short term business loans over loan terms of 3 to 36 months. We have already supported thousands of other business owners in New Zealand and Australia, and we could help you too with funding of up to $500K possible in 24 hours.

So if your business is located on the North Island from Auckland to Wellington, or from Christchurch to Dunedin on the South Island, Prospa is waiting to help your business. We offer fast access to funds to support cash flow that keeps you moving or to help you seize opportunities for growth and expansion.

Choice

Borrow up to $500K with 10 minute application, fast decision and funding possible in 24 hours

Support

Confidence

have borrowed from Prospa.

You could benefit too.

How can we help you build your business?

A short term business loan from Prospa could you help you realise your business potential. We provide quick turnaround funding for NZ small businesses to meet the demands of a growing market or for sudden opportunities.

Use a short term business loan to:

- Update your shopfront or office

- Invest in the latest technology

- Stock up before peak periods

- Expand your stock and offerings

- Update a business logo or signage

- Conduct a marketing campaign

- Support cash flow and more

FAQs

If you need to borrow funds and want the option to pay the loan back quickly, you could consider a short term business loan or perhaps a line of credit. Prospa offers small business loans of $5K to $500K with set daily or weekly repayments over loan terms of 3 to 36 months. There are no penalties for early repayment – so you can pay the loan off at any point in the term. A short term business loan is a great option for New Zealand small businesses when they need quick access to cash to support cash flow, pay suppliers or to cover invoice gaps – and no asset security is required upfront to access up to$150K.

When you apply for a short term business loan with Prospa, the online application process takes around 10 minutes. You’ll need your NZBN, driver’s licence details, basic details about your business (operating years, structure & turnover) & trading business bank account details. For SME business loans over $250K, you’ll also need some basic financial statements, like a P&L and cash flow.

With the above information at hand, we’ll can provide a quick decision and funding is possible in 24 hours to approved applicants.

Prospa is proud to support New Zealand small businesses with a fast, hassle-free application process on our short term business loans. If you can demonstrate a turnover of $6K or more per month you can apply for a small business loan with Prospa today. Start with our online application form.

Other questions?