Small Business Loan For fast funds

Funds to cover cash flow or help you grow

Borrow from $5K up to $150K

Funding possible within hours

No upfront security

No need to put your house or other assets down as security to access up to $150K in Prospa funding.

Flexible repayments

Make unlimited extra repayments to save on interest and pay off your loan faster

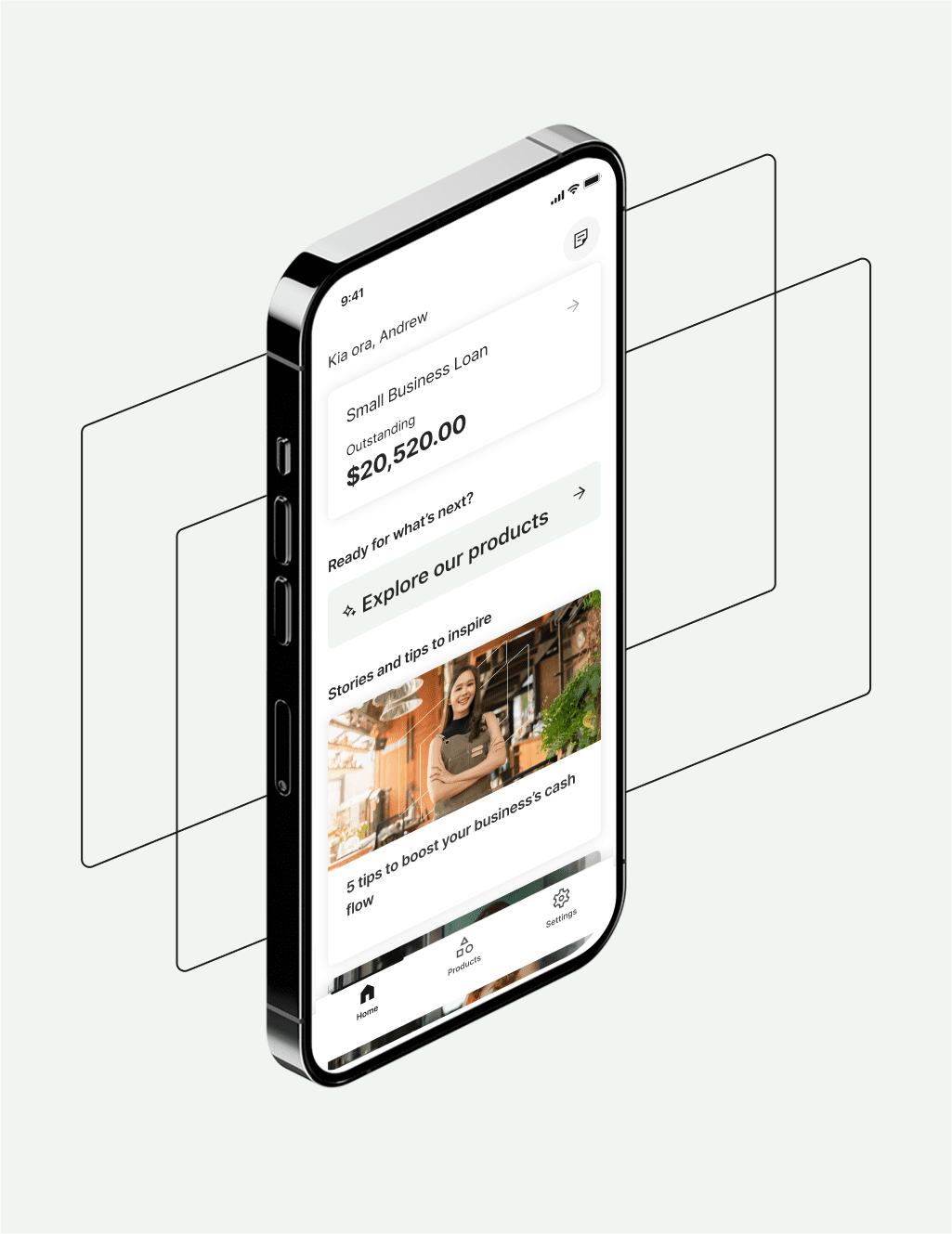

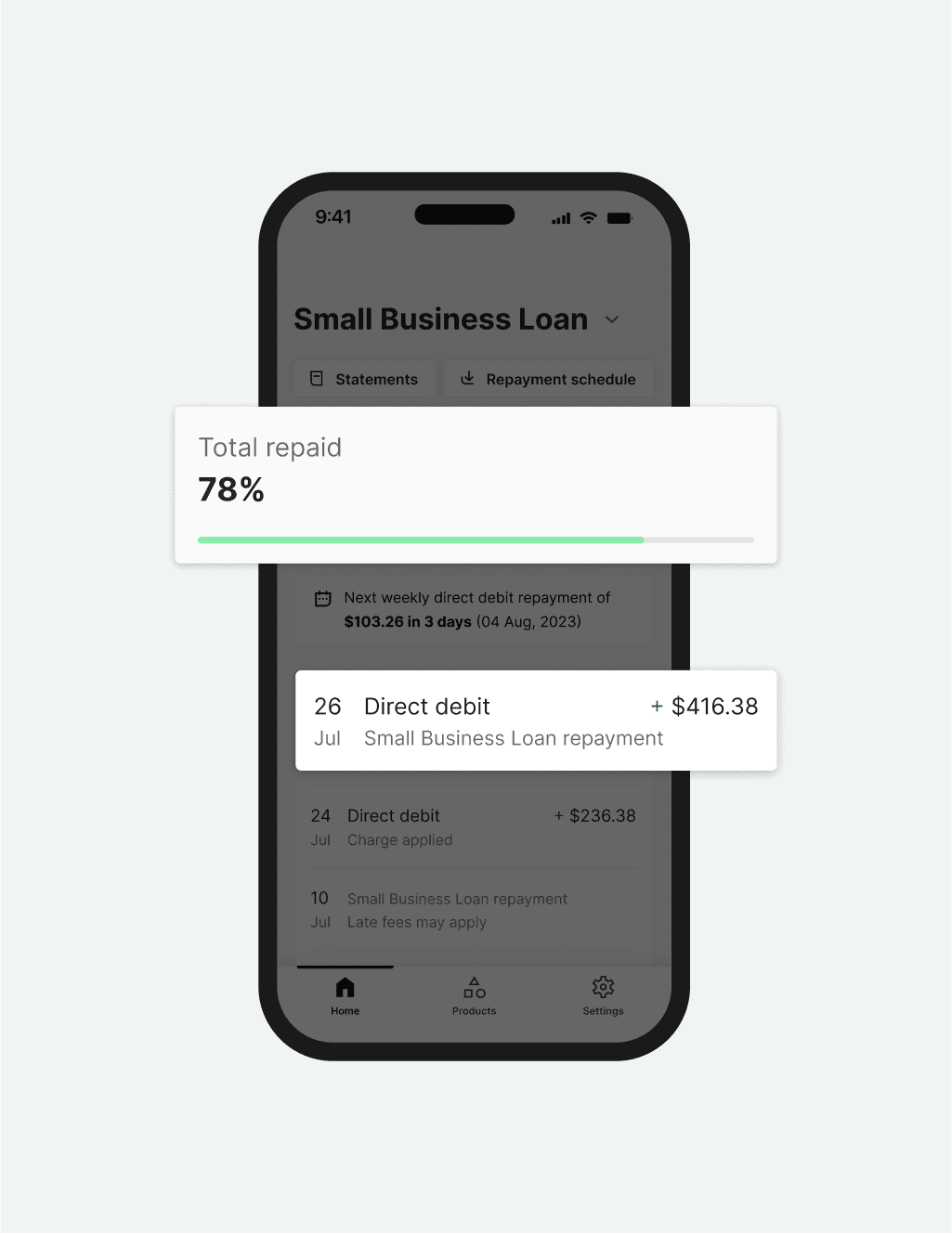

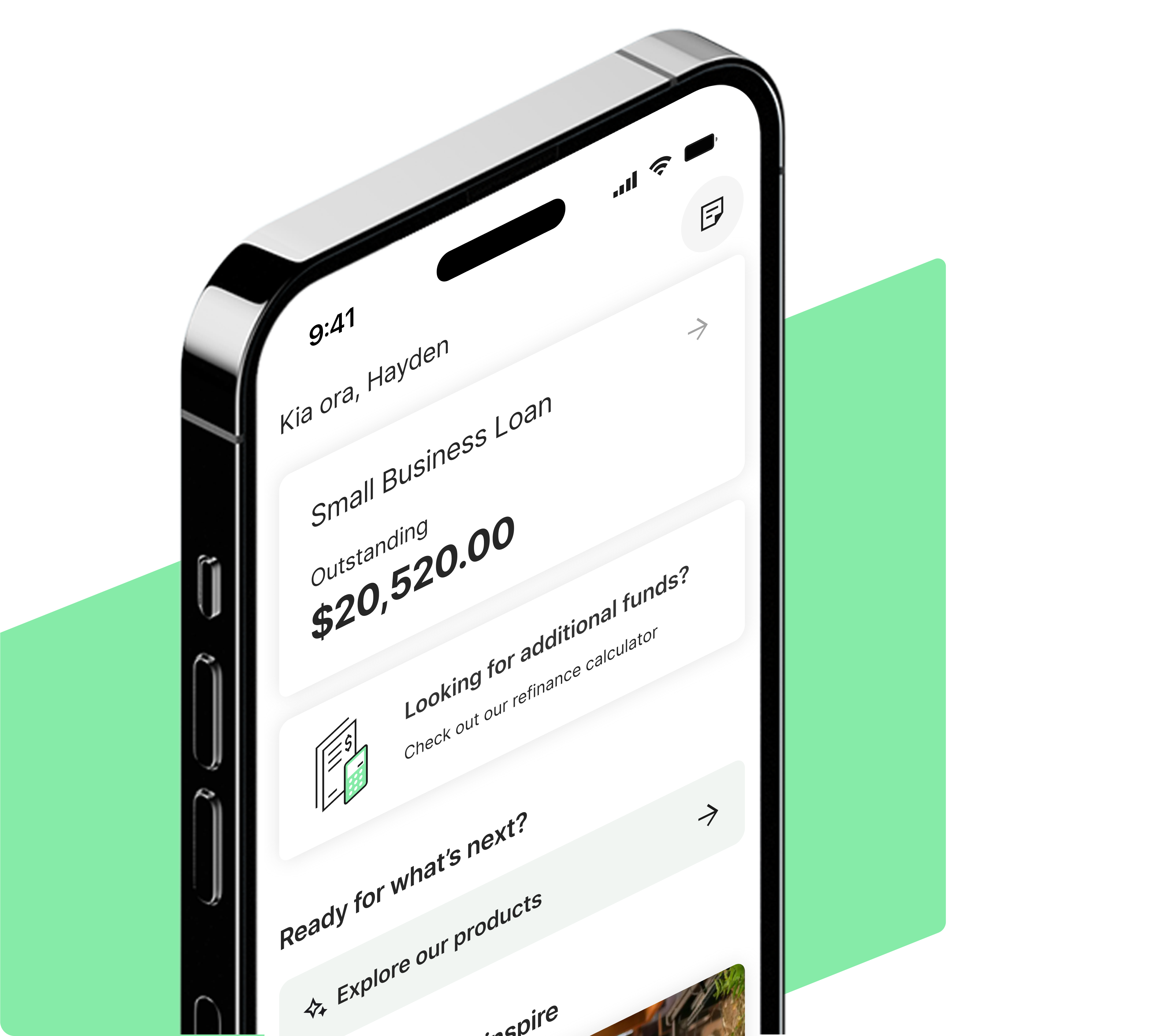

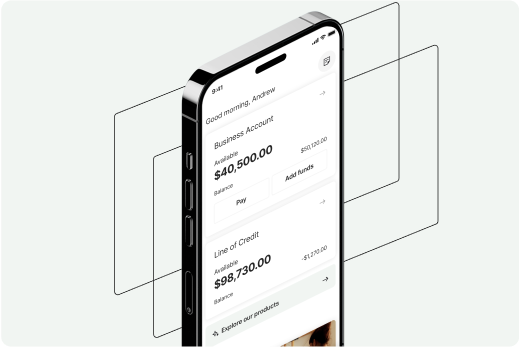

Manage anytime, anywhere

Manage your cash flow on the go with the Prospa App or Prospa Online

Your cash flow, your choice

Our calculator will help you estimate how much you’ll pay per week

See full T&CsPlease select a product

How to apply

01

Apply in minutes

02

Get a fast decision

03

Access your funds

Easily manage

cash flow

on the go

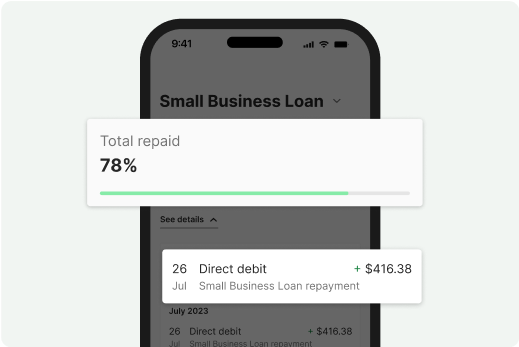

Stay on top of your repayments

FAQs

Common questions answered

The application process is quick and easy. Simply complete the online form in minutes and a dedicated business lending specialist will be in touch to guide you.

- For funding between $5K to $150K we can often provide a response in one hour – as long as you apply during standard business hours and allow us to use the advanced bank verification system link to instantly verify your bank information online. If you choose to upload copies of your bank statements we can provide a decision in as little as one business day.

- For funding between $150K to $500K we may take a little longer. Turnaround times are around 2–3 days for final approval, however this may be quicker depending on the circumstances of each application.

Often, you can have the funds in your account in as little as 1 hour after settlement.

We offer Business Loans or Line of Credit up to $500K, however the total amount of your loan will depend on the specific circumstances of your business.

We consider a variety of factors to determine the health of your business and based on this information we will make an assessment on how much you can borrow.

Use our loan calculator to discover much you could afford to borrow.

We understand that circumstances can change. That’s why we offer a 14-day Change of Mind Policy. If you decide you no longer want the funds, you can cancel your loan agreement and return the funds free of charge, as long as it’s within 14 days of your loan agreement date.

To take advantage of this policy, simply contact one of our lending specialists at 0800 005 797, and we’ll assist you with the process.

If it’s been more than 14 days since your loan agreement date, you still have the option to pay off your loan in full to minimise interest costs. However, please note that fees and charges will still apply. For assistance with a full payout, reach out to our lending specialists at 0800 005 797.

When you apply, we will assess the risk profile of your business and provide you with a customised offer including loan amount, term and interest rate.

We charge a small establishment fee of 3.5-4%. Provided you continue to meet your loan obligations (as detailed in your contract) this will be the only Prospa fee you will pay.

For funding over $150K, a registration fee may apply if we register a caveat or mortgage over real property you own.

You can choose to repay the entire amount of your loan early at any time.

If you decide to do this please speak to our friendly business loan specialists on 0800 005 797. They will provide you with repayment details and an early payout figure. This will be calculated as the total of the remaining principal amount and any accrued interest at the date of early payout, plus 1.5% of the remaining principal and any outstanding fees.

To help you avoid missing repayments and to fit in with your cash flow cycle we offer weekly repayments. These are automatically deducted from your nominated business account.

You can apply for the Prospa Small Business Loan online in minutes, receive a same day response and the funds could be in your account within hours.

Traditional business loans reference an interest rate per annum plus other fees and charges. Prospa’s prices the loan upfront so you will know in advance the total amount payable including any interest, fees or charges. This is then broken down into a weekly repayment figure.

The Small Business Loan can be used for almost any business purpose including cash flow management, business renovations, marketing, to purchase inventory or new equipment, as general working capital and much more. The loan cannot be used for personal purposes.

Yes, a small Origination fee of 3.5-4% will apply.