Demand for funding grows, Prospa hits $500 million in originations locally

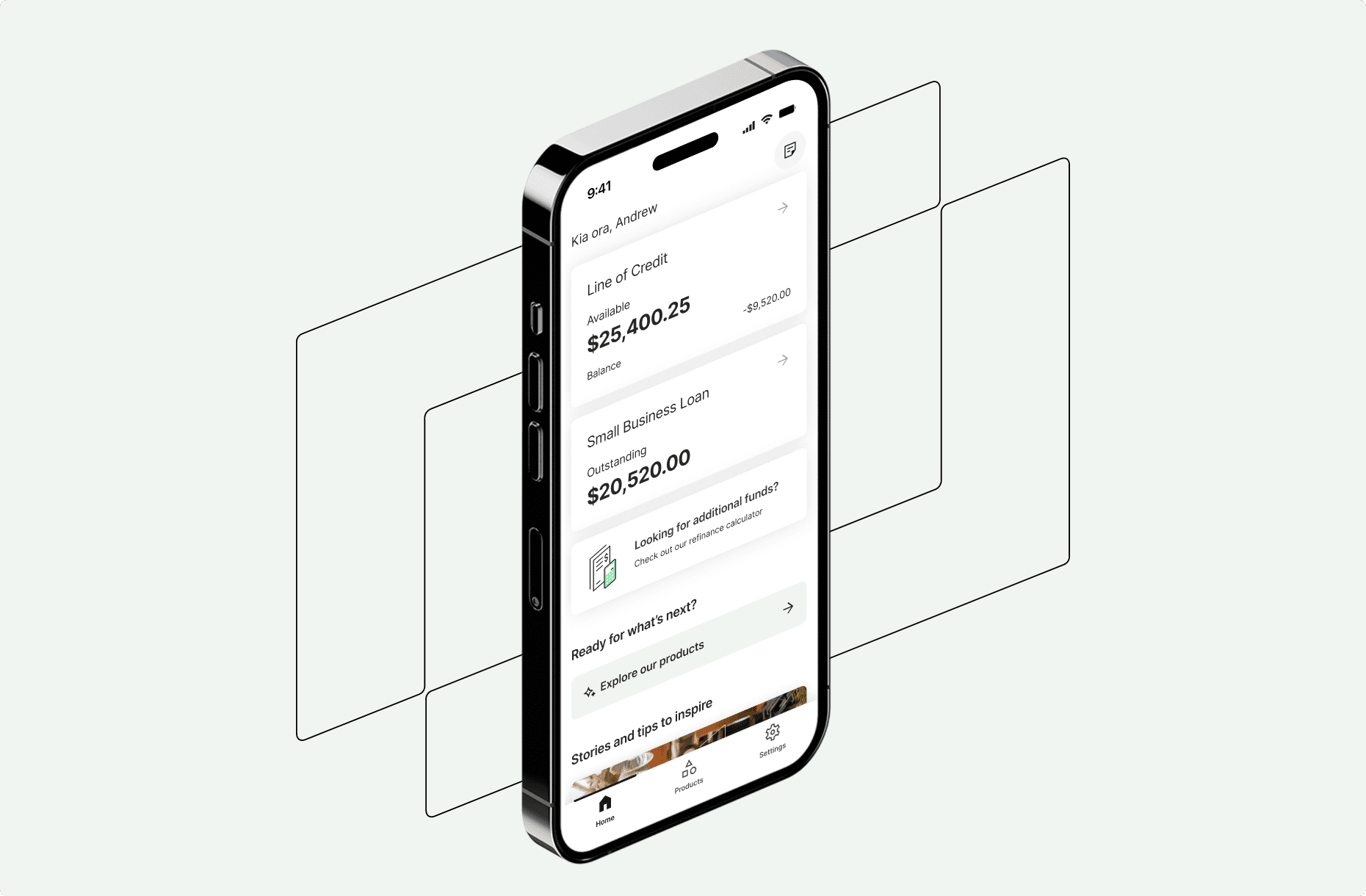

Small business lender Prospa launches a mobile app for its New Zealand customers, providing local business owners with a simple way to manage their cash flow. As demand for funding continues to grow, Prospa also announced that it has reached a key milestone of more than $500 million in originations since it launched in New Zealand, supporting thousands of small businesses across the country.

As business owners continue to grapple with market uncertainty and the rising cost of living, this new offering helps small businesses stay on track of their cash flow, allowing them to better manage expenses and repayments, so they can focus on running their business. Designed with simplicity and convenience in mind, the App offers 24/7 access to Prospa’s suite of SME lending products on both Android and Apple iOS platforms, making it easier than ever for small business owners to stay on top of their business finances.

Adrienne Begbie, Managing Director of Prospa, says the App will be the first to offer SME customers, who are looking to fund and grow their business, a digital experience that’s tailored to them.

Adrienne Begbie, Managing Director, Prospa New Zealand.

Existing customers will also be able to apply for funding faster and easier through express application.

Adrienne Begbie, Managing Director, Prospa New Zealand.

Prospa also recently partnered with Lend Captial on the launch of its loan marketplace to help even more local small businesses get fast access to the funding they need. The launch of the App in New Zealand follows the success of the App in Australia and demonstrates Prospa’s commitment to investing in the local market.

Adrienne Begbie, Managing Director, Prospa New Zealand.

The launch of the App in New Zealand is part of Prospa’s commitment to building technology that empowers small businesses. Last year, Prospa introduced the Line of Credit to address cash flow fluctuations, and the App is the latest innovation to help customers manage their finances easily and effectively.

For more information about the Prospa App, visit: https://www.prospa.co.nz/

For further information, contact [email protected].