Is your money working hard enough? Discover how to calculate ROI to measure profitability, identify weak areas and choose the investments that deliver the best returns.

At a glance

- ROI helps you understand whether an expense is strengthening your business or costing you more than it returns.

- The ROI formula is: (Net profit ÷ Cost of investment) × 100, and you can use it to assess decisions such as upgrading equipment, improving your menu or running targeted marketing.

- Knowing how to calculate ROI percentage helps you compare options, prioritise spending and decide when external funding could support your growth plans.

Every business owner wants to know if their money is working as hard as they are. Whether you’re planning a fit-out, updating equipment or exploring new ways to attract customers, relying on instinct alone can lead to costly choices.

Learning how to calculate return on investment gives you a clear and unemotional way to judge whether something is worth the spend. Instead of hoping an upgrade will pay off, you’ll have a measurable figure showing whether it’s driving profit or draining

cash flow.

Here’s how to calculate ROI in business and use it to guide more confident and profitable decisions.

How to calculate ROI

ROI is a percentage that shows how much profit you earn for every dollar invested. The formula is straightforward:

ROI = (Net profit ÷ Cost of investment) × 100

Where:

- Net profit = Total return – Total cost

- Total return = Revenue generated after expenses

If you’re unsure how to calculate ROI percentage, plugging your numbers into this formula gives you a reliable benchmark for comparisons.

Example: A restaurant refreshes its bar area

A Wellington restaurant spends $12,000 updating its bar layout. Over the next 12 months, faster service and increased seating result in $37,500 in additional revenue.

Net profit: $37,500 – $12,000 = $25,500

ROI calculation: ($25,500 ÷ $12,000) × 100 = 212.5%

This shows the refresh produced more than double what it cost in its first year.

A smarter way to calculate ROI: Prospa’s free ROI Calculator

You don’t need a spreadsheet to figure out how to calculate ROI.

Don’t do the math in your head. We have built a free ROI Calculator to help you run these numbers instantly. It includes a Comparison Tool so you can weigh up short-term wins (like marketing) against long-term investments (like renovations) side-by-side.

| ROI CALCULATOR | ||

|---|---|---|

| Inputs | ||

| Amount Invested | $1,000 | Include your amount |

| Amount Returned | $1,500 | Include your amount |

| Results | ||

| Net Profit | $500 | Your results appear here – Do not modify |

| ROI % | 50% | Your results appear here – Do not modify |

| Investment Multiple | 1.5x | Total revenue returned for every $1 spent |

Prospa’s free ROI Calculator makes it easy to enter your numbers and instantly see the result. It also includes a comparison view so you can weigh up short-term initiatives such as local advertising against larger projects like expansions or technology upgrades Try the Prospa ROI Calculator to see how potential investments stack up.

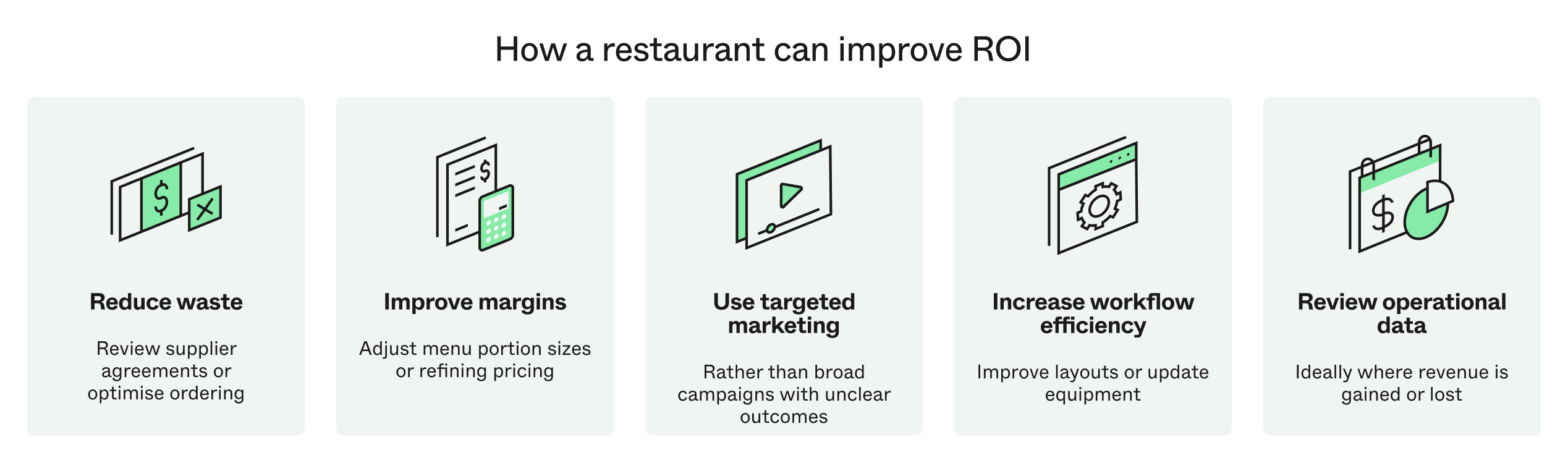

Ways to improve your ROI

Boosting ROI is often about making precise improvements rather than spending more. Small and well-planned adjustments can have a meaningful impact.

Here are practical steps small businesses such as restaurants can take:

- Reduce waste by reviewing supplier agreements or optimising ordering.

- Improve margins by refining pricing or adjusting menu and product portions.

- Use targeted marketing rather than broad campaigns with unclear outcomes.

- Increase workflow efficiency by improving layouts or updating equipment.

- Review operational data to identify where revenue is being gained or lost.

Mistakes to avoid when calculating ROI

Many businesses understand the formula but still trip up on the inputs. When learning how to calculate ROI in business, watch out for these common errors:

-

- Using revenue instead of profit.

A campaign that brings in $6,000 in sales but costs $5,500 doesn’t generate much return. Always use net profit. - Leaving out hidden or ongoing costs.

Installation fees, servicing, staff hours and subscriptions all affect your real return. - Ignoring time frames.

A three-month campaign and a long-term renovation shouldn’t be compared without adjusting for time. - Not factoring in risk.

Tourism fluctuations, seasonality, weather dependency and economic shifts can change ROI dramatically. - Overlooking long-term value.

Branding, customer loyalty and team development may deliver modest short-term ROI but significant long-term gains.

- Using revenue instead of profit.

How ROI helps you make smarter decisions

Understanding how to calculate ROI percentage allows you to compare ideas on equal footing, identify the most profitable paths and reduce emotional bias in decision-making.

1. Compare returns within the same investment category

ROI puts numbers behind everyday decisions.

Example: Marketing options for a local bakery

Option A: Google Ads

- Cost: $1,000

- Return: $2,600

- ROI: 160%

Option B: Community event sponsorship

- Cost: $850

- Return: $1,100

- ROI: 29%

The cheaper option isn’t always the most effective.

2. Compare returns across different types of investments

Once you understand how to calculate ROI, you can compare decisions that seem unrelated.

Example: Digital ordering system vs outdoor dining upgrade

Option A: Online ordering system

- Cost: $8,000

- Increase in annual revenue: $17,000

- ROI: 112.5%

Option B: Outdoor dining expansion (loan-funded)

- Cost: $25,000

- Increase in annual revenue: $40,000

- ROI after first year: 60%

- ROI over two years: 220%

Both options deliver value, but one delivers larger gains over time.

3. Improve long-range planning

Knowing how to calculate ROI helps you build more accurate financial forecasts. High-return hospitality initiatives might include:

- Adding takeaway or delivery options

- Investing in energy-efficient equipment

- Expanding seating capacity

- Testing higher-margin products

- Running marketing during peak tourism seasons

4. Identify weak areas that hold profits back

When you analyse ROI, you see which activities genuinely grow the business.

Example: New product launch vs staff development

Option A: New gelato line

- Cost: $1,400

- Eight-week return: $3,100

- Net profit: $1,700

- ROI: 121%

Option B: Staff service training

- Training cost: $3,000

- Six-month return: $38,500

- Net profit: $35,500

- ROI: 1,183%

Improving capability often delivers stronger long-term returns than expanding a product range.

5. Make decisions with clarity, not emotion

ROI provides a shared reference point for owners, partners and managers. Being able to say, “This project is expected to return 60% in the first year and more than 200% by year two” reframes decisions around financial outcomes.

Example: Loan-funded kitchen upgrade

- Initial cost: $40,000

- Annual net profit increase: $65,000

Year one ROI: ($65,000 – $40,000 = $25,000 net profit); ($25,000 ÷ $40,000) × 100 = 62.5%

Two-year ROI: ($25,000 + $65,000 = $90,000 total net profit); $90,000 ÷ $40,000 = 225%

A loan that supports revenue growth can produce returns far beyond its upfront cost.

Small business loans to support ROI growth

When you’ve identified a high-return opportunity but cash flow is tight, external funding can help you act sooner.

Prospa small business loans offer flexible capital, allowing you to pursue equipment upgrades, renovations or marketing initiatives that strengthen long-term profitability.