A clear, concise guide to business cash flow loans. Learn how cash flow lending works, who it suits, and how to access quick funding.

At a glance

- Cash flow lending shifts the focus from the value of your physical assets to the strength of your consistent sales and revenue to assess your business.

- Rather than asking for extensive paperwork, during the application process lenders directly analyse your bank data online to get a clear picture of your financial health.

- A good fit for established businesses with consistent sales that need access to working capital to manage seasonal trade, purchase inventory, or fund new growth opportunities.

If you run a café, a marketing studio, or a busy retail shop, you know the real value of your business lies in its daily trade and loyal customers. However, traditional loans tend to prioritise physical assets like property or equipment as security. Cash flow lending takes a different approach: focusing on the strength of your sales. It is a way to unlock funding based on your business performance, not your balance sheet, and it can offer a more accessible path to growth for service-driven or sales-based businesses.

How cash flow lending supports your business growth

Cash flow lending is a type of business finance where your eligibility is based on the strength of your revenue, not the value of your physical assets. Unlike traditional loans that are often secured by property or equipment, this approach looks at how consistently your business brings in sales.

A lender will review your sales history and projected income to assess whether your business can comfortably manage repayments. For a local café, for instance, a steady flow of daily customer transactions tells a clearer story about business health than the resale value of a coffee machine. That ongoing revenue becomes the basis for the funding.

What to expect when applying for a cash flow loan

Rather than asking for pages of paperwork, lenders use secure online access to review your business bank data and assess your financial position. The process is typically broken into three straightforward steps:

- Apply online. You fill out a simple digital form and securely share access to your business bank statements.

- Get a quick decision. Your transaction history is assessed to confirm steady sales and a healthy cash flow. Because the review is data-led, lenders can respond quickly.

- Access your funds. Once approved, the funds can be in your account within 24 hours. Repayments are made automatically in fixed amounts that work with your cash flow cycle.

Who can benefit from a cash flow loan?

A cash flow loan can be a smart option for established businesses with steady turnover that need quick access to working capital. It is especially useful when new opportunities or cost pressures arise before incoming revenue hits the account. Here are some common scenarios where cash flow lending could support your business:

- Covering an unexpected bill or paying a supplier invoice early

- Purchasing stock ahead of a seasonal rush, like Christmas or back-to-school

- Launching a new marketing campaign to boost visibility and sales

- Bringing on extra staff ahead of a busy trading period

- Smoothing out the natural highs and lows of seasonal business

Why choose Prospa for cash flow lending?

When Prospa assesses your business, we focus on how it performs in the real world. That means reviewing hundreds of data points, including your bank transactions, turnover, and trading history, to understand how your business operates day to day. If your business shows steady turnover and regular sales, that puts you in a strong position.

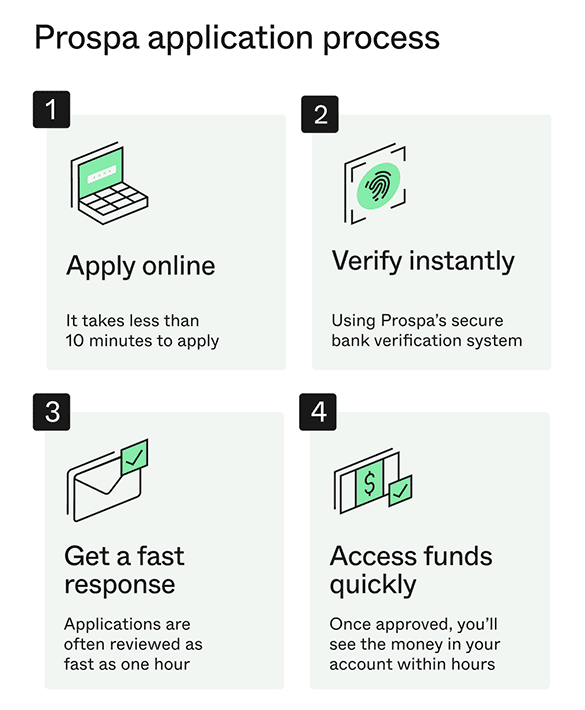

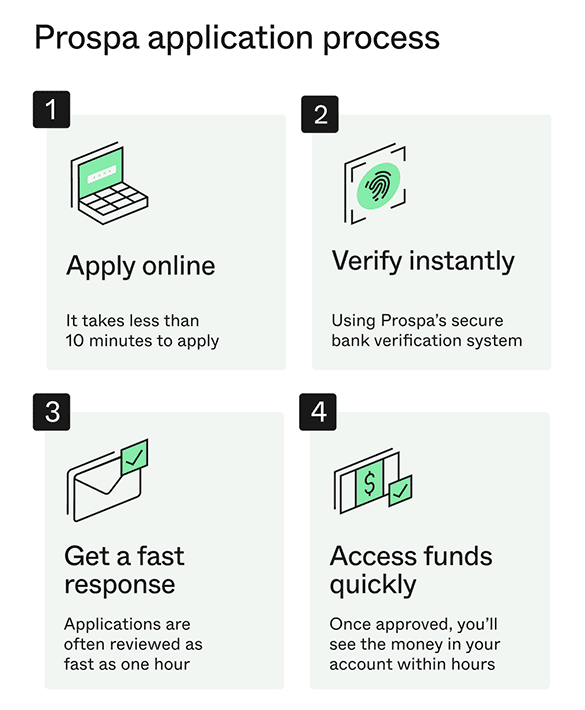

We have designed the application process to be quick and straightforward:

- Apply online. It takes less than 10 minutes to apply. You’ll just need your NZBN, driver licence, and access to your business bank statements.

- Verify instantly. Our secure bank verification system checks your statements on the spot — no paperwork to upload.

- Get a quick response. Applications are often reviewed in under an hour.

- Access funds quickly. Once approved, the money can be in your account the same day.

Prospa offers funding up to $150,000 with no upfront security, making it easier for businesses to access the finance they need.

You can use the Prospa Business Loan Calculator to get an idea of your repayments before applying.