The rest of the country might love a good ol’-fashioned public holiday but it’s more complicated when you’re a small business owner.

Public holidays aren’t all sleep-ins and empty roads – instead you often need to figure out how to maintain adequate cash flow in a week where you miss out on a day of trading but still get the same amount of bills coming in.

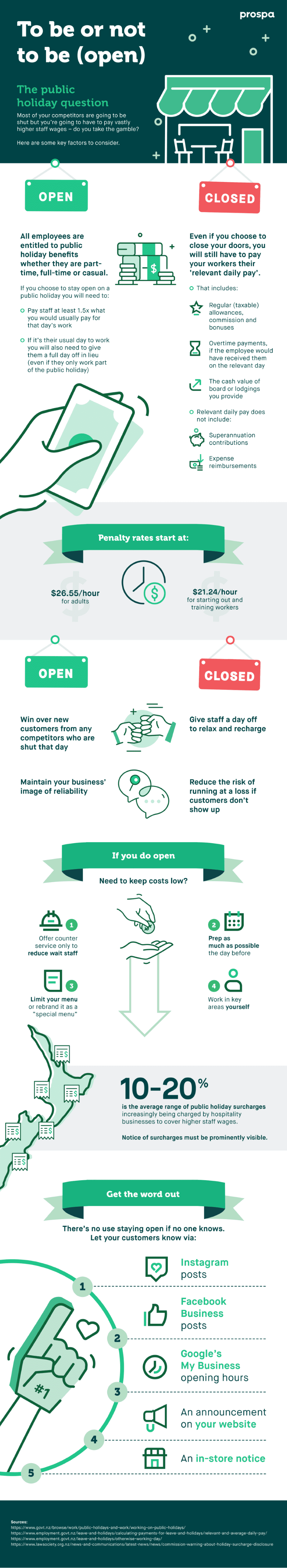

It’s part of the reason more and more businesses are trading on public holidays, but making that call for your small business requires weighing up multiple factors. Opening often means paying higher penalty rates, but foot traffic can be unpredictable.

Every business (and every public holiday) is different, so there is no magic formula for determining whether it’s worth your while to forgo the lure of a day off in favour of opening up, but there are some key considerations that need to be factored into your decision.

If you need a little financial help to tide you over during the quiet holiday period, talk to Prospa about how a small business loan might be able to help support cash flow.