What really sets small businesses apart from large corporates? This guide breaks down the practical differences in structure, speed, and strategy to help you plan your growth.

At a glance

- Competing with large corporates can be challenging for small businesses managing limited resources, tighter margins while keeping pace with new opportunities.

- SMEs can use their size as a strength by staying agile, making quick decisions, and building close customer relationships that big organisations find difficult to match.

- Turning that agility into action, with the right support in place, helps small business owners move quickly when new opportunities arise

For many New Zealand business owners, large corporations seem to have every advantage: scale, specialist teams, and resources that smaller businesses may not have access to.

However, those same advantages can make them slower to react and less flexible when things change. Smaller businesses often hold the edge through focus and adaptability. The potential to move quickly, adjust plans, and make decisions without layers of approval is what helps SMEs stay competitive and able to grow.

With around 99.5 percent of all New Zealand businesses classified as small or medium-sized, you’re part of a large community of likeminded owners planning, growing, and competing against bigger players. This guide explores what sets SMEs apart and how to turn your strengths into long-term advantages for your business.

What are SMEs?

Small and medium-sized enterprises, or SMEs, are a driving force behind New Zealand’s economy. They include everything from local cafés and retailers to innovative tech startups and professional services firms.

These businesses are usually independently managed and stay close to their customers, which helps them respond quickly to new ideas and market changes. At the same time, many balance daily operations with long-term goals like improving cash flow, hiring staff, and investing for growth.

According to the Ministry of Business, Innovation and Employment (MBIE), a small business in New Zealand typically employs fewer than 20 people, while a medium-sized business has up to 99 employees.

What makes a large enterprise?

Large companies in New Zealand employ 100 or more people and often operate across multiple locations or markets. They usually have structured governance systems and separate departments for areas such as finance, marketing, and operations.

This size brings advantages in capital access, brand stability, and market presence. Even so, it can make decision-making slower because every change requires coordination across many teams and systems.

While SMEs depend on adaptability and close customer connections, large enterprises tend to focus on efficiency, consistency, and managing risk.

How SMEs and Large Enterprises Differ in Practice

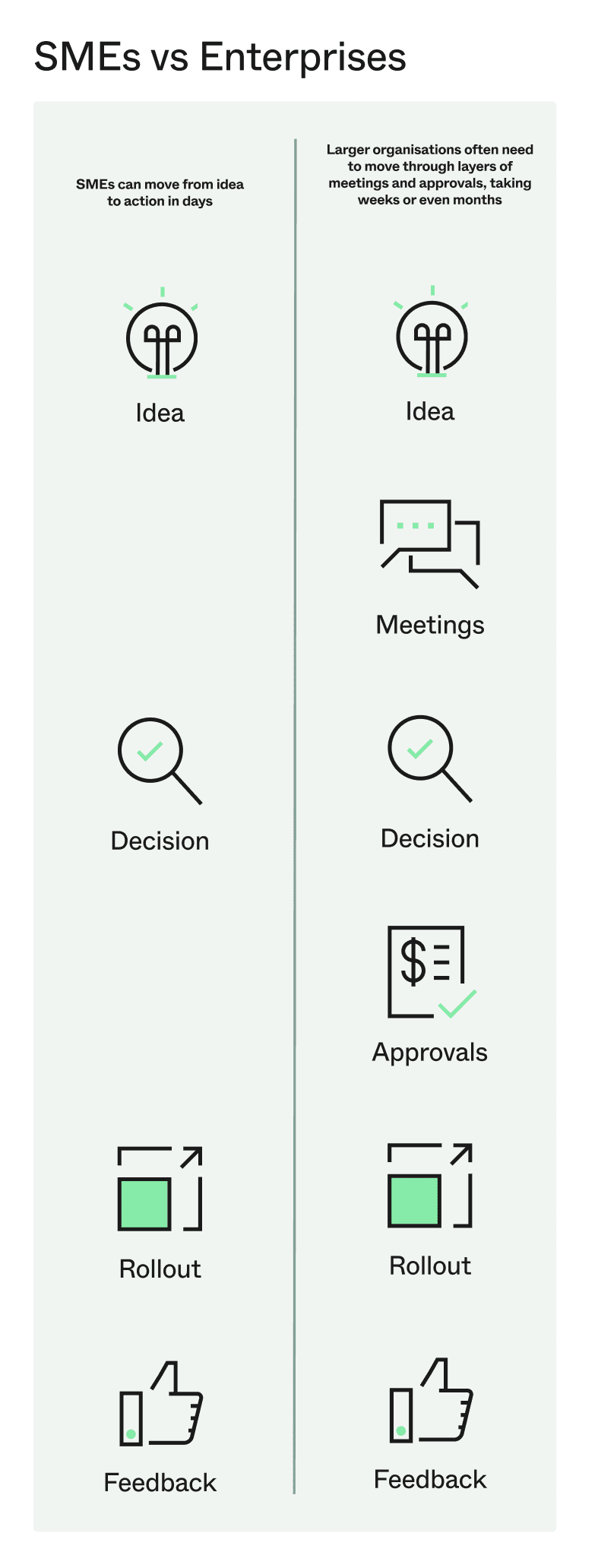

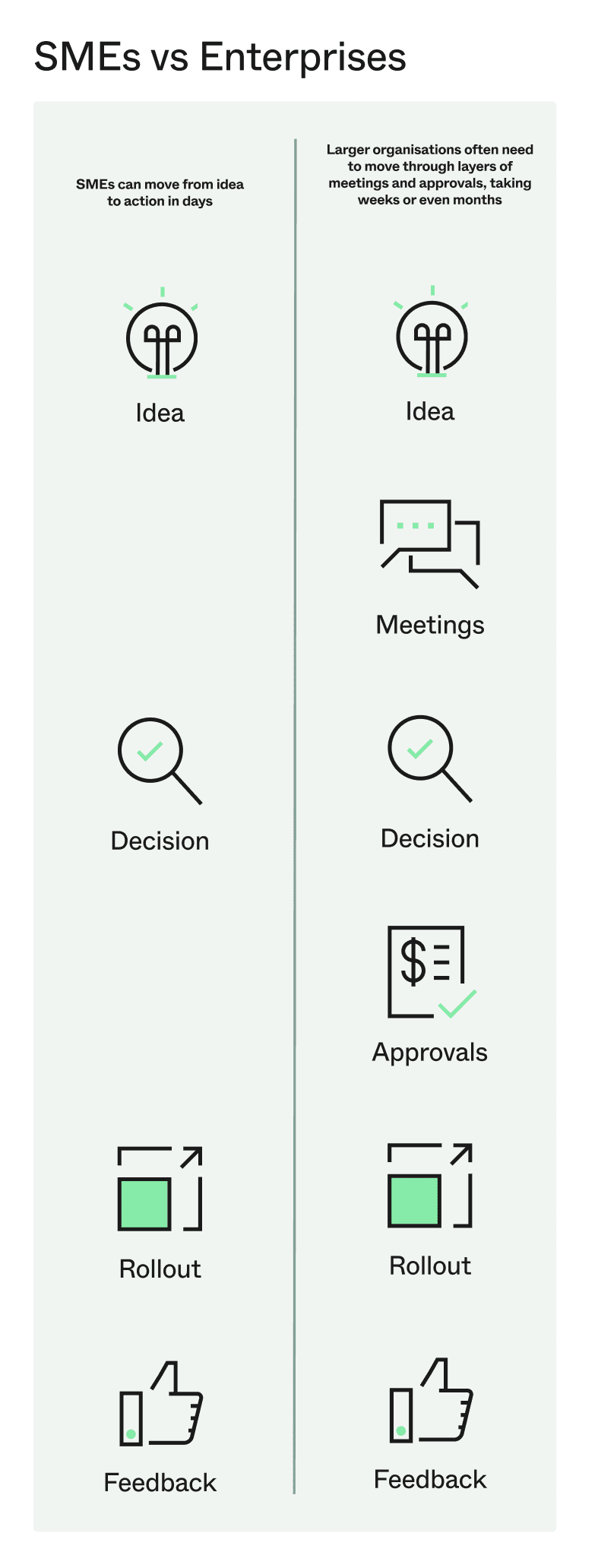

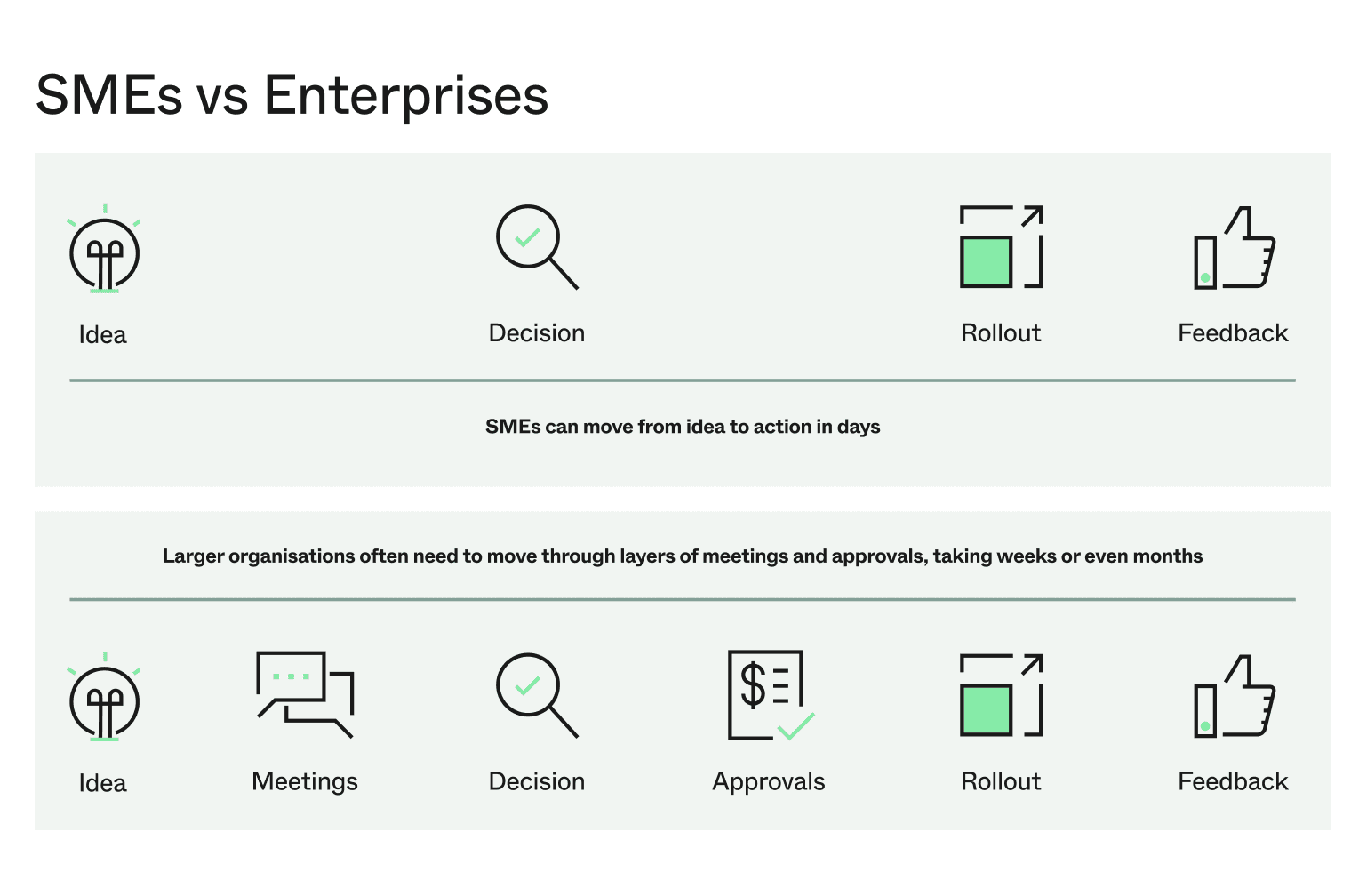

For many small business owners, the gap between SMEs and large enterprises is most visible in how work actually happens. SMEs can often move from an idea to execution within days, while bigger organisations work through layers of meetings, approvals, and reports before anything changes.

Say you own a local café and you see more customers asking for dairy-free options. You can add an almond milk flat white to the menu the very next morning. In a national coffee chain, that same idea would first pass through product testing, supplier agreements, and marketing sign-off before it ever reaches a customer.

Managing people and resources also looks different. Large companies usually divide their budgets across departments and follow long-term plans with clear roles for each specialist. Smaller businesses work on tighter margins, so every dollar counts. Owners often move between roles, from handling invoices and supplier orders to serving customers or training staff. This hands-on involvement keeps them connected to every part of the business.

While these contrasts can seem limiting, they are often where small businesses find their edge. SMEs can identify trends faster, adapt when markets shift, and maintain closer relationships with their customers.

Comparing SMEs and large enterprises

| Feature | SME | Large Enterprise |

|---|---|---|

| Decision-Making | Decisions in days. Owners can act on opportunities immediately. | Approvals in weeks. Decisions move through multiple layers. |

| Innovation | Test ideas quickly. Adapt based on direct customer feedback. | Structured R&D. Innovation follows a formal, planned process. |

| Customer Focus | Direct and personal. Owners build strong customer relationships. | Managed by departments. Customer relationships are handled by dedicated teams. |

| Resources | Hands-on and flexible. Owners wear many hats to manage resources. | Specialist teams and budgets. Resources are allocated according to long-term plans. |

| Growth Capital | Quick, flexible funding. Access capital through business loans to seize opportunities. | Structured, long-term finance. Relies on shareholders, bonds, or corporate credit. |

Focusing on those strengths allows growth on your own terms, without needing to match the scale or structure of larger competitors. Access to timely and flexible finance, such as a small business loan, can help when opportunities arise and fast action is required.

Why these differences matter for your business or research

Understanding how your business compares to larger organisations can make planning and decision-making easier. It highlights where to focus your effort, what to prioritise, and how to grow without losing the agility that gives your business its advantage.

For small business owners, this knowledge leads to smarter, more confident choices about when to hire, how to manage cash flow, and how to compete for customers.

For consultants and researchers, recognising these structural differences helps explain why smaller and larger organisations operate the way they do. It provides context for more accurate business models, market analysis, and growth strategies that reflect real-world conditions.

How SMEs and enterprises fund business growth

Every business needs capital to grow, but how it’s raised often depends on scale. Large enterprises can access major funding channels from corporate bonds to long-term lending arrangements with big banks. Their finance teams can plan years ahead, building strategies around stability and structured growth.

For SMEs, growth tends to happen closer to the action. It might mean hiring extra staff, stocking up for a seasonal rush, or investing in new equipment when demand increases. These decisions often need quick access to working capital rather than complex corporate finance.

Instead of turning to investors or venture capital, SMEs rely on small business loans and lines of credit that fit their cash-flow cycles. The right funding gives you flexibility to manage costs, act on new opportunities, or smooth out seasonal dips without slowing momentum.

When your next opportunity can’t wait, Prospa’s small business loans are built to help you act quickly, stay agile, and keep growing.