Learn what a bank guarantee is, how it works, and the common fees. See how flexible funding can help you keep cash flow moving while a guarantee is in place.

At a glance

- Many contracts, commercial leases, and supplier agreements require a bank guarantee to assure that financial obligations will be met.

- Understanding how bank guarantees work helps you weigh their value in building trust and credibility against the possible impact on your cash flow.

- Flexible funding can help you manage that impact by maintaining liquidity and keeping day-to-day operations running smoothly.

For many New Zealand small businesses, growth relies on winning contracts, securing commercial leases, and setting up supplier terms. Those opportunities often come with a request for a bank guarantee. It is a standard requirement in many agreements, and worth understanding before you sign.

This guide explains what you need to know about bank guarantees: how they work, what they cost, and when they are required. It also looks at ways to manage them effectively, including flexible funding options that can help you secure new opportunities when flexibility matters most.

What is a bank guarantee?

A bank guarantee is a commitment from your bank to pay a third party if your business cannot meet a financial obligation under a contract. It serves as a form of security, giving suppliers, landlords, or project partners confidence that they will still be paid if something goes wrong.

Instead of paying cash up front, the guarantee shows that your bank stands behind your business. This added assurance can help you secure commercial leases, win new contracts, or build supplier relationships that may otherwise be out of reach.

How a bank guarantee works in practice

A bank guarantee outlines what happens if a business cannot meet its financial obligations under a contract. It sets out who is responsible, when the bank steps in, and how payment is managed. The aim is to give both parties clarity about how financial risks will be managed before any work starts or goods are delivered.

Common business uses

Bank guarantees are common across many New Zealand industries. In construction, they protect project owners and main contractors by covering performance or defect risks. Suppliers may ask for one before providing stock on account, while commercial landlords often accept a bank guarantee instead of a cash bond. In these cases, the guarantee gives both parties confidence that contractual obligations will be met and ultimately builds stronger business relationships.

For example, say you own a commercial painting business and secure a $120,000 project with a new property developer. Before work begins, the client requests a $20,000 bank guarantee to cover potential delays or defects. You apply through your bank, which reviews your financial position and may require cash or a term deposit as security. Once approved, the guarantee is issued and provided to the client so the project can move ahead.

Who is involved in a bank guarantee?

A bank guarantee brings together three parties:

- Applicant: The business requesting the guarantee from the bank. The applicant is responsible for meeting the contract terms and repaying the bank if a claim is made.

- Beneficiary (or Favouree): The third party, such as a landlord, supplier, or client, that requires the guarantee as security. The beneficiary can claim payment from the bank if the applicant does not meet their obligations.

- Bank: The financial institution issuing the guarantee on your behalf. The bank agrees to pay the beneficiary if a valid claim is made, then seeks repayment from your business.

Step-by-step process

Once a third party requests a guarantee, the process typically runs from application through to release:

- Requirement: The beneficiary asks for a bank guarantee as part of a contract, lease or supply agreement.

- Application: Your business submits details and supporting information to your bank.

- Assessment: The bank reviews your financial position and risk profile.

- Issuance: Once approved, the bank issues the guarantee and provides it to the beneficiary.

- Term: The guarantee remains in place while you meet your obligations.

- Claim or release: If the contract is completed, the guarantee is released. If your business defaults, the beneficiary can claim from the bank, which then seeks repayment from your business.

This process provides clear protection, but it can take time and may require security that ties up cash. If you need to move quickly, flexible funding can help keep cash flow moving while the guarantee is in place.

How much does a bank guarantee cost?

The cost of a bank guarantee can vary between banks and depends on your business’s financial position, but most include two main fees:

- Establishment Fee: A one-off application or processing charge that the bank applies to review your details and set up the guarantee.

- Ongoing Facility Fee: A recurring fee, usually charged quarterly or annually. It’s generally calculated as a percentage of the total guarantee amount and continues for as long as the guarantee is active

In addition to these fees, it’s worth considering the opportunity cost of the security itself. If your bank requires a cash deposit to secure the guarantee, that’s money your business can’t use for day-to-day operations or future growth.

That can create short-term cash pressure for essentials like payroll or stock. Flexible funding options, such as a business line of credit, can help you access working capital when you need it. This keeps operations running smoothly while your cash is tied up as security with the bank.

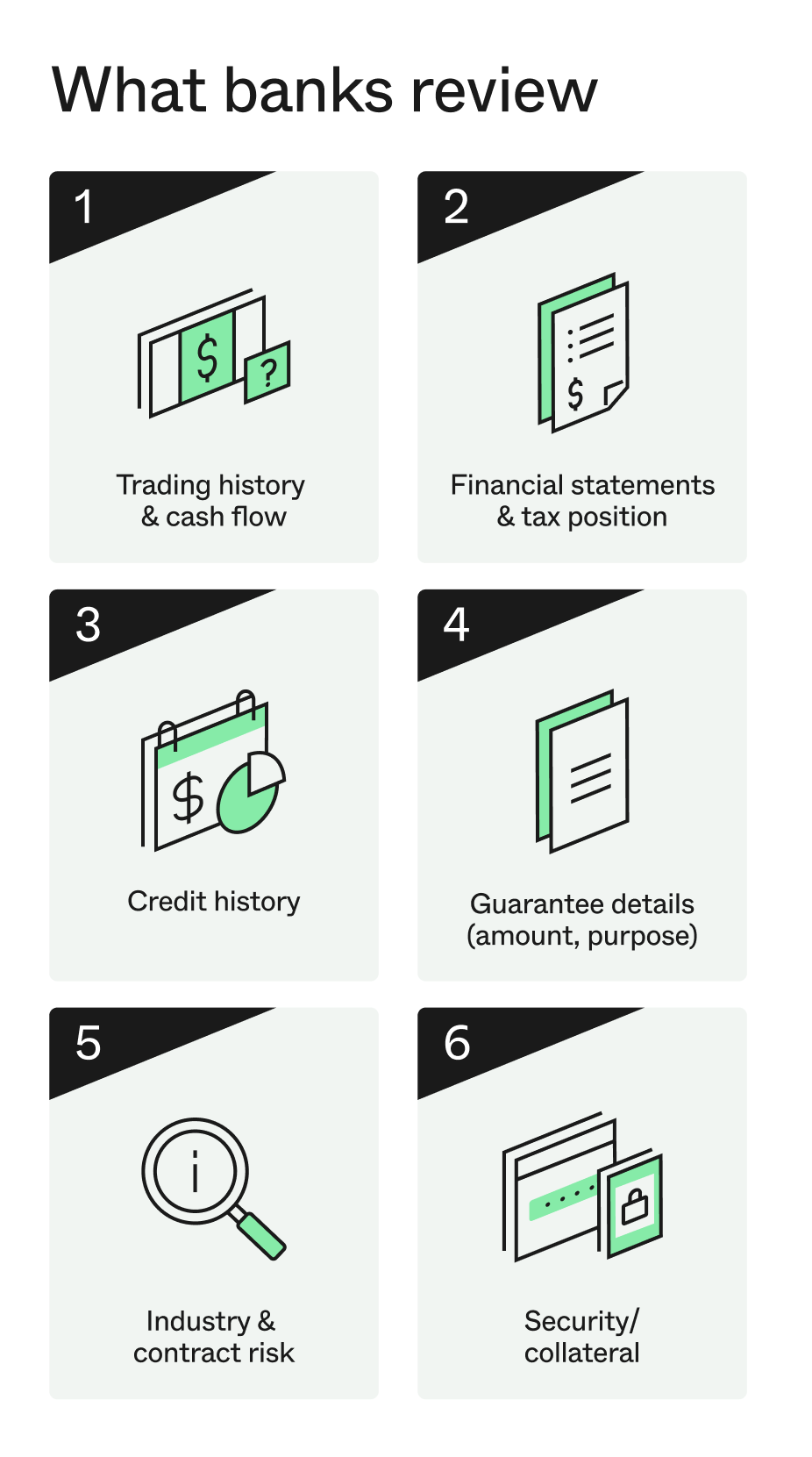

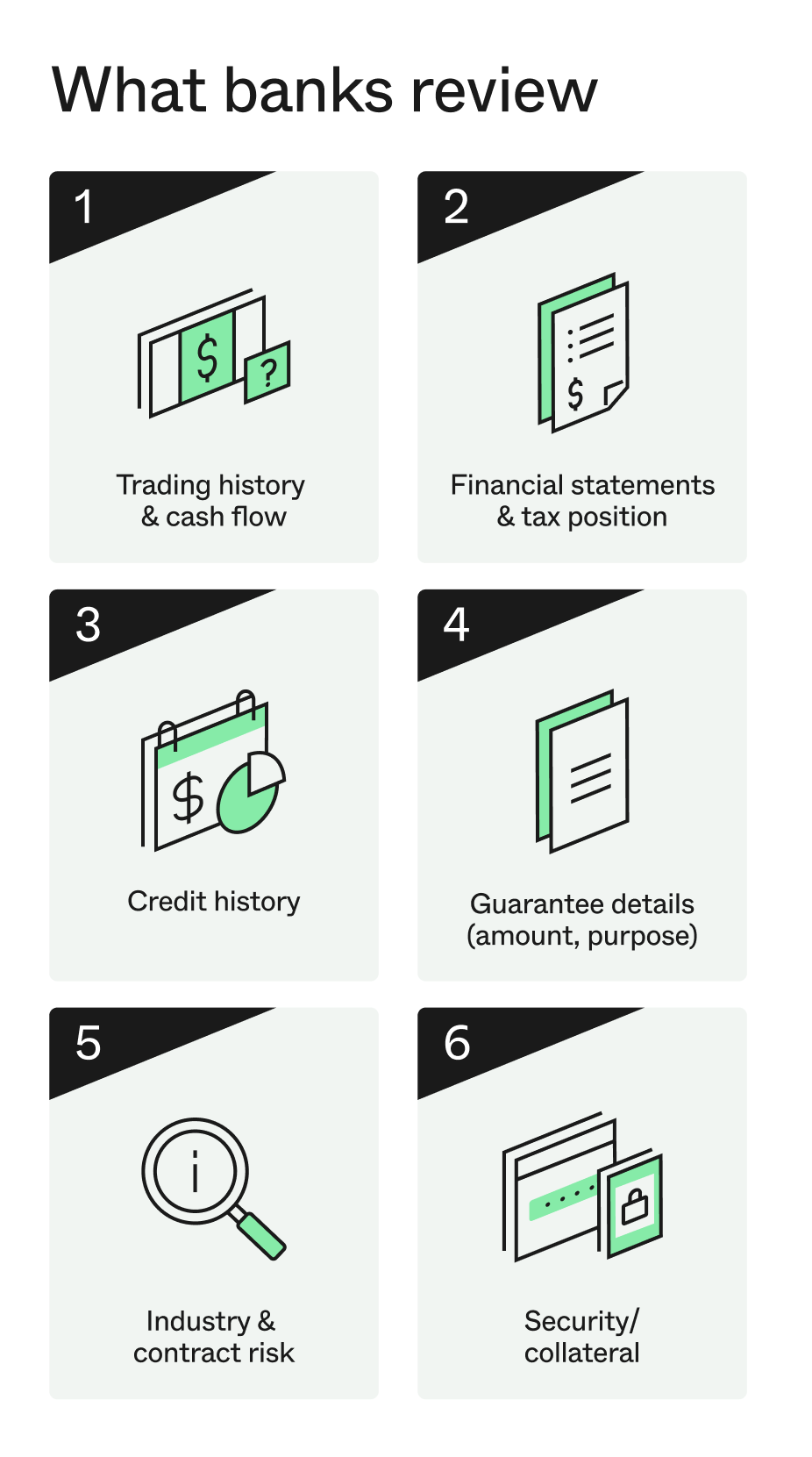

What banks review before approving a guarantee

Before approving a bank guarantee, banks take a close look at your business’s financial strength and reliability. They typically review:

- Trading history and stability of cash flow

- Financial statements and overall tax position

- Credit history for both the business and its directors

- The amount, purpose, and duration of the guarantee

- Industry and contract risk

- Security arrangements, such as a cash or term deposit held by the bank

In some cases, the bank may request extra security, like a term deposit or other assets held with them.

For finance or operations managers, understanding this review process helps you prepare the right documentation and compare requirements between banks. For business decision-makers, it also highlights how bank guarantee fees and security terms can vary across providers.

Benefits of a bank guarantee

A bank guarantee can play a key role in helping small businesses build trust and take on bigger opportunities. It shows suppliers, clients, or landlords that your business can meet its commitments, even if something unexpected happens.

Some of the main benefits include:

- Security without upfront payment: A bank guarantee provides financial assurance to the other party without requiring an immediate cash outlay.

- Access to new opportunities: Many larger contracts and supplier agreements require a guarantee before work begins or goods are supplied.

- Reduced financial risk: The guarantee sets clear terms around responsibility if obligations are not met, helping to protect relationships and reduce potential losses.

- Increased credibility: Having a bank guarantee demonstrates financial stability and professionalism to potential partners or clients.

Returning to your painting business, holding a guarantee gives the property developer the confidence to award the contract, reducing perceived risk and building a stronger working relationship. That trust can lead to larger or repeat projects over time.

While bank guarantees provide clear advantages, they often require cash or assets to be held as security. If that ties up too much working capital, flexible business loans can provide the liquidity you need to meet the security requirements and keep your business moving.

Who can apply for a bank guarantee?

Bank guarantees are typically available to established businesses with a solid trading history and steady cash flow. They are commonly used by SMEs, contractors, and companies that regularly enter into supplier agreements or lease commercial property. Newer or rapidly growing businesses that don’t yet have a long financial track record or the collateral to support a guarantee may find it more difficult to qualify.

Be ready when opportunity arises

Understanding how bank guarantees work helps you take control when securing contracts or managing suppliers. While your cash may be held as security for a guarantee, a Small Business Loan or Business Line of Credit can give you the flexibility to keep operations running smoothly. You can apply online and be ready to act when the next opportunity appears.