Fast Business LoansFast, easy, flexible

As New Zealand’s top online lender for small businesses, we provide quick business loans with same-day approvals.

- Borrow from $5K to $500K

- Apply online in under 10 minutes

- Funding possible in 24 hours

Your cash flow, your choice

Our calculator will help you estimate how much you’ll pay per week

See full T&CsPlease select a product

Business loans on the same day

Quick business loans offer fast access to funding when your business needs it most. Whether you’re managing short-term cash flow, covering unexpected expenses, or seizing a growth opportunity, our fast business funding solutions can help. With a simple application process and same-day approval, you can keep your operations running smoothly. Plus, there’s no upfront security required for loans up to $150K.

A range of funding solutions

Small Business Loan

For fast funds

- From $5K up to $150K

- Easy application and funds available same-day

- Up to 3 year terms

- No upfront security required

Business Loan Plus

For big plans

- From $150K to $500K

- Same day approvals on funding up to $250K

- Up to 5 year terms for lower weekly repayments

- Security may be required for over $150K in Prospa funding

Business Line of Credit

Ongoing access to funds to simplify cash flow.

- From $2K up to $500K

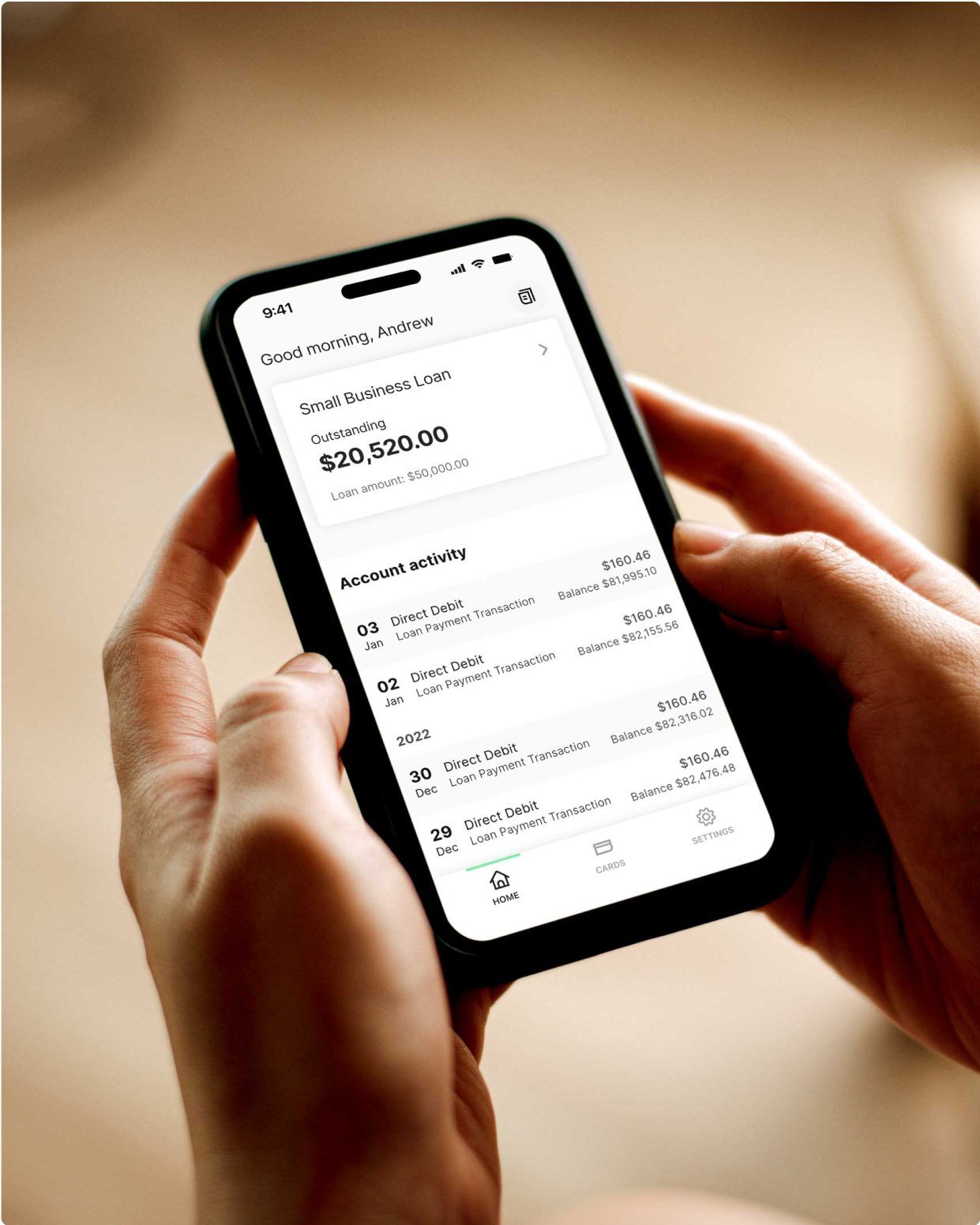

- Access funds anytime via the Prospa App

- Only pay interest on what you use

- Security may be required for over $150K in Prospa funding

When to consider applying for quick business loans

Some situations that may warrant accessing a same-day loan include:

- Equipment breakdown: Sudden failure of essential machinery or equipment that disrupts operations and requires immediate repair or replacement.

- Unexpected expenses: Pay for emergency expenses such as repairs, upgrades, and legal fees.

- Cash flow gaps: Cover dips in cash flow or temporary cash shortfalls that may threaten your ability to cover expenses.

- Inventory shortages: Sudden loss of inventory that impacts your ability to continue sales and meet customer demand.

- Growth opportunities: Take advantage of an unexpected business opportunity.

- Cover payroll, taxes, utilities, and supplier bills: Ensure timely payment of essential obligations to avoid disruptions and maintain business operations.

The advantages of securing an emergency loan quickly include:

- Same-day access to funds: Get the money you need in hours instead of weeks.

- Peace of mind: The ability to cover unexpected expenses promptly, allowing you to get on with running your business.

- Faster application process: Apply in under 10 minutes and receive same-day approval.

- Avoid business disruption: Prevent delays and interruptions that may impact revenue and customer satisfaction.

How to apply

01

Apply in minutes

02

Get a fast decision

03

Access your funds

Choice

Borrow up to $500K with 10 minute application, fast decision and funding possible in 24 hours

Support

Confidence

have borrowed from Prospa.

You could benefit too.

Quick business finance designed for NZ small businesses

In the business world, challenges can arise unexpectedly, often requiring immediate financial attention. Prospa is here to address these urgent needs with our streamlined, fast business solutions. Our same-day business loans allow you to access up to $500K quickly, with minimal hassle. With our easy online application process, you can apply for a loan in under 10 minutes, get a same-day decision, and access your funds straight away. Whether you’re dealing with unexpected expenses, cash flow gaps, or wanting to take advantage of a growth opportunity, Prospa is the choice for fast, reliable financial support.

Customers making it happen with a Prospa loan

Read customer storiesFAQs

Frequently asked questions

Prospa takes the hassle out of small business loans with a fast and easy application process. To qualify for a Prospa small business loan you need a turnover of $6K or more per month. Minimum trading history applies.

Our fast business loan online application form takes around 10 minutes to complete. You’ll need to have on hand your driver licence, NZBN, some basic details about your business (like how long you’ve been in business, your business structure and turnover) and details of your trading business bank account. If you are applying for over $150K we’ll also need to see a few other financial statements like your profit & loss and cash flow.

It varies from borrower to borrower. Prospa fast business loans range from $5K to $500K. Plus, with Prospa’s hassle-free business-friendly loan process, minimal documentation is required to apply for small business loan amounts of up to $150K. Get your business finance online application done in as little as 10 minutes.

Many lenders require an asset to be used as security upfront when you take out a small business loan. This could be the asset you purchase or another asset, such as property you already own. If you aren’t purchasing an asset, your loan is for working capital, you just need a quick cash injection, or would just prefer to avoid the whole ‘security’ question, talk to Prospa about our fast business loan. There’s no security required to access up to $150K.

Other questions?