Understanding Unsecured Business Loans in New Zealand

What is an unsecured business loan?

Simply put, in New Zealand an unsecured business loan is a form of financing that doesn’t require borrowers to pledge collateral such as real estate, equipment or inventory. Instead, this type of loan is provided based on the borrower’s creditworthiness and ability to repay. An unsecured small business loan is a flexible and accessible option for NZ small businesses.

How do unsecured business loans work?

Unsecured business loans provide New Zealand business owners with the funds they need without requiring them to risk their assets. Unlike secured loans (which are backed by tangible assets), unsecured loans are granted based on the borrower’s creditworthiness, business performance, financial health and ability to repay. This makes them an attractive option for small businesses that either may not have significant assets to pledge as collateral or feel uncomfortable putting their personal and business assets at risk.

When applying for an unsecured business loan, lenders assess factors such as credit score, revenue history, profitability and cash flow. The loan amount and interest rates are determined based on these evaluations. Once approved, the funds can be used for various business purposes, such as inventory purchase, equipment upgrades, marketing campaigns or working capital.

Repayment terms for unsecured business loans in New Zealand typically involve regular instalments over a predetermined period, often ranging from months to several years. When applying for an unsecured business loan or similar, it’s essential for small business owners to review the loan terms and ensure that the repayment schedule aligns with their business’s cash flow capabilities.

Unsecured loans vs ‘No asset security’ loans

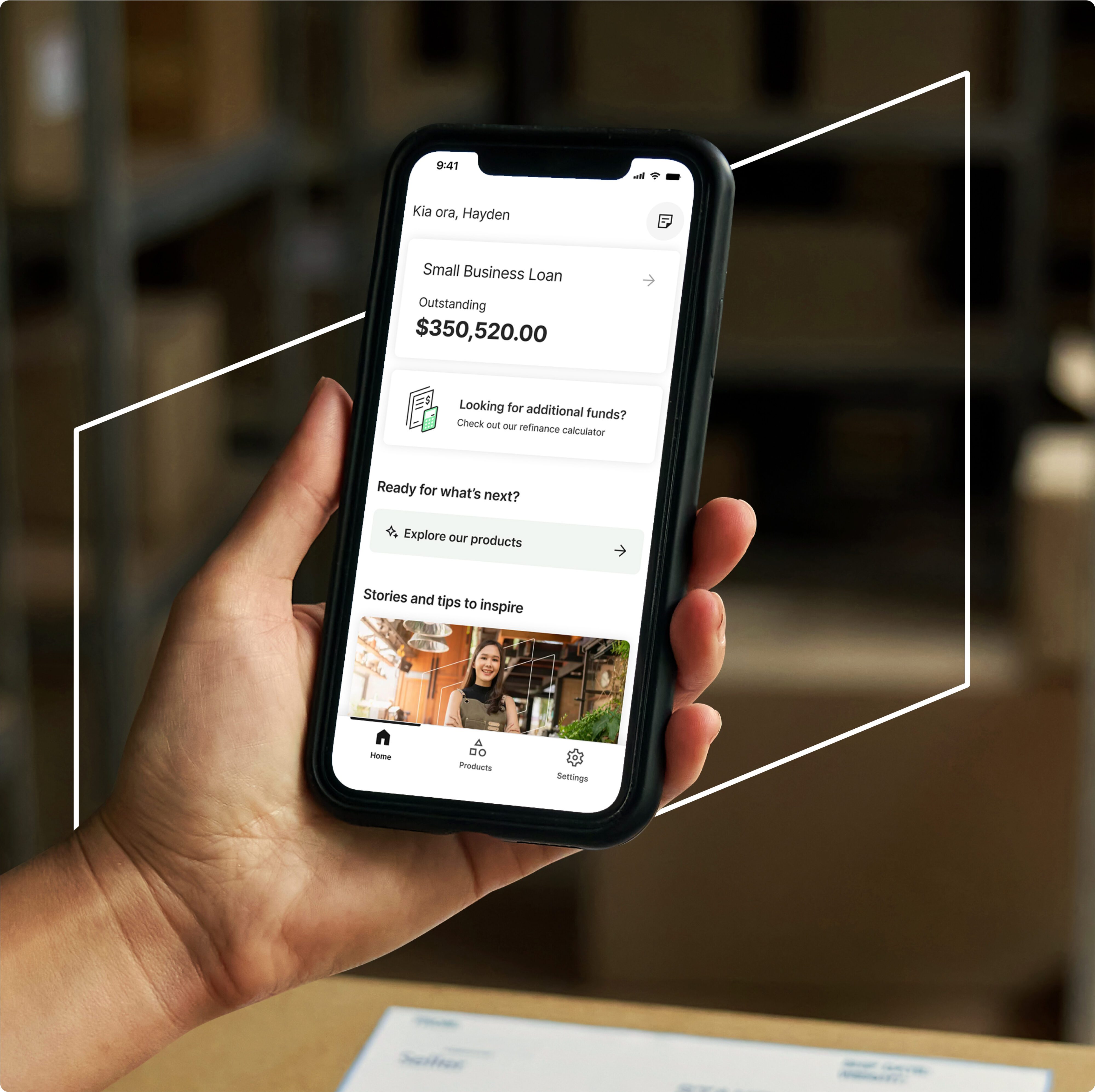

We’ve discussed traditional ‘unsecured loans’ for businesses. However, at Prospa we use the term ‘no asset security’ when it comes to our loans for NZ small businesses. When a small business owner borrows up to $150K from Prospa, there is no asset security required to access the funds.

The term ‘no asset security’ means no collateral or tangible assets are needed upfront to back the small business loan. Instead, when Prospa provides financial support to a small business, we get a personal guarantee from directors, shareholders or individuals actively involved in the business’s management, such as the business owner.

When does Prospa require security for business loans?

There are two situations in which we might request security in the form of a ‘charge over assets’. Firstly, if the small business client’s total exposure to Prospa funding reaches or exceeds $150K, at that point we may register the security interest on the Personal Property Securities Register (PPSR) [LINK to new PPSR article]. Secondly, if a client fails to fulfill their contractual obligations we may do the same.

In summary, for customers borrowing less than $150K from Prospa, there is no need for asset security. And as long as they meet their contractual commitments, including timely repayments, and their total Prospa funding exposure remains below $150K, security should never come into play.

FAQs

FAQs about Unsecured business loans in NZ

The amount of unsecured business finance you can obtain as a New Zealand business owner, depends on several factors, including your business’s financial health, creditworthiness, and the lender’s policies. Prospa, for example, offers business loans of up to $150K (with no upfront asset security required) to eligible New Zealand businesses.

The specific loan amount you qualify for may also be influenced by your cash flow. Typically, you can expect to receive a loan amount that aligns with your business’s needs and financial capabilities. This approach simplifies the borrowing process and can reduce the risk for small business owners.

Interest rates on unsecured business lending in New Zealand vary significantly. With unsecured loans, as there is no collateral to mitigate the lender’s risk, interest rates can typically be higher than with secured loans.

When you borrow from Prospa, interest rates are based on several factors, including the type of loan, the loan amount, and the repayment term, the borrower’s creditworthiness and current market conditions.

In addition, while some lenders may offer variable rates that fluctuate with market conditions, Prospa offers fixed interest rates, ensuring consistent monthly payments, making it easier for New Zealand small business owners to factor repayments into their budget.

Unsecured business loans are like other loans when it comes to fees. It depends on the lender as to which fees are charged, and how much they are. Common fee types include:

Origination Fees: An upfront fee to process the loan application.

Late Payment Fees: If a scheduled payment is missed, the borrower may incur late payment fees.

Service Fees: Lenders may charge ongoing service fees to manage the loan account.

Prospa’s commitment to transparency means that we provide clear information about any fees associated with our business loans for New Zealand small business owners.