Turn holiday chaos into your most profitable season with this step-by-step guide for retail and hospo covering everything from stock and staff to cash flow.

At a glance

- Holiday trading requires extra stock, additional staff, and higher upfront costs, often weeks before revenue comes in.

- The best preparation is a clear forecast of sales and expenses, supported by smart inventory planning and early hiring of seasonal staff.

- Having flexible finance in place lets you commit to key decisions and make the most of the busiest time of year.

October marks the start of the holiday rush in retail and hospitality. For Kiwi business owners, it’s a double-edged sword with a chance to capture the year’s strongest sales, while also creating the toughest operational and financial challenges.

The opportunity is enormous: in 2024, New Zealanders spent $818 million in the first week of December alone. However, so are the pressures. Extra stock needs to be ordered weeks in advance, seasonal staff must be hired and trained, and cash flow must stretch to cover it all before the first festive dollar comes in.

Fortunately, with a clear plan to stock up, staff up, and protect your cash flow, you can make the most of the lucrative holiday season.

Step 1: Forecast your holiday cash flow

The first step is to get clear on your numbers by reviewing last year’s holiday period. Look at sales data alongside higher expenses like extra stock orders, additional wages, and increased marketing activity.

Use this data to project your cash flow for the upcoming November-December period. A realistic forecast will show you exactly when cash is due to come in and go out, highlighting any potential shortfalls and how large they might be. This clarity not only helps you decide when to commit to supplier orders or bring on new staff, but it also empowers you to take proactive steps to fill any funding gap.

You can use Prospa’s free cash flow forecasting template to map out your plan.

Step 2: Plan your holiday inventory and funding

With your forecast in hand, you can focus on inventory. Running out of popular items during the December rush is a major missed opportunity that can lead to disappointed customers, while over-ordering can leave you with dead stock in the new year. Start by auditing what you have on hand and reviewing last year’s sales data to identify your bestsellers. These are the products or menu items worth stocking up on.

A point-of-sale (POS) or retail inventory system makes this process much easier, helping you track sales in real time to stay ahead of demand and prevent overselling online. However, the biggest challenge is often timing. Suppliers usually require payment weeks in advance, putting significant pressure on your cash flow long before that holiday revenue arrives. This is where having access to flexible funding becomes invaluable. It means you can cover supplier invoices when they’re due and order the stock you’re confident will sell, without holding back.

Susy Egneus founded Bodyworkz in 2010 to improve employee wellbeing through on-site chair massage. “When demand started picking up, hiring extra staff was essential, but the upfront costs were a challenge,” she shares.

After finding traditional lenders weren’t able to help, she turned to Prospa. “I was surprised how easy and quick it was,” she says. “The finance that Prospa provided helped us take on more staff so we could manage the growth.”

Step 3: Build your seasonal hiring plan

The holiday rush puts just as much pressure on your people as it does on your shelves. With the season already underway, it’s important to start the hiring process now to secure the best talent before peak demand hits.

Write a clear and compelling job ad

Start by writing clear job ads that highlight the busiest weeks and the shifts you need covered. Be upfront about weekend and evening availability to avoid last-minute shortages, and keep interviews focused so you can move quickly from shortlisting to offers.

Writing better job ads with AI

AI can be a huge time saver when drafting seasonal job ads quickly, as long as you give it the right input. Follow these simple steps to get the best results:

- Start with a description of the role in your own words. Include all responsibilities and tasks you want them to handle

- List the character traits and skills that matter most, such as reliability, composed, or adaptable. Often these are more important than the actual experience

- Highlight what tangible benefits you can offer beyond pay, like flexible shifts, staff discounts, or on-the-job training that builds useful customer service experience.

- Use an AI writing tool to pull this together into a polished draft

- Review it carefully to ensure it reflects your voice and gives a realistic picture of the role.

- Share the final ad on jobseeker platforms and your own social channels to reach the widest pool.

Understand your obligations

Before bringing people on, it’s essential to understand their entitlements. The Employment New Zealand website offers a clear overview of different employee types and your obligations as an employer.

Plan rosters and payroll

Once staff are on board, plan rosters well in advance and communicate them early to help your team prepare and to spot any gaps. Remember that your payroll costs will rise from the very first shift. Having flexible finance in place ensures you can meet the increased wage bill without putting a strain on your business.

Step 4: Secure your festive season funding buffer

Even with thorough planning, preparing for holiday trading still means committing money before revenue starts flowing. A short-term business finance facility can provide the breathing room to make stock and staffing decisions with peace of mind.

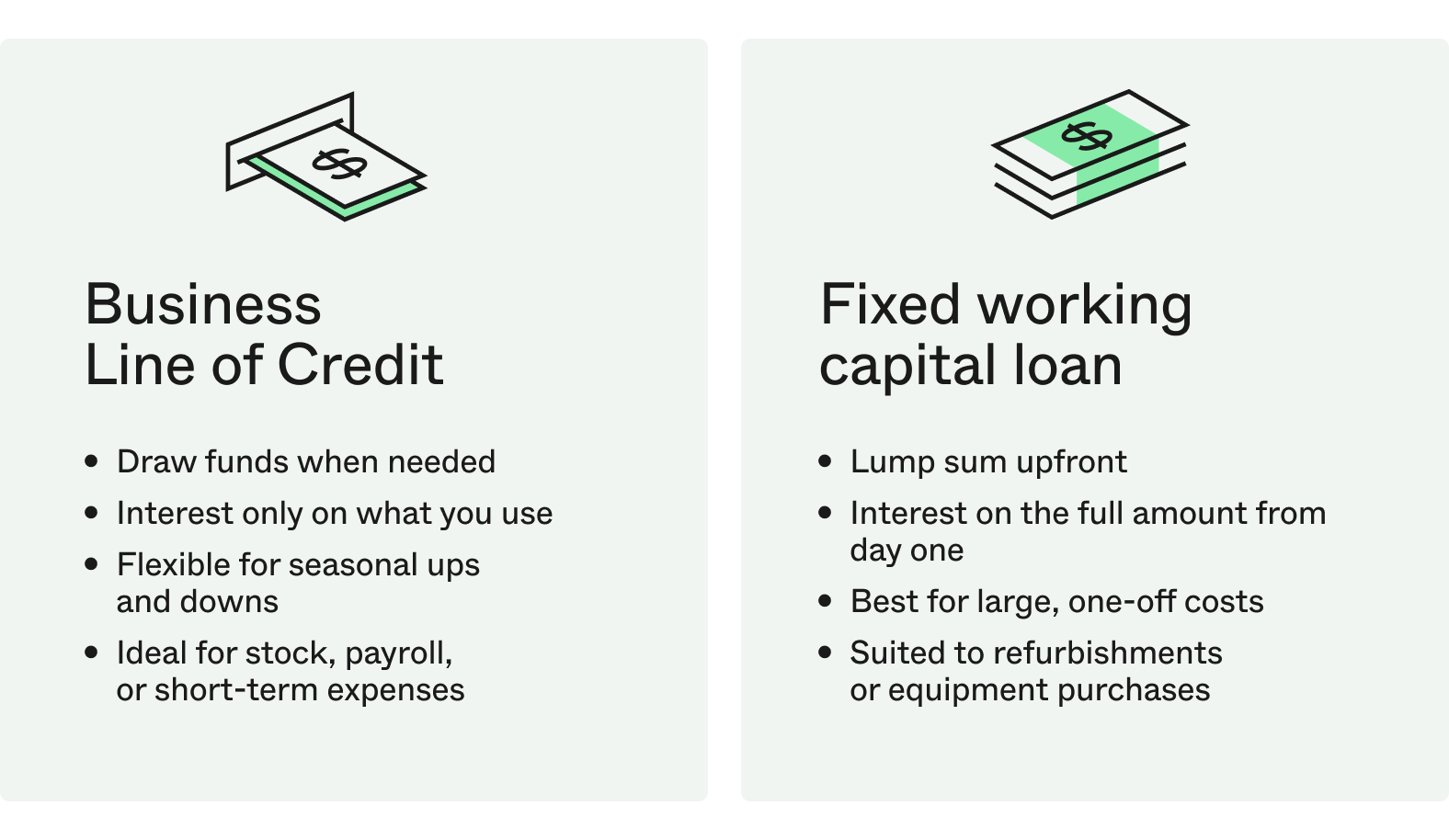

A business line of credit is one of the most flexible options, giving you access to a pool of funds specifically for seasonal expenses. Key benefits for managing the holiday period include:

- Drawing funds only when needed for stock, payroll, or other costs.

- Paying interest only on what you use, making it highly cost-effective.

- Having the flexibility to manage the financial ups and downs of seasonal trade.

While a fixed working capital loan can also help, it’s usually better for a single large expense, like a refurbishment. You pay interest on the full amount from day one, making it less efficient for managing fluctuating holiday costs.

You can learn more about how a business line of credit works and see if it is the right fit for your festive season plans.

Step 5: Boost your sales with these holiday marketing ideas

Once your stock, staff, and funding are sorted, the final step is making the most of the increased traffic and customer interest. A few simple, low-cost marketing tactics can go a long way toward turning browsers into buyers.

Plan your promotional calendar

Think about running your campaign in two waves. Start now with gift guides or bonus offers to capture organised shoppers, then shift to urgency messaging in December to appeal to last-minute buyers.

Make gifting easy

Make the purchasing decision as simple as possible. Highlight bestsellers, offer online filters like “Gifts under $50,” and provide simple touches like gift-wrapping or digital vouchers to save time for busy customers.

Expand your reach

Use social media to create buzz by running a short contest or giveaway that encourages shares and brings new customers to your door. Consider partnering with a complementary local business to create a limited holiday bundle or cross-promotion that benefits you both.

Reward your loyal customers

Don’t forget your regulars. A personalised email campaign with an exclusive holiday offer or early access to promotions can drive repeat visits when people are actively looking to spend.

Step up this holiday season

Preparing for the holiday rush does not have to be overwhelming if you focus on these five steps:

- Build a clear forecast of sales and expenses.

- Make smart decisions about stock.

- Hire and roster the right seasonal staff.

- Create a funding buffer to cover the gap.

- Finish strong with some clever marketing ideas.

Get these right and your business can turn the silly season into a time of success rather than stress.

See how Prospa can keep you in control of your cash flow with a business line of credit.