Small Business Financing

With the right funds, your business can achieve stability and capture new opportunities faster. Explore how Prospa can help you reach your business goals with confidence.

- Fast funding with approvals possible within 24 hours

- Access up to $500K in funding to fuel growth

- Start with no upfront asset security requirements needed

Why Prospa is the Big Difference in Small Business Finance

Prospa is dedicated to empowering New Zealand small businesses by offering fast, flexible, and accessible financing tailored to your needs. With an in-depth understanding of the local market, Prospa knows that New Zealand small businesses face unique challenges and opportunities. With Prospa, you get more than just funding; you gain a financial partner committed to helping you succeed. Our solutions are crafted with local business owners in mind, ensuring your business has the support it needs to grow in today’s competitive landscape.

Join the Prospa family and experience a new level of financial support!

At Prospa you get:

1. Tailored Solutions for Every Industry

No two businesses are alike, and that’s why we offer financing solutions that cater to a wide range of industries. Whether you’re in trades, retail, or services, our financing options can be customised to meet your specific business needs.

Here are some examples of customisation:

- Trades: Flexible repayment schedules aligned with project cash flow, ensuring you only pay when earning. For instance, if you’re a builder, you can set your repayments to coincide with project milestones or client payments, making it easier to manage your finances without stress.

- Retail: Seasonal funding options to support stock purchases during peak seasons without compromising cash flow. For example, a seasonal retailer can access extra funds before the holiday rush to stock up on inventory, with repayment terms adjusted based on expected sales revenue during busy months.

- Hospitality: Short-term loans to cover unexpected repairs or renovations during off-peak times, allowing you to maintain a high standard of service without significant downtime. This could include financing kitchen equipment upgrades or refurbishing dining areas to enhance customer experience.

Let us create a tailored solution for your business!

2. Fast and Flexible Approval Process

Running a business leaves little time for lengthy paperwork and slow approvals. Prospa’s streamlined application process means you can apply online within minutes and receive funding within 24 hours. Our process is designed to be fast, flexible, and accessible, enabling you to focus on what matters most—growing your business.

- Quick online application: Complete your application in just minutes from anywhere.

- Same-day funding available: Get the financial support you need without the wait.

Experience our quick approval process!

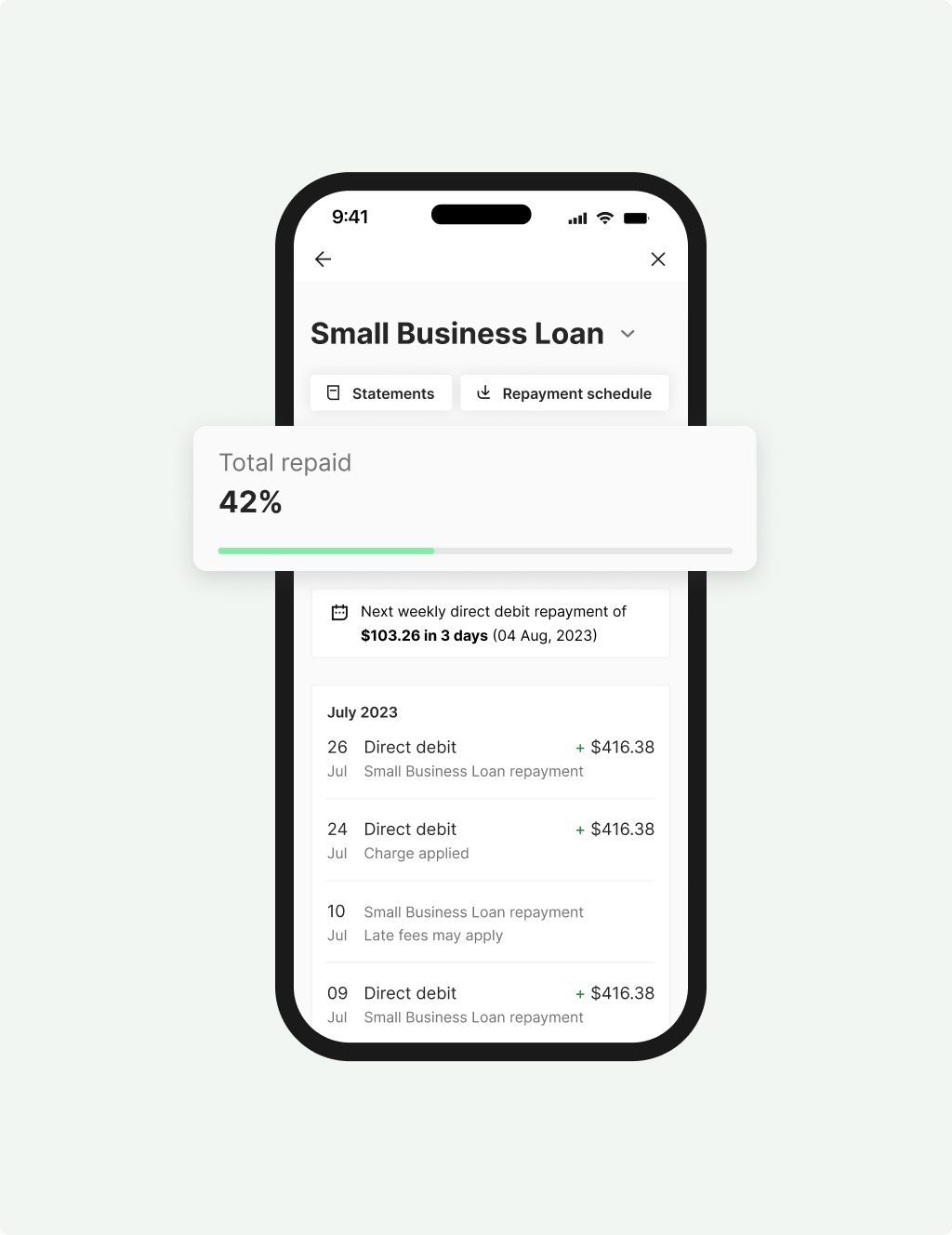

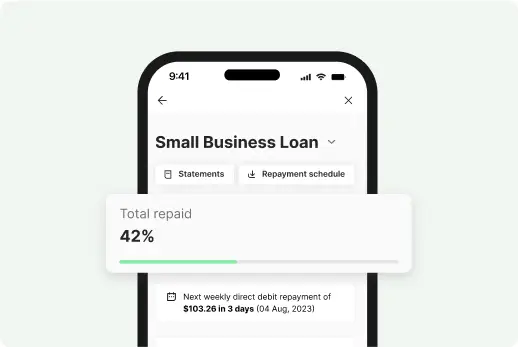

3. Early Repayment Options

Prospa believes that financing should be as flexible as your business. You can make extra repayments to help save on interest and pay down your loan faster.

Take control of your financing today!

4. Cash Flow-Friendly Repayment Terms

With Prospa, your repayment schedule is built to align with your cash flow needs. Choose between daily or weekly repayments to make managing your budget easier without impacting your working capital. Our cash flow-friendly terms help you stay on top of your finances while keeping your business on a growth trajectory.

- Customisable repayment options: Pick a plan that fits your cash flow cycles.

- Manageable payment frequency: Options to keep your financial obligations aligned with income.

See how our repayment terms can work for you! Estimate your loan repayments quickly with our Business loan calculator

5. Unsecured Funding Options

Prospa offers unsecured funding up to $150K, allowing you to access capital without tying up valuable assets. This flexibility is especially helpful for small businesses looking to grow quickly without risking their property or personal assets. Prospa’s unsecured funding option gives you the freedom to invest in your business’s future with confidence.

- No collateral required: Secure funding based on your business’s financial health, not your assets.

- Quick access to cash: Get funds fast without the hassle of securing them against your property.

Unlock unsecured funding for your business today and Learn more

How Prospa Provides Financing Solutions

Prospa offers a range of financing options to help your business access the funds it needs to grow. Each option is designed to meet different needs, from managing day-to-day expenses to expanding operations.

Small Business

Loan

Quick access to $5K – $150K to cover unexpected expenses or a one-off purchase.

- Fixed term up to 3 years with fixed rates

- Fast decision & funding possible in 24 hours

- No asset security required upfront to access Prospa funding up to $150K

- Minimum $6K monthly turnover and 6 months trading to apply

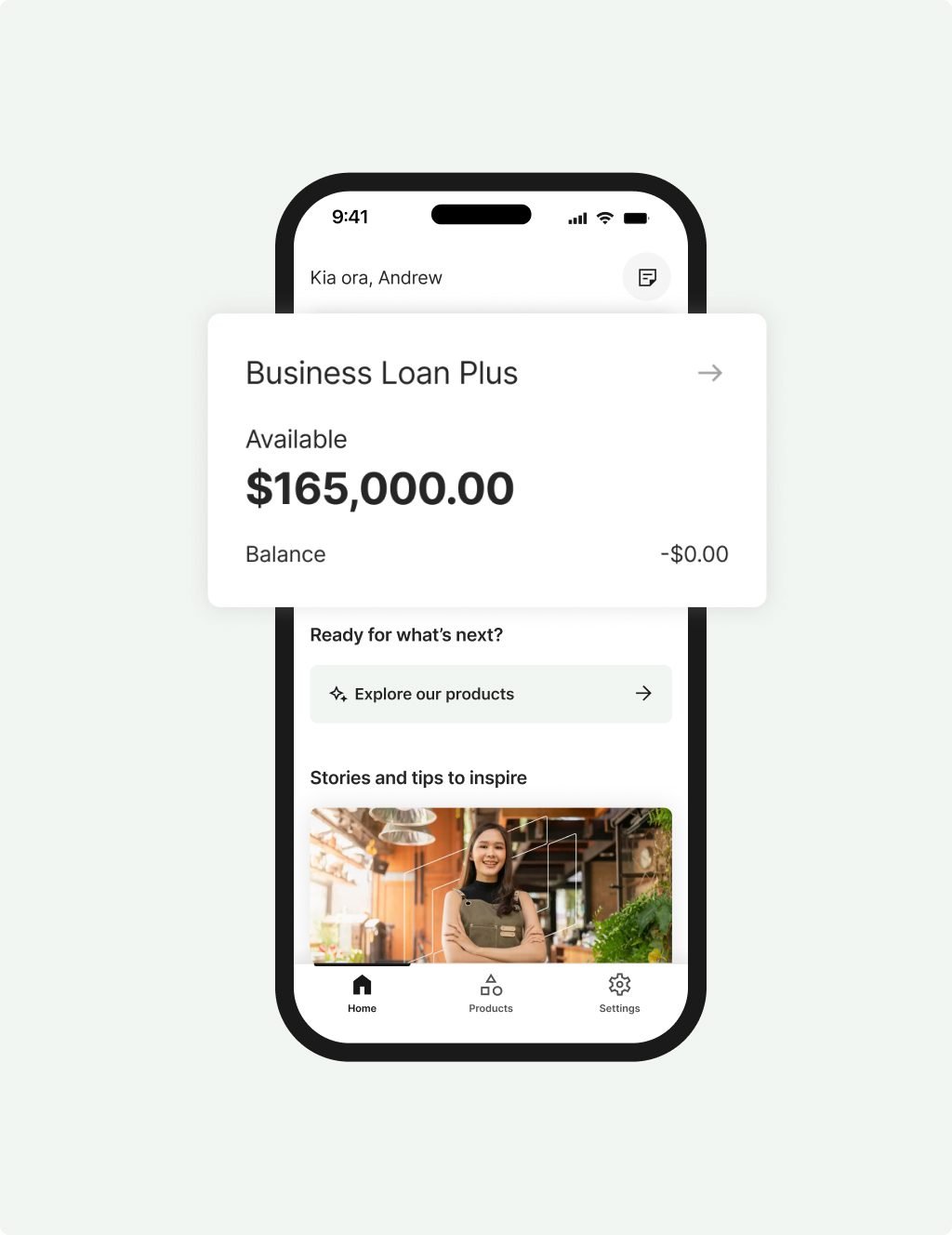

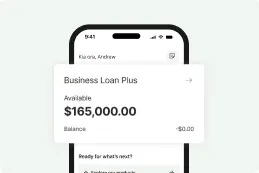

Business Loan

Plus

Larger loans above $150K and up to $500K to invest in your next business growth opportunity.

- Fixed term up to 5 years with fixed rates

- No credit checks to see if you are eligible

- Security may be required when accessing over $150K in Prospa funding

- Minimum $1M annual turnover and 3 years trading to apply

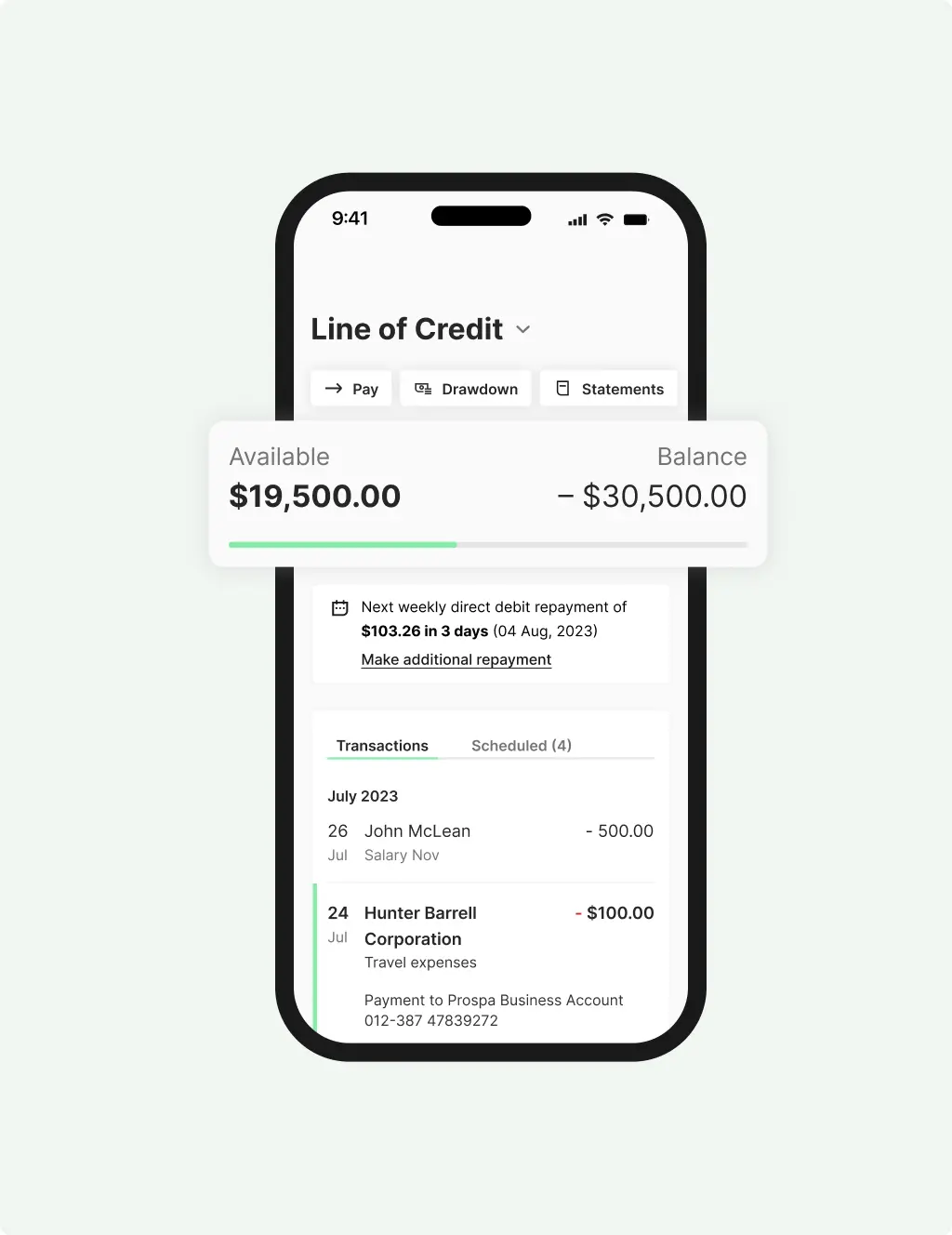

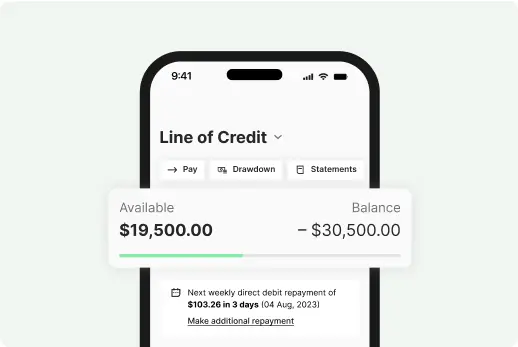

Line of Credit

Ongoing access to up to $500K to keep your business moving.

- Renewable 24 month term

- Fast decision and funding possible in 24 hours

- Only pay interest on what you use

- Access funds 24/7 with the Mobile App

- Minimum $6K monthly turnover and 6 months trading to apply

Borrow from $5K up to $150K

Funding possible within hours

Easy application

Apply in 10 minutes with minimal paperwork

No upfront security

No need to put your house or other assets down as security to access up to $150K in Prospa funding

Flexible terms

Make unlimited extra repayments to save on interest and pay off your loan faster

The Small Business Funding Experts

At Prospa, we are proud to be recognised as leading experts in small business funding in New Zealand. Our commitment to supporting entrepreneurs has earned us several prestigious accolades, including the Deloitte Fast 50 awards for our rapid growth and innovation.

We are dedicated to simplifying the financing process for small businesses, ensuring that our tailored solutions meet the unique needs of the New Zealand market. With our expertise and focus on customer success, Prospa is the trusted partner you can rely on to unlock your business's potential.

Ready to take your business to the next level? Contact us today to explore your financing options.

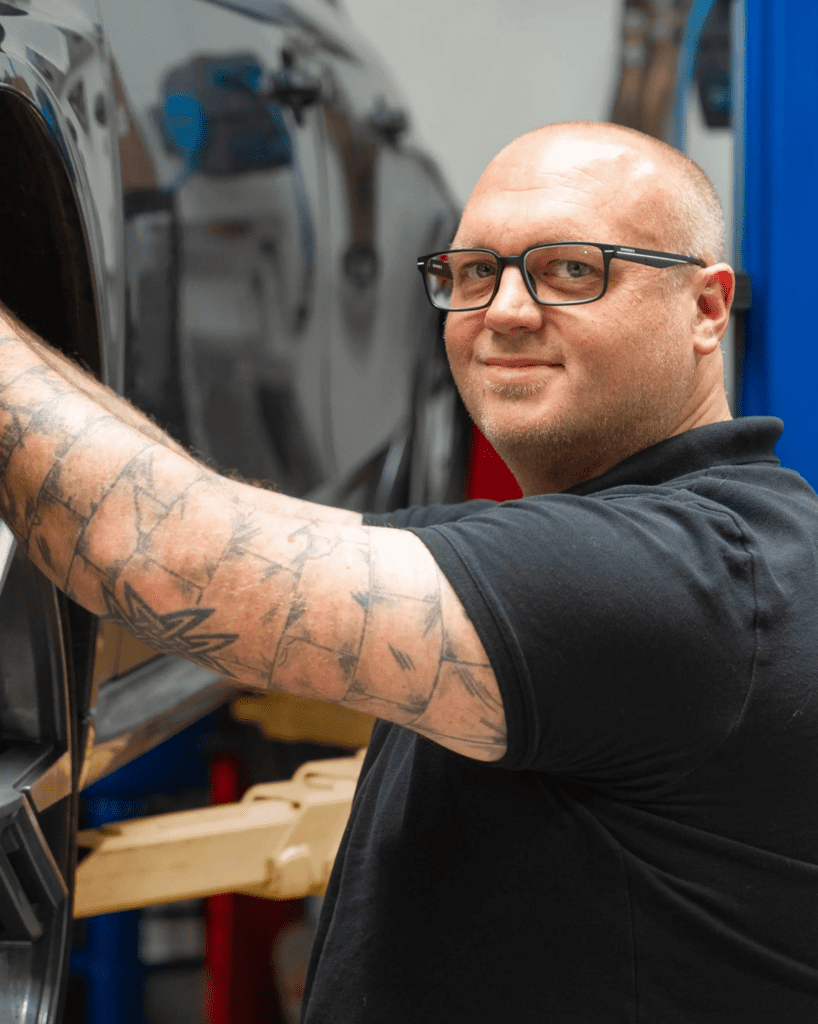

Customers making it happen with a Prospa loan

Read customer storiesWhy Prospa?

No more compromising or missed opportunities with Prospa by your side. Access funds for growth and cash flow support in a fraction of the time and without all the fuss. It’s just what we do.

We’re New Zealand’s small business lending specialist.

Choice

Borrow up to $500K with 10 minute application, fast decision and funding possible in 24 hours

Support

Confidence

have borrowed from Prospa.

You could benefit too.