How Do Business Loans Work

If you’re wondering how business loans work, then chances are you’re looking for a little push to start off your enterprise or maintain its current operations. Not to worry, understanding everything you need to know about business loans in NZ is easy with Prospa. Before you get started, seek out a trusted provider, work out how much funding you need to start a business or cover cash flow, and then make sure you’ll be able to make repayments based on the agreed-upon conditions. Once you’ve ticked all those boxes and you understand how it all works, you can start looking for funding that’s right for your business needs.

Finding what’s right for you

While taking out a loan for a business may seem straightforward, it is important to know that not all small business financing deals are made the same. There are heaps of traditional and online services out there, which may leave you scratching your head about what business credit option to choose. For instance, some readily available commercial loans may require security against the funds while others may have a number of hidden fees.

Before you choose the most suitable small business finance, you need to understand the different types of funding available. Here are a few options to consider:

- Unsecured loan – allows you to access funding without using any business or personal assets as security when you apply for the loan.

- – requires asset security that the lender can use to recoup any losses if you cannot make repayments.

- Line of credit – funding you can draw down whenever you need it (up to an approved amount).

Having a lender you can trust may help you avoid any confusion and uncertainty. You want a dedicated money lender that will go above and beyond, helping you understand how business loans work and what finance might be available to you.

The helping hand you need

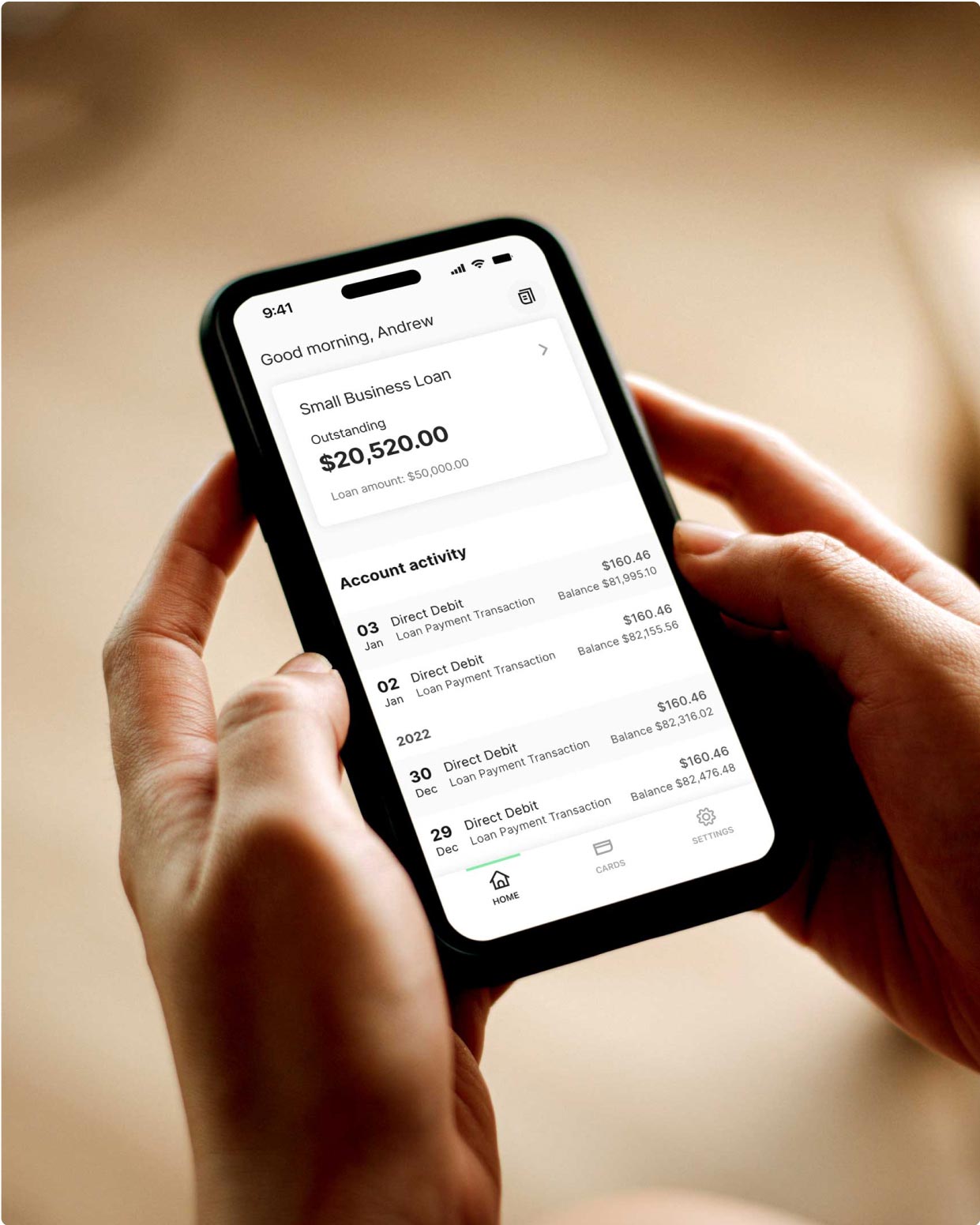

Your search for reliable business lending has now come to an end as you’ve found yourself at Prospa, a leading financial provider in New Zealand. We offer two main alternatives to a bank loan for business: our Prospa Small Business Loan with no asset security upfront to access Prospa funding up to $150K and our Prospa Plus Business Loan. And if you want access to funding to support your business cash flow in the future, you may want to consider our Business Line of Credit.

With these products, you’ll be able to experience all the benefits of borrowing money from our online platform, including a fast application process, a direct connection to a business lending specialist, and, last but not least, confidence in knowing that your enterprise is being financially funded by a company that has handled thousands of Kiwi businesses before.

For more information about our service and get a better understanding of how Prospa business loans work visit our website.

Everything you need to know about Prospa loans

Part of understanding how business loans work is knowing the specific terms and conditions for the loan you choose. With our premium service, you’ll know exactly what to expect – including your principal balance limit, small business loan interest rate, and overall term of repayment.

- Principal balance limit = Anywhere from $5,000 to $150,000 for our Small Business Loan and more than $150,000 up to $500,000 for our Plus Business Loan

- Overall term of repayment = For our Small Business Loan, there’s a fixed term of up to 36 months.

Now that you know more about the specifics of our offers, apply now and receive your funds in less than a day if approved.

A service for just about any business

One of the best parts about applying for a business loan at Prospa is the fact that you can use the money on practically anything you need. Whether you’re looking to pay your employees, fund renovations within your ops site, or are just in need of general business capital – our start-up business loans could be the solution for you. Simply apply online or consider getting a business loan by talking to one of our business lending specialists. Just ensure that you’re eligible for funding before you apply.

Business eligibility

Aside from knowing how business loans work, you also need to know if you qualify. If that’s the case, then you’d be pleased to know that the eligibility criteria for our SME business loan aren’t complicated at all.

For the Prospa Small Business Loan, all you have to do is fulfil a $6K minimum monthly turnover and minimum trading history applies. As for the other requirements, you must be a citizen or resident in New Zealand and 18 years old or above.

On other hand, for our Prospa Plus Business Loan, the same residency and age conditions apply, but your business would have to fulfil a $700K annual turnover and have a verified NZBN/IRD as well as three years of prior trading experience.

Get started today.

Customers making it happen with a Prospa loan

Read customer storiesWhy Prospa? Because we support small business.

No more compromising or missed opportunities with Prospa by your side. This time tomorrow you could have access to funds for growth and cash flow support. It’s just what we do. We’re New Zealand’s small business lending specialist.

Flexibility

Support

Confidence

have borrowed from Prospa.

You could benefit too.

FAQs

FAQs

Unlike a business bank loan or other similar options, you won’t need to present a full-on business plan to secure funds at Prospa. We believe that loans for new businesses, and established businesses for that matter, should be made as easy and readily available as possible. If you meet the business eligibility criteria and tick all the requirements, then you could have funding with 24 hours if approved.

However, to promote responsible lending, keep in mind that we’ll still have to make a thorough background assessment and credit review before we grant you money through a start-up business loan.

You won’t need to make an initial deposit to apply for both our Small Business Loan and Plus Business Loan options. In fact, we won’t even require asset security for access to Prospa funding of up to $150,000. As for larger amounts, security usually comes in the form of a charge over assets. All loans require a personal guarantee.

At Prospa, understanding how a business loan is simple. Apply online in minutes and get a fast decision, and if approved, the money could be in your account in as little as 24 hours.

Other questions?