Prospa offers a competitive business lending solution

Prospa is New Zealand’s small business lending specialist, having lent funds to thousands of customers across New Zealand and Australia so far. We put small business clients first with a business lending solution that helps you achieve your business goals. We help NZ businesses invest in their next big thing or simply get the support they need through the ups and downs of the regular business cash flow cycle.

Prospa makes business lending fast and simple. Our hassle-free online application process is developed with time-poor NZ small businesses in mind providing a quick decision and funding possible in 24 hours. With set loan repayments, either daily or weekly, and no penalty for early repayment Prospa business lending is a great way to support working capital and make sure you don’t miss out on valuable business opportunities.

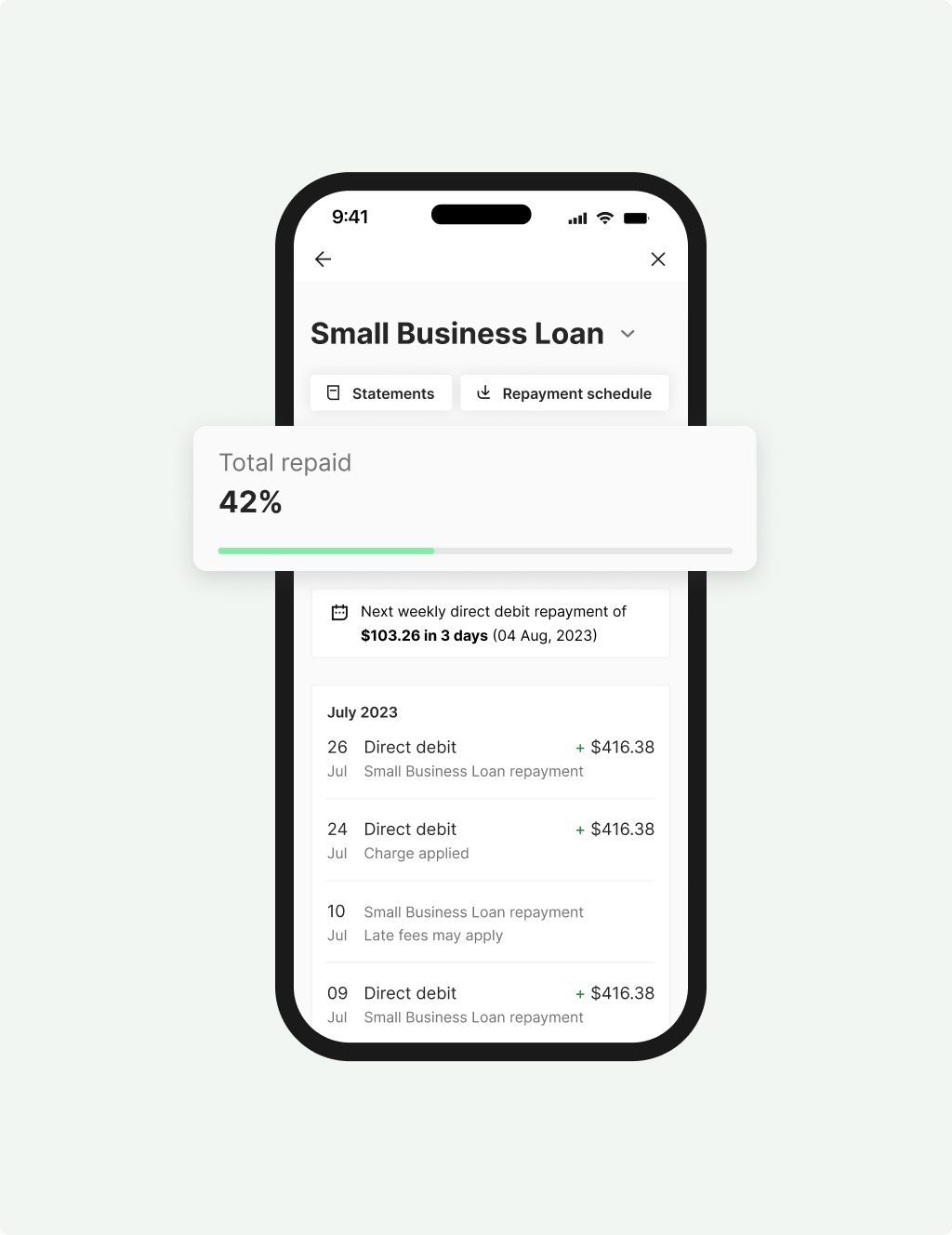

Small Business

Loan

Quick access to $5K – $150K to cover unexpected expenses or a one-off purchase.

- Fixed term up to 3 years with fixed rates

- Fast decision & funding possible in 24 hours

- No asset security required upfront to access Prospa funding up to $150K

- Minimum $6K monthly turnover and 6 months trading to apply

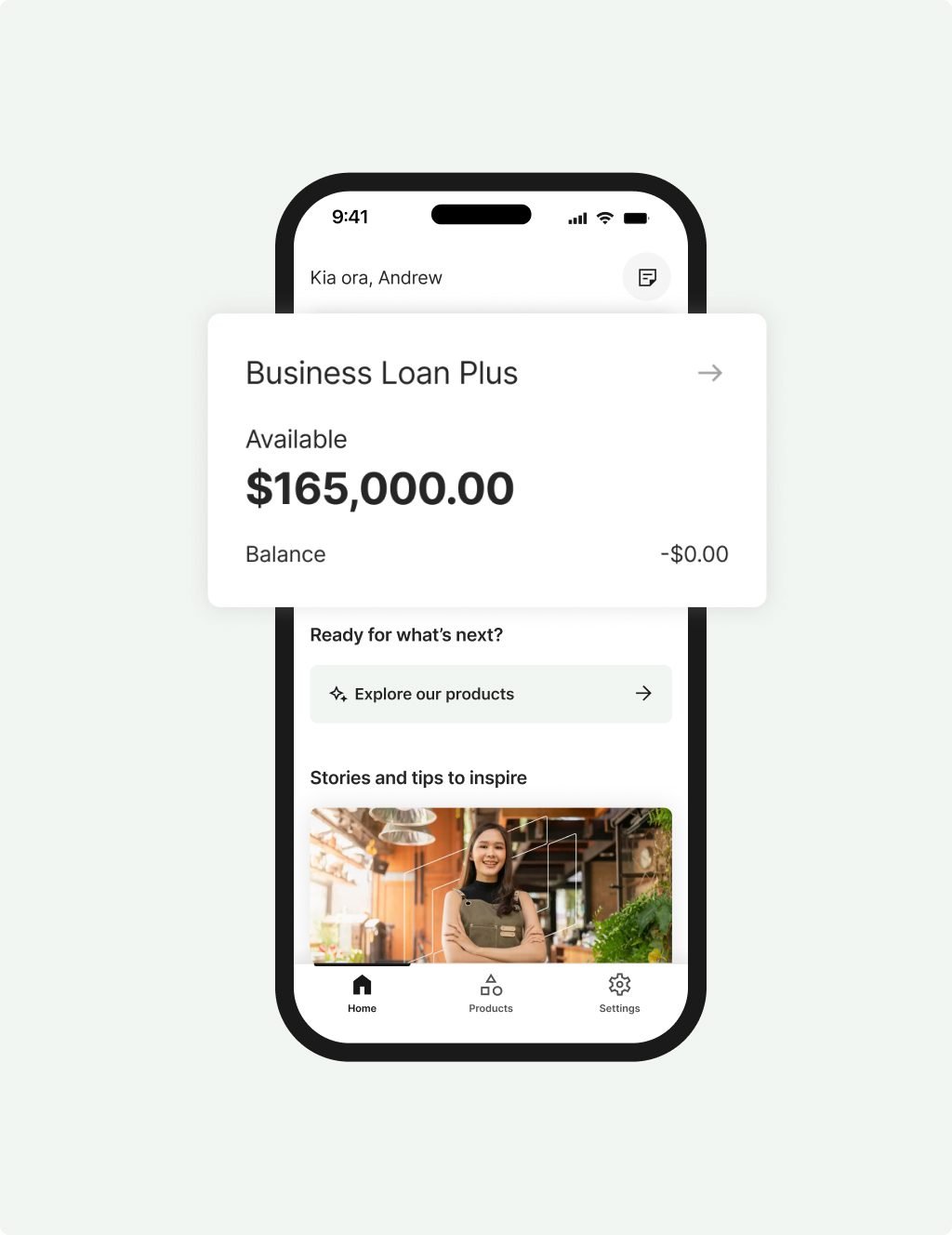

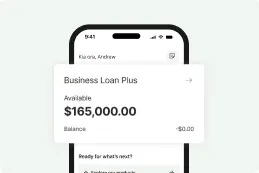

Business Loan

Plus

Larger loans above $150K and up to $500K to invest in your next business growth opportunity.

- Fixed term up to 5 years with fixed rates

- No credit checks to see if you are eligible

- Security may be required when accessing over $150K in Prospa funding

- Minimum $1M annual turnover and 3 years trading to apply

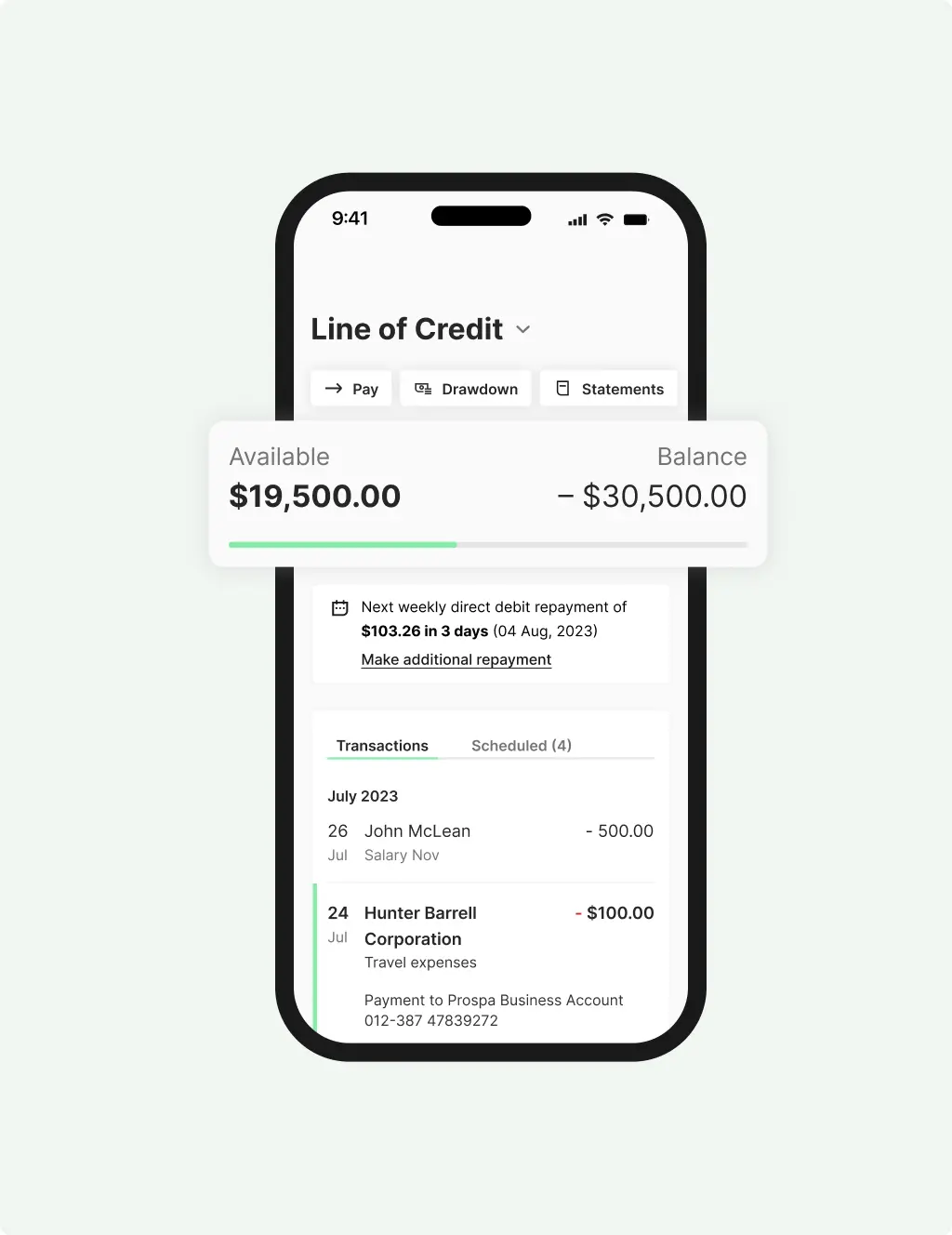

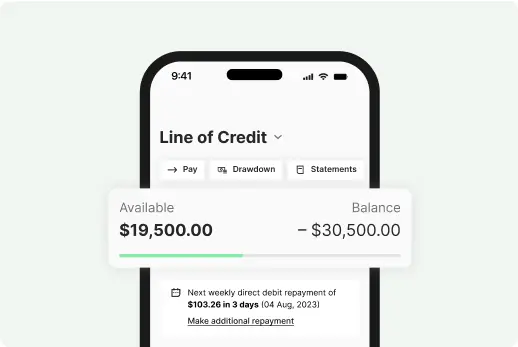

Line of Credit

Ongoing access to up to $500K to keep your business moving.

- Renewable 24 month term

- Fast decision and funding possible in 24 hours

- Only pay interest on what you use

- Access funds 24/7 with the Mobile App

- Minimum $6K monthly turnover and 6 months trading to apply

Why Prospa?

No more compromising or missed opportunities with Prospa by your side. Access funds for growth and cash flow support in a fraction of the time and without all the fuss. It’s just what we do.

We’re New Zealand’s small business lending specialist.

Choice

Borrow up to $500K with 10 minute application, fast decision and funding possible in 24 hours

Support

Confidence

have borrowed from Prospa.

You could benefit too.

How can we help you build your business?

A Prospa business loan is a great option for NZ small businesses that need a finance boost to help them grow. Whether you’re in Auckland, Wellington, Christchurch, Dunedin or anywhere in between, Prospa can help your business reach the next level with some extra funding.

Small business lending is great for:

- Premises renovations

- Hardware and software upgrades

- Advertising and rebranding

- New vehicles or equipment

- Working capital support

- Much more

FAQs

Frequently asked questions

If you’re looking to get fast access to business finance start by filling in Prospa’s no obligation online business loan application form. Once we receive the form, one of our friendly business lending specialists will get right back to you to finalise the application and answer any questions you might have. You’ll get a fast decision and funding is possible in 24 hours to approved applicants. With such a hassle-free experience, it’s no wonder more and more NZ small businesses are turning to alternative lenders like Prospa to help them with growth and opportunity.

Prospa is proud to support New Zealand small businesses – and our lending criteria are straightforward. If you can demonstrate a turnover of $6,000 or more per month and you’ve been trading for at least 6 months (or you bought an existing business 3 months ago or more) you can apply for a business loan with Prospa today.

The small business loan application process takes around 10 minutes and starts with an online form. It’s a good idea to have handy your NZBN, driver licence details, basic details about your business (operating years, structure & turnover) & trading business bank account details. For small business loans over $250K, you’ll also need some basic financial statements, like a P&L and cash flow.

New Zealand business loan interest rates vary widely based on personal circumstances and the product chosen, so it’s best to discuss your particular situation when you apply. Some factors that influence business loan interest rates may include: the amount borrowed, whether the loan is unsecured or secured, the industry, the age of the business, and the overall cash flow ‘health’ or creditworthiness of the business. Talk to our friendly customer service team about business lending and see how they may be able to help you secure the best business loan interest rate for your business.

There are several business lending options available to NZ small businesses, with different lending criteria – secured business loans, unsecured business loans, business overdrafts, a business line of credit, asset finance, equipment finance, business credit cards and invoice finance. Before you decide which is best, it’s important to have a full understanding of what you will use the funds for, the amount you need, the repayment term that will suit your cash flow and whether you want to use an asset as upfront security.

Prospa offers fast business loans, with funding possible in 24 hours and cash flow friendly repayment terms – designed specifically for the way small businesses operate in New Zealand.

Other questions?