Bank Overdraft

If you’re an enterprising individual who is looking for something similar to a bank overdraft, then you should definitely consider other options like short term business loans. With a convenient credit option such as a short term business loan, you can practically buy whatever you need for your business and have the means to operate in the way you want to without worrying about dipping into your personal savings.

Don’t just rely on a Plan B

What is an overdraft exactly? There are two types of overdraft: arranged and unarranged. An arranged overdraft is where you’ve agreed to a limit of funds with your bank that you can use once your account goes below a $0 balance. An unarranged overdraft is where you draw down more than that arranged limit. The bank may still allow you to use the funds, but the amount of interest you pay on the unarranged overdraft will usually be significantly higher.

While having a financial safety net could be useful, if you need to make a purchase for your business it could be a better option to take out a business loan where you know all the costs upfront, avoiding any unexpected charges and making it easier to budget. Prospa offers small business loans for just this purpose.

Modern goals, modern approaches

Nowadays, setting yourself up for success has never been easier. By taking advantage of either the Prospa Small Business Loan or the Prospa Plus Business Loan, you can access the cash you need – helping to make sure you won’t have to stress about unexpected charges that can come with a bank overdraft.

Aside from having full control of how you want to use the money, you’ll also enjoy a quick and flexible process, top-notch client support from one of our lending specialists, and a sense of confidence knowing that you can take your business to the next level. To check out the specifics of our premium service, click here to find out more.

A cash flow safety net for just about any type of business

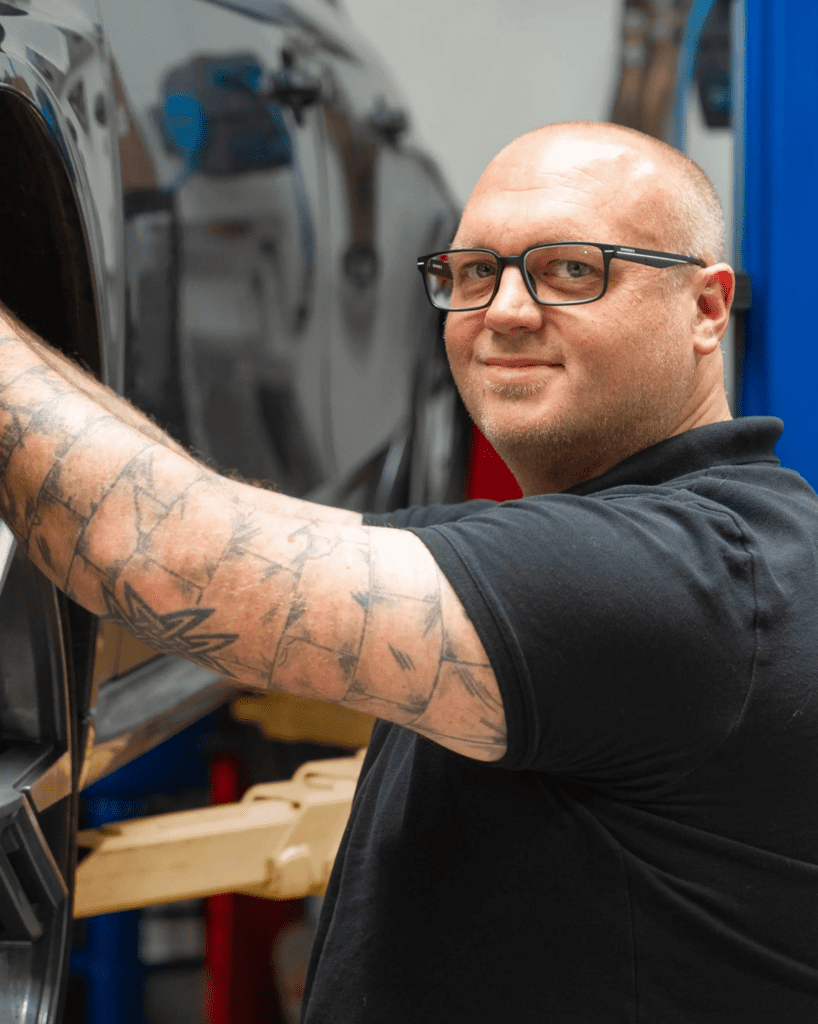

Whether you own a modest food stall in Wellington or a small hair salon in Auckland, our fast business loans here at Prospa could be the solution for you. In fact, our client Cameron Knapp just set up business in his own garage and now has a turnover of about $100K a month.

He has a passion for trading cards and all sorts of collectables. However, he didn’t have enough capital to buy a substantial bulk order at the time. With just a day left to pay the stock invoice, he looked to Prospa for quick funding, and the rest is history.

All of the functionality with added benefits

Just like with a bank overdraft, our Business Loan options can assist your business cash flow and day-to-day transactions.

- Interest rates = Based on your business’s circumstances (turnover, industry type, the reason for the loan, etc.)

- Principal balance = $5K to $100K for our Small Business Loans and $100K to $500K for Prospa Plus Business Loans

- Repayment duration = A fixed duration of up to 24 months for our Small Business Loans and a fixed duration of up to 36 months for Prospa Plus Business Loans

The best part is that we offer benefits such as an online application process, same-day loan decisions, and more. If our options pique your interest, then apply now at Prospa!

Level up your business like never before

Now that you know more about what we have to offer, you can apply to take advantage of the funds we provide in whatever way you’d like. From managing your business’s cash flow to physical renovations and marketing projects – our Small Business Loan can be used for a range of purposes. Just tap on your smartphone screen a few times, get a fast decision, and once approved you’ll receive your money – then you’re ready to go.

Understanding eligibility

It doesn’t take much to qualify for our small business financing service. For the Prospa Small Business Loan, you’ll need to demonstrate a minimum $6K monthly turnover and six months of trading experience. Additionally, you need to be at least 18 years old and a permanent resident or citizen of New Zealand.

As for our Prospa Plus Business Loan, the age and residency requirements are the same, but your business would need a minimum $700k annual turnover, three years of trading experience, and a valid NZBN/IRD.

Get started today with our great alternative to bank overdraft options!

Customers making it happen with a Prospa loan

Read customer storiesWhy Prospa? Because we support small business.

No more compromising or missed opportunities with Prospa by your side. This time tomorrow you could have access to funds for growth and cash flow support. It’s just what we do. We’re New Zealand’s small business lending specialist.

Flexibility

Support

Confidence

have borrowed from Prospa.

You could benefit too.

FAQs

FAQs

Adding an overdraft to your bank account can have a number of consequences. First, if you do not have overdraft protection, your bank may charge you a fee for each transaction that causes your account to go into the negative. This can quickly add up, so it’s important to be aware of your account balance at all times.

Additionally, you may accrue interest on the negative balance. The interest rate will depend on your bank.

In extreme cases, your bank could even close your account if you continuously go into overdraft. This is typically only done in cases of severe negative balances, but it is something to be aware of.

With Prospa, you can avoid these fees and penalties. Through our business loans, you can get the money you need upfront to cover your business expenses and you always know what you owe and when.

Some of the pros of a bank overdraft are as follows:

- It can provide a safety net in the event of an unexpected financial emergency.

- It can help you avoid costly fees, such as bounced check fees or late payment fees.

- It can help you maintain a good credit score.

Some of the cons of a bank overdraft are as follows:

- It can be expensive as you will be charged interest on the amount of money that you borrow from your bank.

- If you have a large overdraft, it may be difficult to qualify for a loan or other forms of credit in the future.

- It can potentially damage your credit score if you are unable to repay your overdraft on time or you consistently use your overdraft.

With a small business loan from Prospa, you don’t have to worry about many of the disadvantages associated with a bank overdraft. You can access the funds you need, when you need them, you know the amount due and when you need to make a repayment as the funds are borrowed over a set term with regular set repayments. In addition, we don’t require upfront asset security to access Prospa funds up to $150,000.

Bank overdraft options, especially their maximum lending amount, would drastically vary from provider to provider. It can be quite difficult to understand all the fees, charges, and rates associated.

Instead of asking questions like ‘How to apply for overdraft?’ or ‘What are the overdraft requirements?’ you can simply apply at Prospa to enjoy our streamlined procedures and wide range of benefits.

Here, among other advantages, you’ll be able to receive full transparency. To learn more about how Prospa can help you, feel free to visit our website or contact us today.

Other questions?