Small business funding options

Through the support of small business funding options, kickstarting your next big goal or improving the way your business runs has never been easier. Gone are the days when you would have to tap into your own personal savings, borrow from family or friends or rely on unpredictable crowdfunding methods. Nowadays, you can take advantage of professional business lending and have fast access to cash at your disposal (within days if approved).

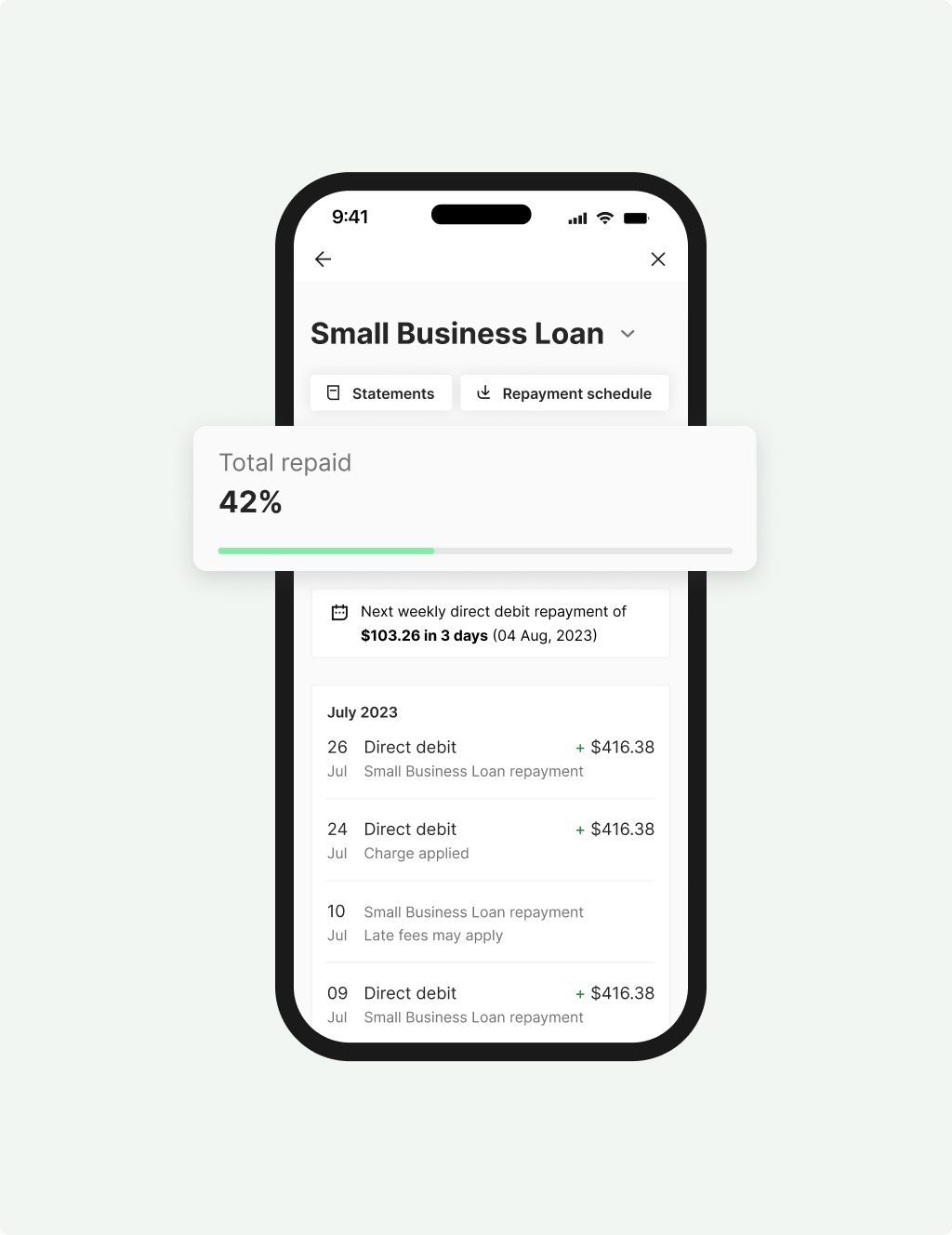

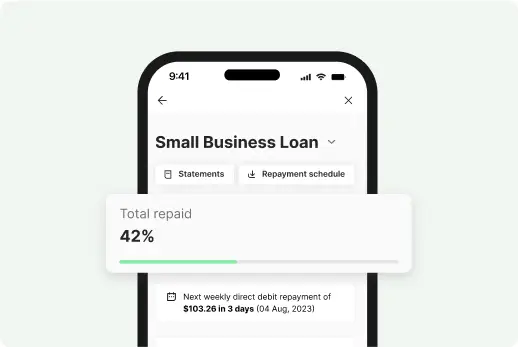

Small Business

Loan

Quick access to $5K – $150K to cover unexpected expenses or a one-off purchase.

- Fixed term up to 5 years with fixed rates

- Fast decision & funding possible in 24 hours

- No asset security required upfront to access Prospa funding up to $150K

- Minimum $6K monthly turnover and 6 months trading to apply

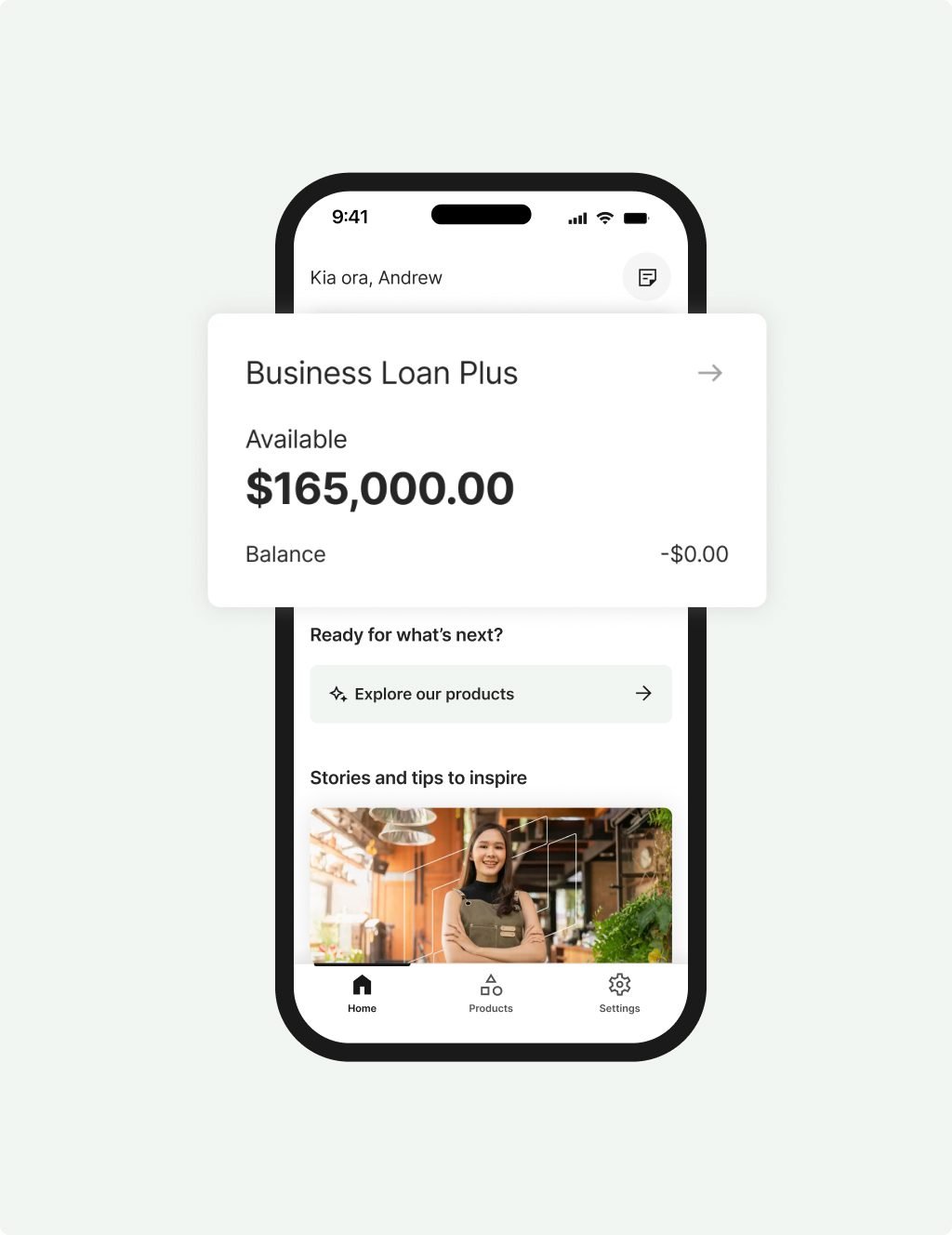

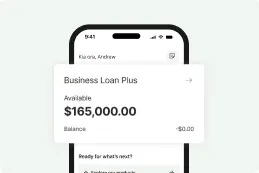

Business Loan

Plus

Larger loans above $150K and up to $500K to invest in your next business growth opportunity.

- Fixed term up to 5 years with fixed rates

- No credit checks to see if you are eligible

- Security may be required when accessing over $150K in Prospa funding

- Minimum $1M annual turnover and 3 years trading to apply

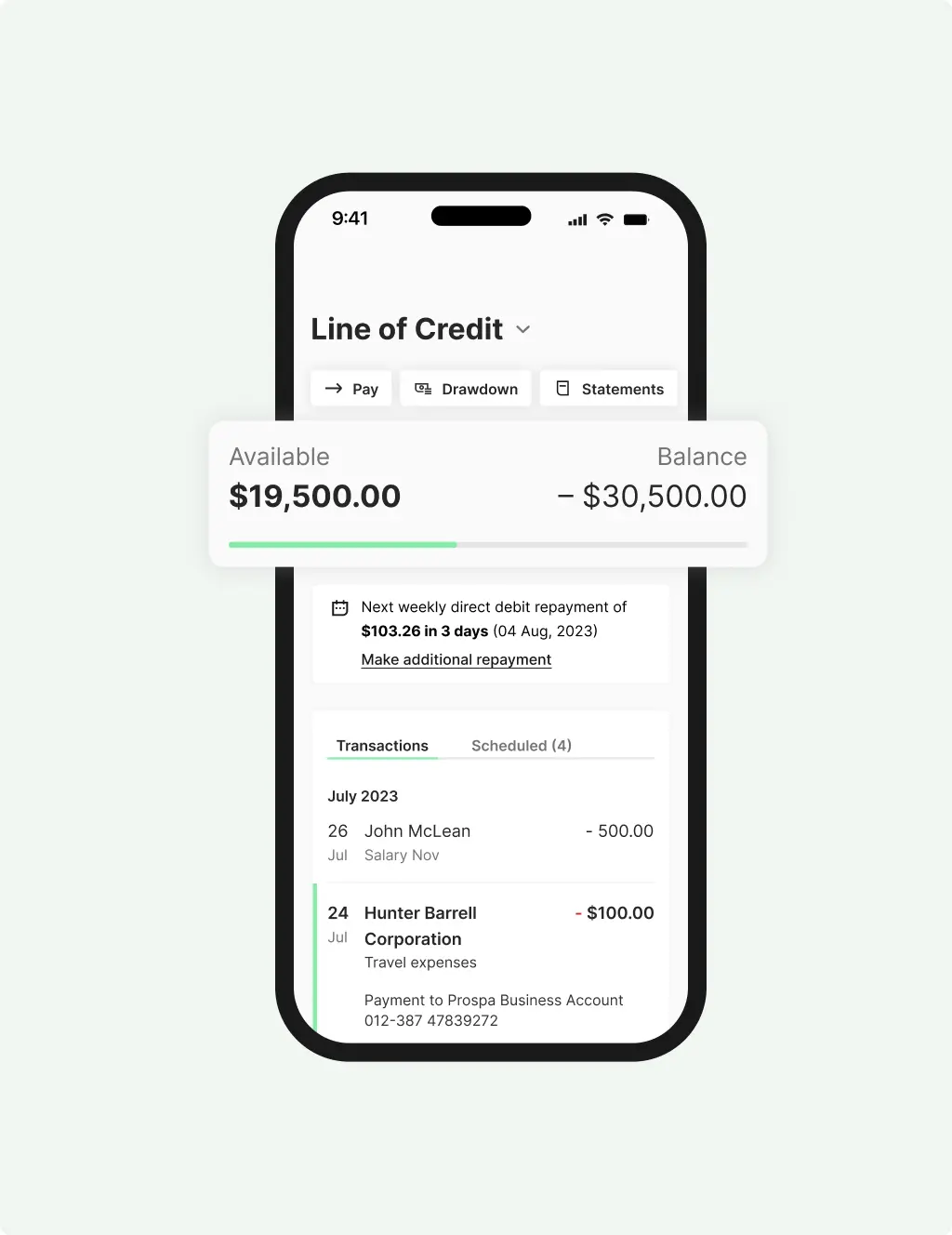

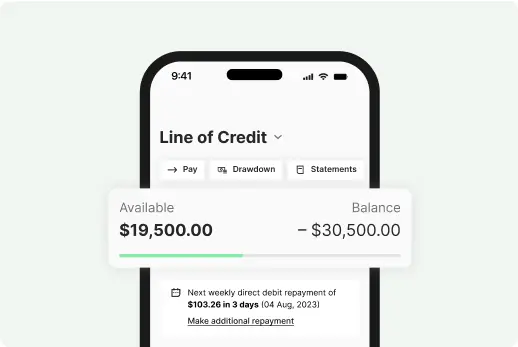

Line of Credit

Ongoing access to up to $500K to keep your business moving.

- Renewable 24 month term

- Fast decision and funding possible in 24 hours

- Only pay interest on what you use

- Access funds 24/7 with the Mobile App

- Minimum $6K monthly turnover and 6 months trading to apply

Secure substantial business funding today

If you have ever searched for something like ‘small business NZ help’ or ‘government grants for new business’ on the web, then you know how many results come up. With the range of small business funding options, it’s perfectly normal for you to feel overwhelmed. Instead of scrolling through all the pages for hours on end, you should get to know the advantages of small business loans from online lenders like Prospa.

Prospa is committed to providing small business funding options to New Zealand businesses. As the leading online lender to small business in this country, and with over a decade of experience here and in Australia, you can count on us to streamline the process of getting a business loan.

Quick and reliable small business support in New Zealand

At Prospa, you could receive just the right amount of funds in under 24 hours (if approved), and the best part is that it will only take you a few taps on your smart device or ten minutes over the phone with one of our lending specialists. Our dedicated team can answer any of your general enquiries and has provided assistance to hundreds of businesses in New Zealand.

Are you keen on learning more about our small business funding options? Click here and find out more about our convenient alternative to large financial institutions and government business grants.

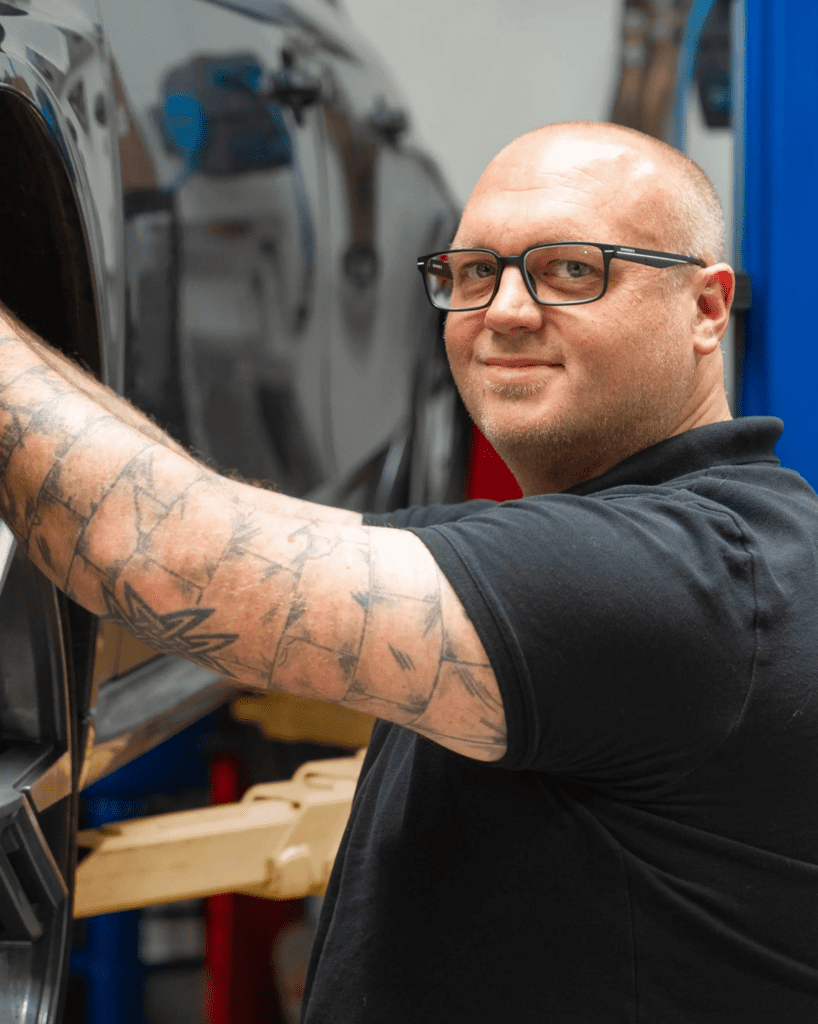

Letting your business blossom and flourish

When the owner of a small business called Twisted Willow florist needed monetary support to facilitate cash flow, Prospa was there to help. Using our small business funding options, an outdoor sign was created for optimal brand visibility, products were stocked up based on customer preferences, and the shop name was ultimately made known to the local community.

‘All my communication with Prospa was so easy. So I was able to secure my small business loan quickly, keep the store fresh and new for my customers, and get cracking on growing the business.’ Kerri Murphy, Twisted Willow florist.

With a business loan, anyone can turn their entrepreneurial dreams into a reality, and this satisfied client is proof of that.

A glance at our start-up funding for small business owners

On top of the exclusive benefits of our SME business loan offers, we offer favourable terms and conditions:

- Rates determined based on the health of your business. When determining the rate that will apply to your loan, our dedicated team considers a number of factors, including the type of industry you work for and the reason for your business venture.

Apply now and see just how easy our process is here at Prospa!

The opportunities brought about by small business funding

Now that you know more about the specifics of our business lending, you can plan out what exactly you’re going to do after we’ve reviewed your application and potentially approved your funding. With the versatility of our small business funding options, you can purchase or finance anything relating to your business – from equipment that can expedite sales to store renovations, all the way to services from companies with the expertise you need.

Customers making it happen with a Prospa loan

Read customer storiesWhy Prospa? Because we support small business.

No more compromising or missed opportunities with Prospa by your side. This time tomorrow you could have access to funds for growth and cash flow support. It’s just what we do. We’re New Zealand’s small business lending specialist.

Flexibility

Support

Confidence

have borrowed from Prospa.

You could benefit too.

FAQs

FAQs

Other than using your personal savings, some other small business funding options could include venture capital or crowdfunding. Small business loans, however, are typically the most popular option because they offer a lower barrier to entry than other options. Prospa could help your business get the funding it needs to grow if you’re approved.

With our small business loan, funding of up to $150K is possible in just 24 hours, plus you have the option to delay repayments for four weeks (should you need to). If you do decide to do that, though, the term will be extended at the end and interest will accrue from settlement.

It’s possible to raise funds for a small business without a loan, but it may be difficult to do so as not all businesses have access to the same funding sources. Loans can be an important source of funding for small businesses, and Prospa has a number of funding options to choose from. Rather than holding off and waiting for crowdfunding offers or angel investors, you could apply at Prospa for suitable small business funding options – and even have the funds you need in your account in as little as 24 hours if approved.

Apply today and get the money you need wherever you are in New Zealand!

Other questions?