Sole Trader Business Loans

A sole trader business loan is designed to help small business owners take advantage of opportunities and grow their business. For many small business owners, it could mean the difference between keeping their business afloat or taking a considerable loss in profit. This type of business loan is a financial product dedicated towards individually run businesses; they can immediately address sudden cash flow gaps that could disrupt the regular conduct of business.

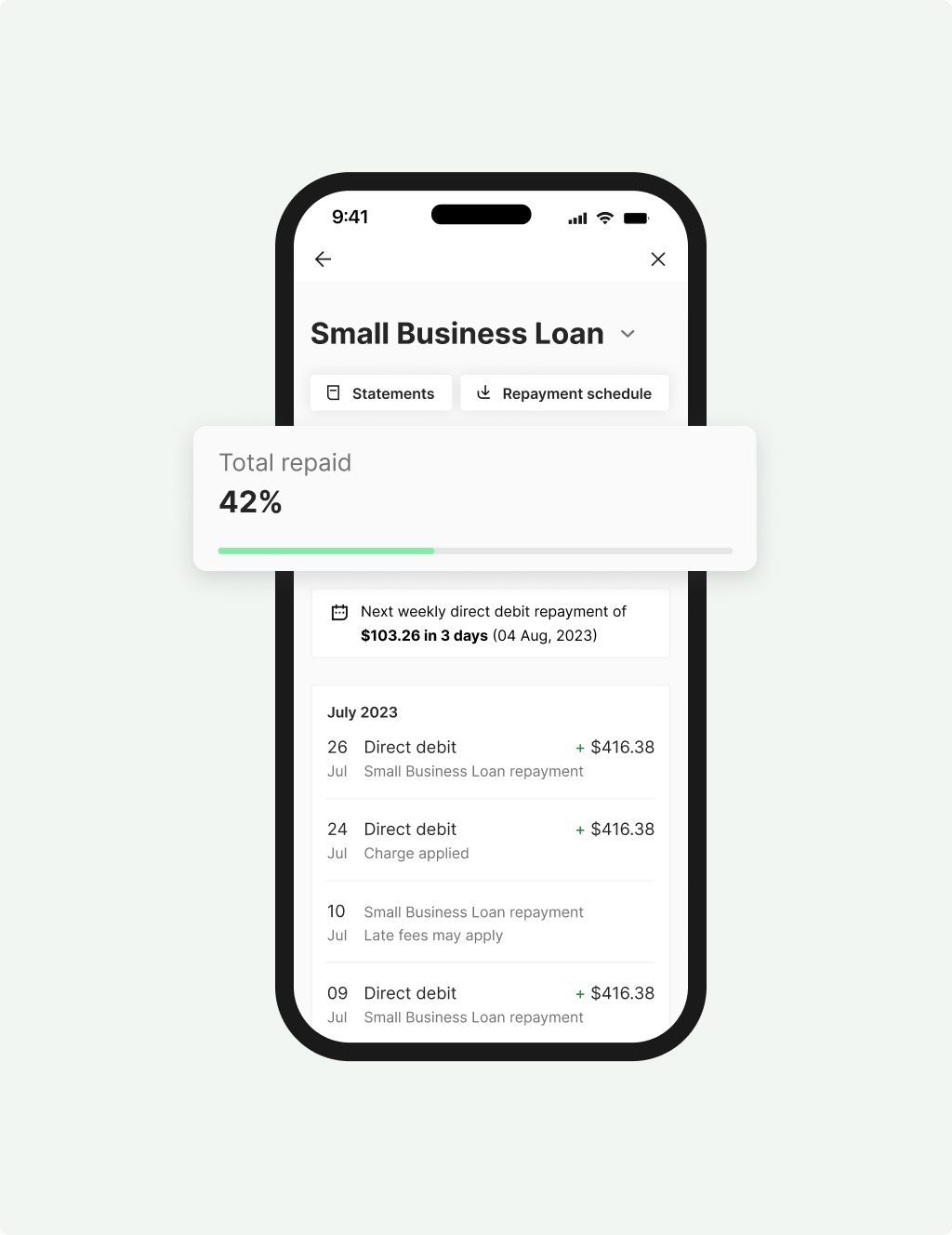

Small Business

Loan

Quick access to $5K – $150K to cover unexpected expenses or a one-off purchase.

- Fixed term up to 5 years with fixed rates

- Fast decision & funding possible in 24 hours

- No asset security required upfront to access Prospa funding up to $150K

- Minimum $6K monthly turnover and 6 months trading to apply

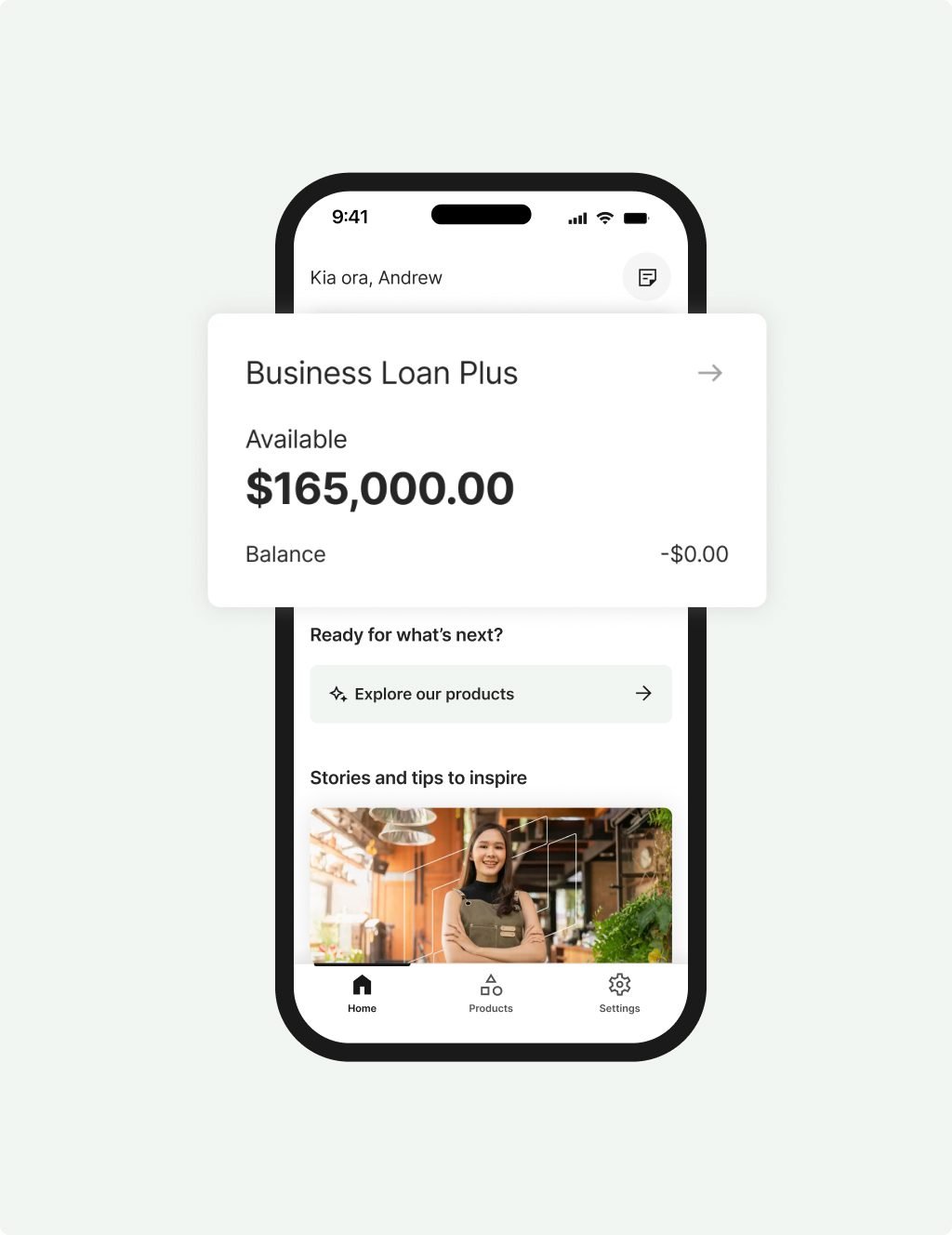

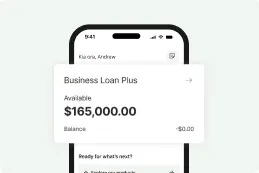

Business Loan

Plus

Larger loans above $150K and up to $500K to invest in your next business growth opportunity.

- Fixed term up to 5 years with fixed rates

- No credit checks to see if you are eligible

- Security may be required when accessing over $150K in Prospa funding

- Minimum $1M annual turnover and 3 years trading to apply

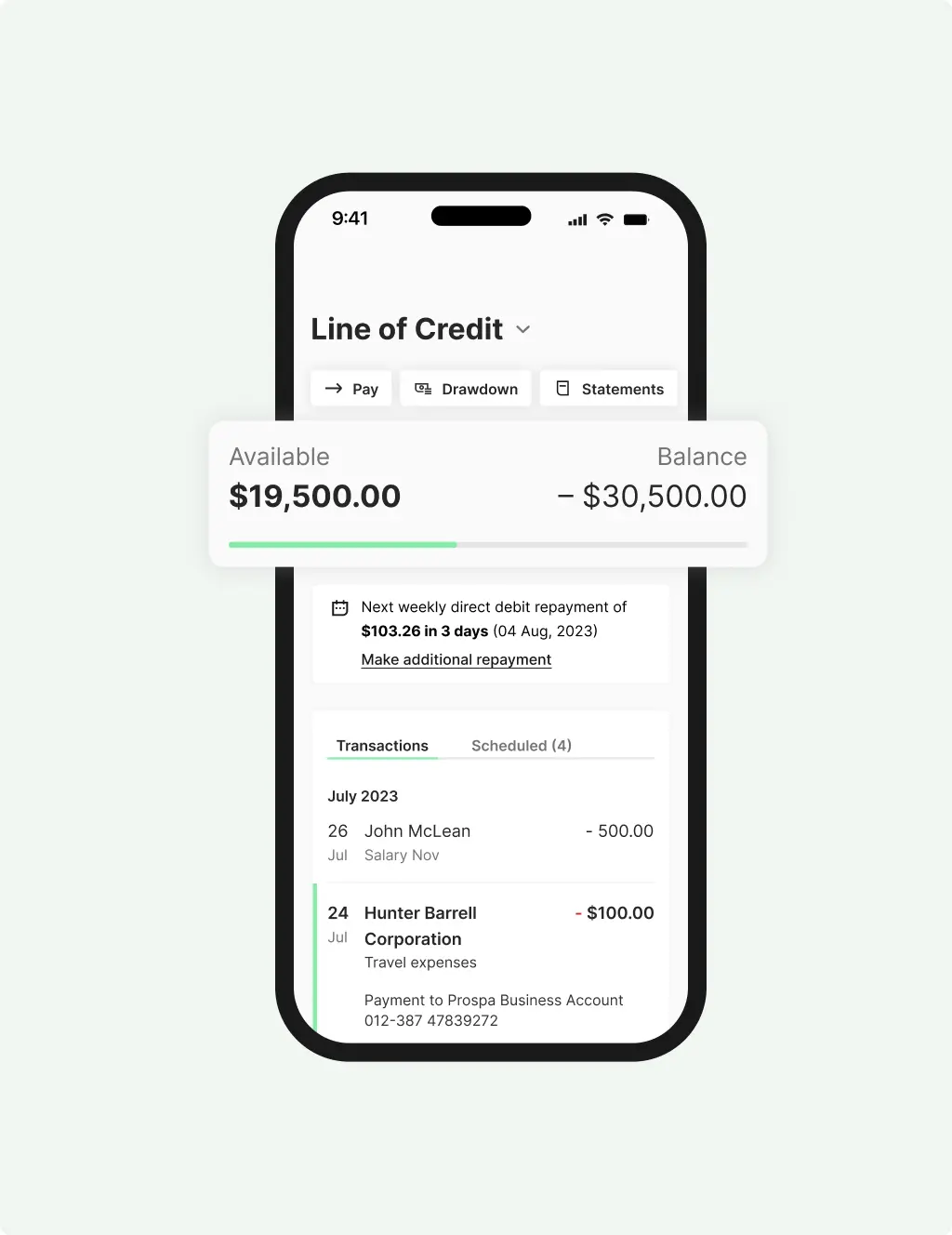

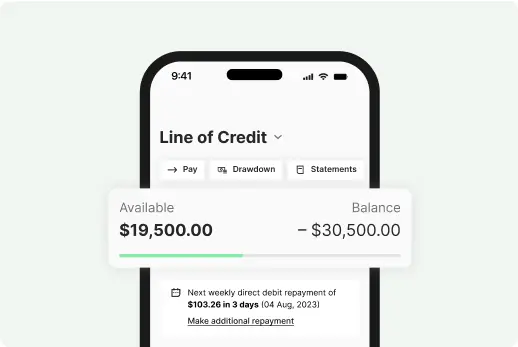

Line of Credit

Ongoing access to up to $500K to keep your business moving.

- Renewable 24 month term

- Fast decision and funding possible in 24 hours

- Only pay interest on what you use

- Access funds 24/7 with the Mobile App

- Minimum $6K monthly turnover and 6 months trading to apply

The importance of a sole trader business loan

Small business owners are an important part of many communities in New Zealand, providing unique products and services to their customers that bigger companies sometimes cannot. Because small businesses are individual in nature, they also have unique needs unique.

No two sole trader businesses are the same, and they need a financial provider that understands their business.

Small loans for businesses through Prospa

Prospa is an award-winning small business lending specialist that provides valuable financial products to thousands of customers across New Zealand and Australia. Recognised locally and internationally for our effective customer service and product offerings, we place priority value to our customers’ needs and growth.

Many small businesses are often wary of committing to financial products like government loans or business bank loans to stay afloat because of the rigorous requirements and paperwork involved. It’s why Prospa is trusted by many customers from both new and established small businesses all over the country. We offer small loans for businesses with no asset security required upfront to access Prospa funding up to $150K, and our robust loan terms are ideal for addressing gaps in cash flow with fast decision-making and funding possible within 24 hours.

Apply for small business loan now through our online application form.

Years of experience with business finance

Prospa has been recognised for our small business finance products as early as 2015. We’ve supported businesses like Sofa Doctor (Auckland) and Animal Natural Health Centre (Orewa) through different types of loans. From short-term business loans to invoice finance, Prospa’s helped small business owners make the most out of our finance products.

The advantages of small business loans are many, but let us summarise them into one crucial point: building the life you want, through work that gives purpose, satisfaction, and livelihood. It’s the core mission of every Prospa loan approval: we help you make the most of the opportunities you’ve worked hard to attain.

Am I eligible for a Prospa loan?

Applying for business loan at Prospa is a hassle-free process. These are the criteria when you apply for a sole trader business loan ranging from $5K up to $500K with us:

- You are a New Zealand citizen or a permanent resident of the country.

- You are over 18 years old and own a business with a valid NZBN/IRD.

- You can provide proof of business of six months to three years of trading (dependent on business loan amount).

Our commercial loan calculator is available for free to help you personally determine the best-suited loan amount for your needs, and we’ve outlined the documents required for business loan applications on our website as well.

Why Prospa? Because we support small business.

No more compromising or missed opportunities with Prospa by your side.

This time tomorrow you could have access to funds for growth and cash flow support.

It’s just what we do. We’re New Zealand’s small business lending specialist.

Customers making it happen with a Prospa loan

Read customer storiesFAQs

FAQs

Sole traders who meet our three main criteria can apply for a sole trader business loan, and if approved, you could have the funding within 24 hours. Certain loan amounts may require additional documentation or other business information.

At Prospa, any eligible small business owner could gain access to a sole trader business loan of up to $500K if approved. No asset security is required upfront to access Prospa funding up to $150K.

If you’d like to consult on what amount or which type of loan for a business suits your circumstances, our business lending specialists are more than happy to help. Contact us by email at [email protected], or call 0800 005 797. You can also chat on our website for live support or submit a support form.

Other questions?